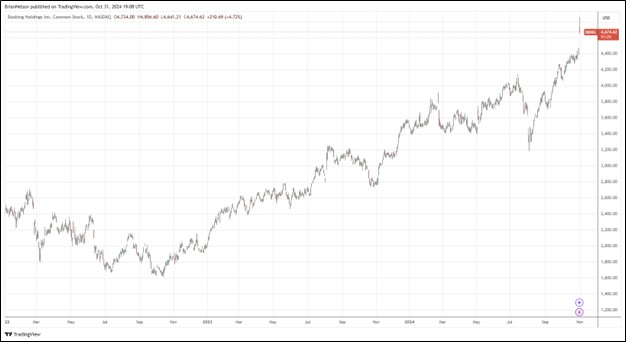

Image: Booking Holdings’ shares soar to all-time highs.

By Brian Nelson, CFA

Booking Holdings (BKNG) reported excellent third quarter results October 30 that showed a beat on both the top and bottom lines. Total revenues increased 9% from the prior-year quarter, as room nights booked increased 8% and gross travel bookings increased 9% from the prior-year quarter. Net income was flat with respect to the prior-year quarter, while net income per diluted common share came in 7% higher than the year-ago quarter. Adjusted net income increased 9% from the prior-year quarter, while adjusted net income per diluted share advanced 16%, to $83.89, which beat expectations by $6.51.

Management spoke of momentum behind its business in the press release:

We are pleased to report third quarter room night growth of 8%, which exceeded our prior expectations, driven primarily by stronger performance in Europe. We continue to make progress against our strategic initiatives while driving cost efficiency in our business, which I believe will position our company well for the long term.

Booking Holdings ended the September quarter-end with $15.8 billion in cash and cash equivalents versus short- and long-term debt of $16.2 billion. Through the first nine months of the year, cash flow from operations expanded to $7.6 billion, up from $6 billion in the year-ago period. Capital spending was $353 million through the first nine months of the year versus $251 million in the same period a year ago.

Booking’s free cash flow of $7.25 billion through the first nine months of the year is nearly 40% of revenue, showcasing its cash-rich business model. The company declared a cash dividend of $8.75 per share to stockholders of record as of the close of business December 6. The high end of our fair value estimate range for Booking Holdings stands north of $5,000. We continue to like shares as an idea in the Best Ideas Newsletter portfolio. Shares yield 0.75% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.