Image Shown: Shares of Vertex Pharmaceuticals Inc, an idea included in our Best Ideas Newsletter portfolio, have performed incredibly well year-to-date through October 2022.

By Callum Turcan

Through the end of normal trading hours on October 7, shares of Vertex Pharmaceuticals Inc (VRTX) are up ~34% year-to-date on a price-only basis. We include shares of Vertex Pharma as an idea in the simulated Best Ideas Newsletter portfolio and remain huge fans of the name. Vertex Pharma’s commercialized drug portfolio consists of various treatments for cystic fibrosis (‘CF’) and the cash flows generated from sales of these therapeutics are used to invest in the biotech company’s robust drug development pipeline.

Earnings and Guidance Update

On August 4, Vertex Pharma reported second quarter 2022 earnings that beat both consensus top- and bottom-line estimates. Vertex Pharma’s GAAP revenues rose 22% year-over-year in the second quarter to reach $2.2 billion as sales of its TRIKAFTA/KAFTRIO CF treatments surged higher by 51%. In July 2021, Vertex Pharma launched TRIKAFTA in the US for patients aged 6-11 after receiving regulatory approval from the Food and Drug Administration (‘FDA’) in June 2021, which helped set the stage for strong sales growth.

Internationally, Vertex Pharma’s TRIKAFTA/KAFTRIO treatments posted 46% year-over-year sales growth along with 13% sales growth in the US in the second quarter though sales of its other CF treatments declined. Vertex Pharma’s GAAP operating income clocked in a $1.1 billion in the second quarter of 2022, up from an operating loss in the same period last year, though we caution that special items created some noise here.

In April 2021, Vertex Pharma agreed to pay Crispr Therapeutics AG (CRSP) $0.9 billion along with the potential for a $0.2 billion contingent payment in return for a greater economic interest in the potential CTX001 treatment, which aims to treat sickle cell disease (‘SCD’) and transfusion-dependent beta-thalassemia (‘TDT’). CTX001 represents one of Vertex Pharma’s most promising drug candidates and could be a major medium-term growth driver as CTX001 is currently undergoing Phase 3 clinical trials. By acquiring a greater economic interest in CTX001, a move we were very supportive of, Vertex Pharma’s ‘acquired in-process research and development expenses’ shot higher in the second quarter of 2021 (we covered our thoughts on this agreement here).

Due to a combination of robust net income growth and a modest decline in its outstanding diluted share count, Vertex Pharma’s GAAP diluted EPS came in at $3.13 in the second quarter of 2022 (up from $0.26 in the same period last year). Vertex Pharma has been firing on all-cylinders of late and that encouraged management to once again boost the firm’s full-year guidance for 2022.

When Vertex Pharma reported its second quarter results in August 2022, management raised the company’s full-year ‘product revenues’ up to $8.6-$8.8 billion from $8.4-$8.6 billion previously. Please note that Vertex Pharma’s product revenues represent the lion’s share of its total revenues, and this metric is an effective proxy for its underlying financial performance. Additionally, Vertex Pharma raised its full-year ‘combined GAAP R&D, Acquired IPR&D and SG&A expenses’ for 2022 during its second quarter earnings update to $3.48-$3.63 billion from $3.3-$3.45 billion previously.

Management’s confidence in Vertex Pharma’s near term financial performance is a welcome sign during turbulent times such as these.

Financial Update

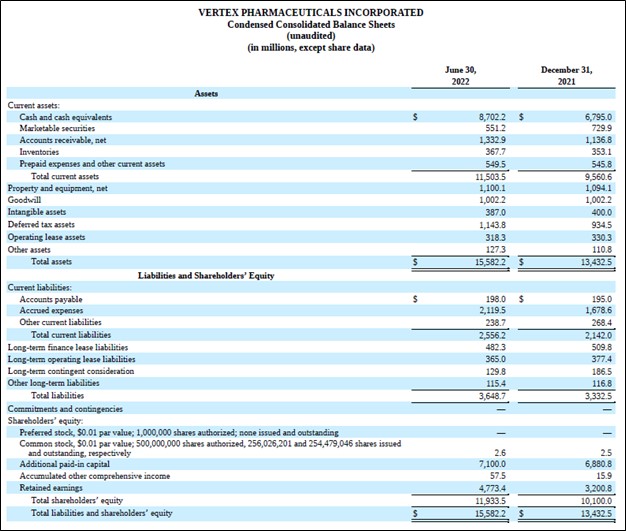

At the end of June 2022, Vertex Pharma had $9.3 billion in cash, cash equivalents, and current marketable securities on hand with no short-term debt on the books and $0.5 billion in noncurrent finance lease liabilities. We are huge fans of Vertex Pharma’s fortress-like balance sheet. The firm can utilize its financial strength to invest heavily in its robust drug development pipeline, make strategic acquisitions if warranted, and repurchase “gobs” of its common stock going forward.

