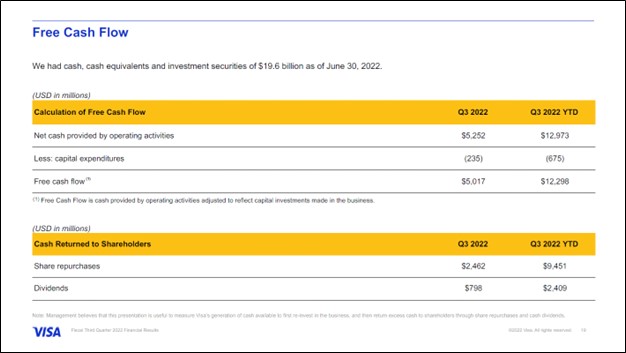

Image Shown: Visa Inc is a tremendous free cash flow generator and is very shareholder friendly. Management distributes cash back to investors primarily through sizable share repurchases and to a lesser extent, through dividend increases. Image Source: Visa Inc – Third Quarter of Fiscal 2022 IR Earnings Presentation

By Calum Turcan

Visa Inc (V) reported third quarter earnings for fiscal 2022 (period ended June 30, 2022) that beat both consensus top- and bottom-line estimates. Visa is included in the Best Ideas Newsletter portfolio as we view its capital appreciation upside potential quite favorably. Our recently updated fair value estimate for Visa stands at $226 per share with room for upside as the high end of our fair value estimate range sits at $271 per share, well above where shares of V are trading at as of this writing. Visa also offers investors incremental dividend growth upside potential, though its payout is not a top capital allocation priority as management prefers to purchase sizable amounts of the firm’s stock. Shares of V yield a modest ~0.7% as of this writing.

First, a quick housekeeping item: Visa has a multiple share class structure, and the publicly traded shares were are referencing here are its Class A common stock. The company also has outstanding Class B common stock and Class C common stock.

Earnings Update

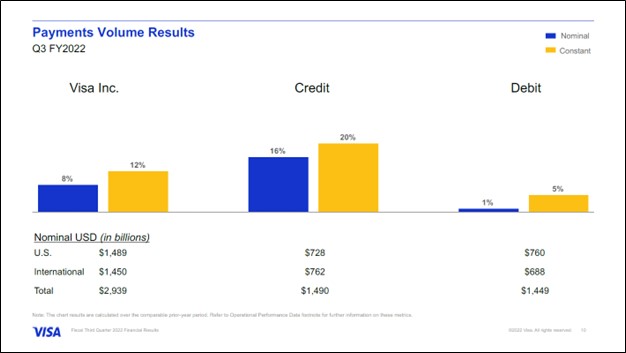

Visa reported that its payment volumes were up 12%, its cross-border volume was up 40% (up 48% when excluding intra-Europe volumes), and that its processed transactions were up 16% year-over-year in the fiscal third quarter. This powered its GAAP revenues higher by 21% year-over-year last fiscal quarter to $7.3 billion. A $0.7 billion litigation provision recorded last fiscal quarter saw Visa’s GAAP operating income rise by just 2% year-over-year to $4.1 billion, though when removing that special item, its operating income would have grown by 19%. Visa’s core operating expenses have also grown meaningfully of late as the firm is bulking up its marketing efforts and back office activities to prepare its business for a post-COVID world.

The company benefited from strong payment volumes growth at its credit card payment processing business, which tends to be more lucrative than its debit card payment processing business. On a constant currency basis, Visa’s credit card payment volumes were up 20% year-over-year last fiscal quarter while its debit card payment volumes were up 5%. It was strong performance on both fronts, though we appreciate the favorable business mix shift as that supports Visa’s profitability metrics.

Image Shown: Visa benefited from strong growth at its credit card payment processing business last fiscal quarter, which tends to be more lucrative than its debit card payment processing business. Image Source: Visa – Third Quarter of Fiscal 2022 IR Earnings Presentation

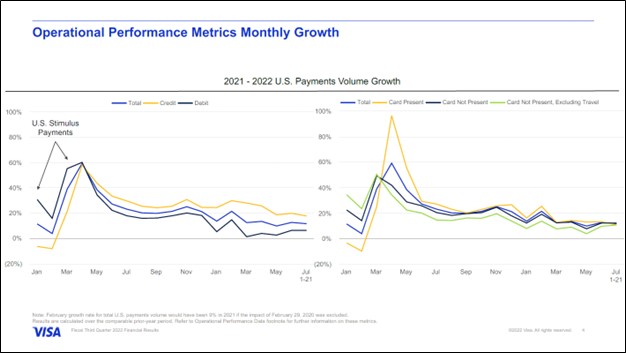

In the US, Visa’s payment processing volumes have held up quite well across the board in terms of ‘card-present’ (primarily purchases at physical stores) and ‘card-not-present’ (primarily online purchases at e-commerce platforms) activities. Visa’s credit and debit card payment volumes are both holding up well in the US.

