Image: Booking Holdings remains an asset-light, free-cash-flow generating powerhouse.

By Brian Nelson, CFA

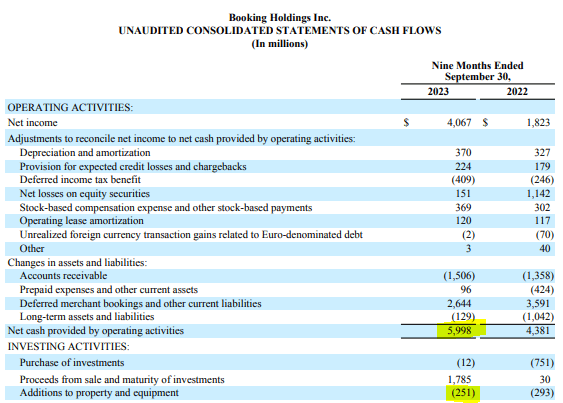

On November 2, Best Ideas Newsletter portfolio holding Booking Holdings (BKNG) reported excellent third-quarter results with revenue advancing 21.3% and non-GAAP earnings per share coming in ahead of the consensus forecast. People around the world continue to book travel and accommodations as pent-up demand from the COVID-19 pandemic continues to showcase itself in Booking Holdings’ results. Gross travel bookings advanced 24% (21% on a constant-currency basis) in the quarter on a year-over-year basis, and the firm converted this strong demand into a 51% increase in net income. We like the asset-light, free-cash-flow generating nature of Booking Holdings, and we continue to believe it belongs in the Best Ideas Newsletter portfolio.

CEO Glenn Fogel was generally optimistic in the press release:

We are pleased to report record quarterly room nights, gross bookings, revenue, and net income driven by a strong summer travel season. We are encouraged by the resilience of leisure travel demand, and we remain focused on executing against our key strategic priorities, which helps position our business well for the long term.

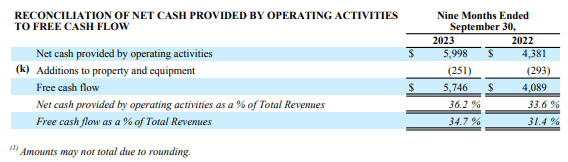

Image: Booking Holdings’ free cash flow margin continues to impress.

Booking Holdings ended the September quarter with a modest net cash position. Cash and cash equivalents totaled ~$13.3 billion and short-term investments came in at $624 million, a sum that was greater than its short-term debt load of ~$1.9 billion and long-term debt of ~$11.9 billion. The company hauled in ~$6 billion in cash flow from operations during the first nine months of 2023 and only spent $251 million on property and equipment, good for significant free cash flow generation. Its free cash flow margin so far in 2023, as measured by free cash flow divided by sales, was an impressive ~35%, showcasing just how efficient Booking Holdings is in converting its top line to cold hard cash. Our $3,164 per share fair value estimate remains unchanged at this time.

NOW READ: Best Idea Booking Holdings Soars!

———-

Tickerized for BKNG, EXPE, SABR, LIND, SOND, H, MAR, FLL, WYNN, MLCO, MGM, PENN, DAL, JETS, ABNB, TRIP, AAL, ALK, UAL, LUV, RCL, CZR, TCOM, CEA, ZNH, HTHT, GHG, INTG, NCLH, CCL, DESP, HGV, TNL, PLYA, LVS, MSC, WYNMF, WYNMY, SCHYY, SCHYF, MCHVF, MCHVY, GXYEF, SJMHF, SJMHY, JBLU, AZUL, TRVG, HA, MESA, SKYW, SNCY, ULCC, ALGT, SAVE, TOUR.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, and QQQ. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.