Image Shown: Vertex Pharma had a nice net cash position on hand at the end of June 2022, putting the firm in a prime position to ride out near term exogenous shocks. Image Source: Vertex Pharma – 10-Q SEC filing covering the Second Quarter of 2022

During the first half of 2022, Vertex Pharma generated $2.0 billion in free cash flow and did not spend a significant amount buying back its common stock. The biotech company does not pay out a common dividend at this time.

In June 2021, Vertex Pharma published an 8-K SEC filing that noted it had authorized up to $1.5 billion in share buybacks through the end of December 2022. While Vertex Pharma repurchased $1.4 billion of its stock last year through its repurchase program (excluding purchases made for employee tax obligations purposes), with $1.0 billion of those repurchases occurring during the second half of 2021, management appears to have removed their foot from the gas pedal on this front in order to bulk up the firm’s balance sheet strength. Should shares of VRTX face selling pressures in the future, management could always choose to step in.

Our fair value estimate for Vertex Pharma sits at $295 per share, near where shares of VRTX are trading at as of this writing. The top end of our fair value estimate range sits at $398 per share of Vertex Pharma, indicating there is room for ample capital appreciation upside going forward.

Drug Development Pipeline

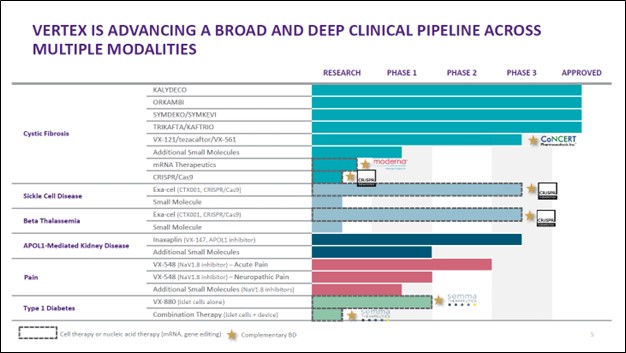

As noted previously, CTX001 is one of Vertex Pharma’s most promising drug candidates. By the end of 2022, Vertex Pharma aims to submit its request for regulatory approval for CTX001 to treat SCD and TDT in Europe and the UK, and its submission in the US is also likely to occur soon. Another one of Vertex Pharma’s promising drug candidates is VX-147, which aims to treat APOL1-mediated kidney disease. VX-147 is currently undergoing Phase 2/3 clinical trials. Vertex Pharma also has drug candidates that aim to treat pain and type 1 diabetes along with CF, SCD, and beta thalassemia.

Its VX-548 drug candidate for pain management could be a game changer in the fight against the opioid pandemic as this is a non-opioid, non-addictive treatment (we covered our thoughts on this drug candidate here). Vertex Pharma also has ample exposure to drug candidates developed through CRISPR gene editing technology and the company has been actively expanding its partnerships on this front in recent years (read more about that upside here). As the biotech firm has multiple avenues for upside as it concerns its drug development pipeline, we view Vertex Pharma’s longer term growth outlook quite bright as the company should be able to get one or more of its promising drug candidates across the finish line in the medium-term.

Image Shown: Vertex Pharma’s robust drug development pipeline underpins its bright longer-term growth outlook. Image Source: Vertex Pharma – Second Quarter of 2022 IR Earnings Presentation

Concluding Thoughts

Vertex Pharma’s performance this year has been stellar, and its financial position is rock-solid. The company has ample financial firepower to invest heavily towards commercializing its existing drug development pipeline and is well-positioned to ride out the numerous exogenous shocks seen of late (inflationary pressures, geopolitical tensions, and the increasing likelihood of a global recession in the near term). We continue to like shares of VRTX in the simulated Best Ideas Newsletter portfolio.

—–

Tickerized for holdings in the IBB.

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Related: CRSP, XLV

Callum Turcan owns shares in DIS, META, GOOG, VRTX, and XLE. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.