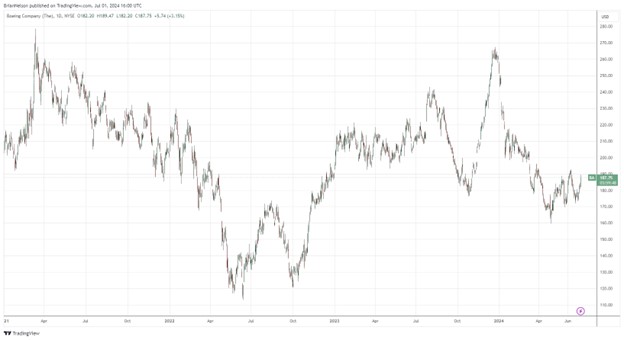

Image: Boeing’s shares have traded sideways the past few years as it works to fix safety issues.

By Brian Nelson, CFA

Boeing (BA) has been plagued with safety issues the past couple of years as the company’s decision to cut costs by outsourcing much of its manufacturing operations has created a whole host of problems. Two deadly plane crashes of its 737 MAX coupled with a blown-out area of the fuselage in a recent Alaska Airlines (ALK) flight are but a few missteps that have plagued the aircraft maker.

On July 1, Boeing announced that it would roll back some of its outsourcing, announcing that it would bring fuselage maker Spirit AeroSystems (SPR) back into the fold. Boeing’s purchase of Spirit AeroSystems is an all-stock transaction, valuing the aerospace supplier’s equity value at $4.7 billion, or $37.25 per share. The total transaction value, including Spirit’s net debt, is $8.3 billion.

Here are more details on the terms of the deal:

Each share of Spirit common stock will be exchanged for a number of shares of Boeing common stock equal to an exchange ratio between 0.18 and 0.25, calculated as $37.25 divided by the volume weighted average share price of Boeing shares over the 15-trading-day period ending on the second trading day prior to the closing (subject to a floor of $149.00 per share and a ceiling of $206.94 per share). Spirit shareholders will receive 0.25 Boeing shares for each of their Spirit shares if the volume-weighted average price is at or below $149.00, and 0.18 Boeing shares for each of their Spirit shares if the volume-weighted average price is at or above $206.94.

Boeing has had its back against the wall following the two deadly crashes years ago, and reports of other missteps have only made things worse for the aircraft maker. The reintegration of Spirit after spinning it off in 2005 won’t solve all of Boeing’s problems, but we think the aircraft maker had to do something to gain better control over its supply chain, especially given the greater scrutiny it now finds itself under. Spirit also announced that Boeing competitor Airbus (EADSY) would acquire certain Spirit assets that serve Airbus platforms, upon closing of Spirit’s acquisition by Boeing.

Boeing benefits from its global oligopoly with Airbus, but the company is in a world of hurt at the moment. Looking at its first-quarter results shows a sizable core non-GAAP net loss per share, operating cash flow burn of $3.4 billion, as well as free cash flow burn of $3.9 billion. We think the near term will continue to be difficult for Boeing as it struggles to right the ship, but a more bullish take will point to its total company backlog of $539 billion, which includes 5,600+ commercial airplanes, as one reason to be optimistic. To us, however, Boeing continues to be a show-me story, and we remain on the sidelines with respect to shares.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for BA, SPR, EADSY, ALK, RTX, HON, GE

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.