Image Shown: Chevron Corporation – August 2021 IR Presentation

By Callum Turcan

Natural gas prices in the US measured by the Henry Hub benchmark (UNG) based in Erath, Louisiana, have surged higher over the past several months. This is partially due to the slowdown in domestic oil & gas development activity that occurred back in 2020 in the wake of the coronavirus (‘COVID-19’) pandemic and low crude oil prices. Though crude oil prices, measured by the domestic WTI (USO) and international Brent (BNO) benchmarks, have since recovered, that has not resulted in domestic drilling activity returning to levels seen in 2019, though development activity has recovered somewhat. Henry Hub futures are trading north of $5 per million British thermal units (‘MMBtu’) through February 2022 as of this writing, dropping just below $5 per MMBtu for March 2022 deliveries.

LNG Considerations

Additionally, US liquified natural gas (‘LNG’) exports have come in quite strong of late after several major LNG exporting facilities have come online in recent years. The US Energy Information Administration (‘EIA’) notes that US LNG exports hit record highs during the first half of 2021, with room to continue surging higher. Elevated prices for natural gas (and thus LNG) in Western Europe, East Asia, and other key markets are playing a big role here.

Image Shown: US LNG exports hit record highs during the first half of 2021 with room to run as elevated natural gas prices in Asia and Europe support LNG export facilities running at or near full capacity going forward. Image Source: US EIA – Website

Natural gas prices are at record levels in Europe, as of September 2021, according to a recent analysis by the Dutch banking giant ING Group NV (ING). The company noted that natural gas inventories in the region are trending well below their historical averages due to unplanned downtime in Norway and Russia, and a cold winter season that delayed the start of injection season, among other factors. Reuters noted that Asian spot prices for LNG hit seasonal records recently in a September 2021 article, citing the relatively high prices seen for LNG deliveries to Northeast Asia for October and November of this year. This is largely due to energy-hungry Asian economies competing with energy-hungry European economies for LNG supplies as both regions seek to build up their natural gas stockpiles.

Chevron and ExxonMobil

Note that what makes this dynamic particularly important is that the financial performance of major natural gas producers and LNG exporters stands to gain immensely from this powerful near-term tailwind. We include Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) as ideas in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

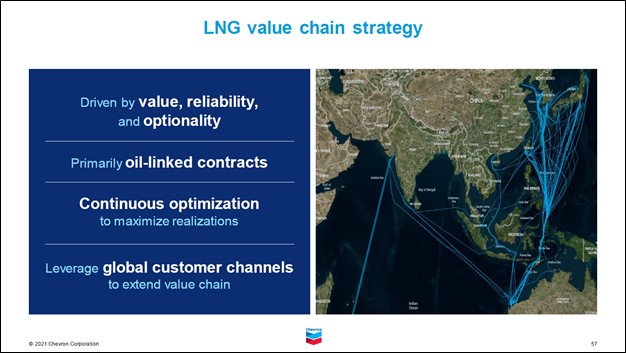

Chevron owns a large economic stake in the Angola LNG export facility, the massive Gorgon LNG export facility in Australia, the enormous Wheatstone LNG export facility in Australia, and the North West Shelf LNG venture in Australia, along with sizable upstream operations in both countries that produce substantial amounts of natural gas from the ground. The company’s LNG export operations are enormous.

Furthermore, Chevron is a major domestic natural gas producer (in 2020, Chevron produced ~1.6 billion net cubic feet of natural gas per day in the US along with ~0.1 billion net cubic feet per day in Canada on average) and has various other LNG and natural gas operations across the globe (such as a major presence in the LNG shipping business and related trading activities). Chevron is well-positioned to capitalize on surging domestic and international natural gas and LNG prices.

ExxonMobil owns a sizable economic interest in the Gorgon LNG export facility (alongside Chevron), the PNG LNG export facility in Papua New Guinea, and various LNG export facilities in Qatar via joint ventures, along with major upstream operations that supply natural gas to those operations. The company also has various other LNG and natural gas operations across the globe (such as a meaningful economic stake in the South Hook LNG regasification terminal in the UK) along with sizable upstream natural gas business in the US (in 2020, ExxonMobil produced ~2.7 billion net cubic feet of natural gas per day in the US and ~0.3 billion cubic feet in ‘Canada/Other Americas’ per day on average).

Looking ahead, ExxonMobil is converting the Golden Pass facility in Texas (which it owns a large economic interest in), currently set up to import LNG, into a major LNG export terminal alongside its partner Qatar Petroleum. The development is expected to be operational by 2024. ExxonMobil is well-positioned to capitalize on booming natural gas and LNG prices as well.

Concluding Thoughts

In our view, the tailwind provided by the recovering global energy complex (i.e. higher crude oil and refined petroleum product prices) from the worst of the COVID-19 pandemic along with the tailwind provided by booming natural gas prices witnessed of late should result in the cash flows of both Chevron and ExxonMobil surging meaningfully higher in the near term compared to their performance in 2020. The recovery in their financials will provide both firms with the opportunity to clean up their balance sheets while continuing to make good on their dividend obligations going forward.

We continue to like Chevron and ExxonMobil as ways to play the ongoing recovery in the global energy complex, and in our view, both firms possess substantial capital appreciation and dividend growth potential. Shares of CVX yield ~5.7% and shares of XOM yield ~6.5% as of this writing. We also include the Energy Select Sector SPDR Fund (XLE) with a “modest weighting” as an idea in the Best Ideas Newsletter portfolio. To read about our two favorite midstream master limited partnerships (‘MLPs’), please check out this article here.

—–

Oil and Gas Complex Industry – BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Related: AMLP, BNO, UNG, USO, XOP, XLE, ING

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.