Image Shown: Visa’s domestic operations have put up rock-solid performance of late. Image Source: Visa – Third Quarter of Fiscal 2022 IR Earnings Presentation

On a GAAP basis, Visa’s Class A common stock posted $1.60 in diluted EPS last fiscal quarter (up 36% year-over-year) due to substantial net income growth and a reduction in its outstanding diluted share count. Its adjusted non-GAAP EPS rose 33% year-over-year to reach $1.98 in the fiscal third quarter. We appreciate that Visa’s business is on a powerful upswing.

During the first three quarters of fiscal 2022, Visa generated $12.3 billion in free cash flow while spending $2.4 billion covering its dividend obligations and another $9.5 billion buying back its Class A common stock. The company’s cash-flow generating abilities are simply stellar, aided by its asset-light business model and relatively modest capital expenditure requirements to maintain a given level of revenues (Visa spent $0.7 billion on its capital expenditures during the first three quarters of fiscal 2022). We view Visa’s share repurchases favorably given that its stock has been trading below our estimate of its intrinsic value for some time and continues to do so.

Visa exited June 2022 with a net debt load of $6.4 billion (inclusive of short-term debt, exclusive of restricted cash and noncurrent investment securities), a burden we view as manageable given its impressive cash flow profile. The company had $17.4 billion in cash, cash equivalents, and current investment securities on the books at the end of this period, providing it with ample liquidity to meet its near-term funding needs.

Additionally, Visa had $2.2 billion in non-current investment securities on hand at the end of June 2022. Some of this position was represented by U.S. Treasuries which would be considered cash-like assets. However, some of this position was represented by marketable equity securities and could be considered strategic holdings, though generally speaking, marketable securities can be liquidated rather easily for cash. Visa’s balance sheet is relatively healthy and moderately stronger than first glances would suggest.

Recent Operational Update and Guidance Commentary

On August 30, Visa published an 8-K SEC filing highlighting its recent operational performance in the US and internationally. The firm noted that from August 1-28, its US payment volumes were up 11% on a year-over-year basis with credit card payment volume volumes up 17% and debit card payment processing volumes up 7%. Additionally, ‘card-not-present’ volumes in the US (excluding travel) were up 9% and ‘card-present’ volumes were up 11% on a year-over-year basis during this period. Pivoting to its international performance, Visa’s global processed transactions were up 12% year-over-year during this period. After Visa exited the Russian market in March 2022, its business from European and Asian customers has started to improve according to the 8-K SEC filing.

During Visa’s latest earnings call, management had this to say on the company’s near term outlook (emphasis added, lightly edited):

“Moving now to our outlook for the [fiscal] fourth quarter …we’re seeing no evidence of a pullback in consumer spending… As such, we are assuming that the trends we have seen in payments volume and processed transactions will continue through the [fiscal] fourth quarter… Through July, the cross-border recovery has progressed faster and further than we had expected last October.

For the [fiscal] fourth quarter, we’re assuming stable growth versus 2019 in cross-border e-commerce and some improvement from travel in and out of Europe and into the US, especially from Asia. The next and perhaps the last leg of the cross-border travel recovery will have to await a full reopening in China, which we do not expect in the near future.

With these assumptions, [fiscal] fourth quarter net revenues could grow at the high teens to 20% range in constant dollars. This includes Tink and Currencycloud [recent acquisitions I, II], which add approximately 0.5 point to net revenues, and the suspension of operations in Russia, which subtracts approximately 5 points. The dollar has continued to strengthen, significantly increasing the exchange rate drag, which we expect will reduce reported net revenue growth by 4 to 5 points.” — Vasant Prabhu, Vice Chairman and CFO of Visa

In light of Visa’s recent update provided by its 8-K SEC filing, it seems the company is on track to report robust revenue growth this fiscal quarter. We caution that headwinds from the strong US dollar and related foreign currency movements are weighing negatively on Visa’s reported financial performance, though its underlying business is still firing on all cylinders.

Concluding Thoughts

As Visa prepares to enter fiscal 2023 on a high note, we would like to highlight that we recently increased the weighting of Visa in the Best Ideas Newsletter portfolio via an email sent out to members. Here is a link to an article published on V.com in August 2022 covering recent changes to the Best Ideas Newsletter portfolio.

Visa is supported by powerful secular tailwinds as the world continues to shift away from cash and further towards card payment options, a trend supported by the proliferation of e-commerce and the desire for national governments to pivot towards more efficient payment transaction methods. The company is a stellar free cash flow generator with ample pricing power and a healthy balance sheet, and recent operational updates indicate Visa’s business is rebounding nicely from the worst of the COVID-19 pandemic. We like Visa in the simulated Best Ideas Newsletter portfolio.

—–

Technology Giants Industry – META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, TXN, EBAY, ADP, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for GPN, EVOP, ACIW, EPAY, FDC, FIS, FISV, FLT, LPS, MA, MELI, PAY, PYPL, V, VRSK, WEX, WU, SQ, SOFI, COIN, UPST, LC, LSPD, NU, HOOD, AFRM, TREE, BLND, RPAY, NVEI, ADYEY, ADYYF, RKT, MQ, LDI, PSFE, PRG, GFOF, FINX

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long VRTX call options. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.