Image Shown: Dollar General Corporation outperformed during its latest earnings update. Image Source: Dollar General Corporation – 10-Q SEC filing covering the Second Quarter of Fiscal 2022

By Callum Turcan

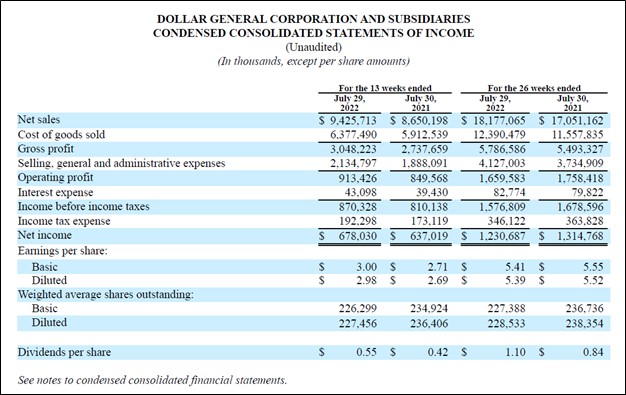

On August 25, Dollar General Corporation (DG) reported second quarter earnings for fiscal 2022 (period ended July 29, 2022) that beat both consensus top- and bottom-line estimates. The discount retailer also raised its full year guidance for fiscal 2022 in conjunction with its latest earnings update after previously raising its full year guidance during its fiscal first quarter earnings report, which we covered in this article here. We include Dollar General as an idea in the Best Ideas Newsletter portfolio and the high end of our fair value estimate range sits at $292 per share. Additionally, shares of DG yield a modest ~0.9% as of this writing.

Earnings Update

Dollar General’s GAAP revenues rose by 9% year-over-year in the fiscal second quarter to reach $9.4 billion as its same-store sales rose by 4.6%. Its same-store sales growth last fiscal quarter was “driven primarily by an increase in average transaction amount, as well as a slight increase in customer traffic” according to its earnings press release. The company’s consumable product sales performed quite well which offset weakness at its apparel, seasonal, and home product categories in the fiscal second quarter.

As inflationary headwinds are weighing negatively on the spending power of US households, consumers appear to be turning to cheaper alternatives and Dollar General is incredibly competitive on this front. While consumable product sales carry lower margins than hardline and apparel sales, Dollar General’s gross margins are still trending in the right direction. The retailer’s GAAP gross margin stood at 32.3% in the fiscal second quarter, up ~70 basis points year-over-year, which given the various exogenous shocks Dollar General is contending with represents incredibly outperformance.

Rising operating expenses, in part due to Dollar General rolling out new store concepts and expanding into Mexico (its first international store expansion plan), saw the firm’s GAAP operating margin decline ~15 basis points year-over-year last fiscal quarter to reach 9.7%. Dollar General’s GAAP operating income rose 8% year-over-year to reach $0.9 billion last fiscal quarter. Its GAAP diluted EPS came in at $2.98 in the fiscal second quarter, up 11% year-over-year, as an increase in its provision in corporate income taxes was offset by net income growth and a decline in its outstanding diluted share count.

Dollar General generated $0.3 billion in free cash flow during the first half of fiscal 2022 while spending a bit over $0.2 billion covering its dividend obligations along with $1.1 billion buying back its stock. Please note that a retailer’s full year (or full fiscal year in this case) performance is a better measure of its free cash flow profile given the large working capital movements that are an inherent part of the business. In fiscal 2021 (period ended January 28, 2022), Dollar General generated $1.8 billion in free cash flow and we expect the firm will remain very free cash flow positive in fiscal 2022.

At the end of the fiscal second quarter, Dollar General had a net debt load of $4.9 billion (inclusive of short-term debt) along with substantial operating lease liabilities on the books. Its $0.3 billion in cash and cash equivalents on hand at the end of this period provides the firm with liquidity to meet its near term funding needs. The retailer also has a $2.0 billion revolving credit facility that matures in December 2026 at its disposal to meet its near term funding needs. As of July 29, 2022, Dollar General had access to virtually all of the revolving credit facility’s borrowing capacity as there were no borrowing against this facility at the end of the fiscal second quarter (though there was a marginal amount of letters of credit posted against the facility).

Guidance Update

Dollar General increased its same-store sales forecast for fiscal 2022 to 4.0%-4.5% from 3.0%-3.5% previously while also increasing its net sales growth forecast to 11% from 10.0%-10.5% previously (both these forecasts incorporate the uplift a 53rd week in fiscal 2022 will have on Dollar General’s net sales, which is expected to provide a ~200 basis point boost to its full fiscal year performance on this front) during its latest earnings update. The retailer maintained its diluted EPS growth forecast of 12%-14% for fiscal 2022, with the 53rd week expected to provide a ~400 basis point uplift to its performance on this front.

Additionally, Dollar General maintained its expectations that it will repurchase $2.75 billion of its stock and spend $1.4-$1.5 billion on its capital expenditures this fiscal year. Here is what Dollar General had to say regarding its capital expenditure plans for fiscal 2022 in its latest earnings press release:

As a result of ongoing delays in permitting and the receipt of construction materials associated with new store openings, the Company is updating its plans for real estate projects for fiscal year 2022. The Company now plans to execute 2,930 to 2,980 real estate projects, including 1,010 to 1,060 new store openings, approximately 1,795 remodels, and approximately 125 store relocations. This is compared to its previous expectation to execute 2,980 real estate projects, including 1,110 new store openings, 1,750 remodels, and 120 store relocations.

Its capital expenditures are going towards updating existing stores, rolling out its new pOpshelf store concept in the US, developing its first stores in Mexico, and expanding its unit store count in the US (with an eye towards larger stores as compared to its traditional store format). We view Dollar General’s growth runway quite favorably. Here is what management had to say on Dollar General’s various initiatives during the firm’s latest earnings call (emphasis added, lightly edited):

“We continue to expect approximately 80% of our new Dollar General stores in [fiscal] 2022 to be in our larger 8,500 square foot store format, which allows us for an even greater assortment as we look to serve our customers with products they want and need. Importantly, we continue to be very pleased with the unit economics of this larger format, highlighted by increased sales productivity and we continue to target returns in the range of 20% to 22%.

In addition to our planned Dollar General and pOpshelf growth in 2022, we are very excited about our plans to expand internationally, and we continue to make good progress towards our goal of opening our first stores in Mexico by the end of 2022.I am pleased to announce that these stores will be branded under the name Super Dollar General, which resonated well with customer focus groups and connotes the idea of a local general store focused on serving customers with products they want and need most.

In addition, the initial stores will be located in underserved communities in Northern Mexico as we look to initially leverage our brand awareness, while extending our value and convenience proposition to a customer base that is similar to our core customer in the United States.Overall, our real estate pipeline remains robust and with more US brick-and-mortar stores than any retailer, we are excited about our ability to capture significant growth opportunities in the years ahead.” — Jeff Owen, COO of Dollar General

Dollar General is also pushing ahead with other initiatives such as adding self-checkout kiosks to its stores, improving its online and e-commerce platforms, bringing more of its distribution activities in-house, adding more products to its stores (including higher margin hardline products along with fresh fruit and vegetables), adding additional freezer and cooler capacity to its stores, and much more.

Concluding Thoughts

We are huge fans of Dollar General as the discount retailer offers investments meaningful capital appreciation upside potential along with incremental dividend growth potential as well. Dollar General’s underlying performance is holding up incredibly well in the face of labor shortages, inflationary pressures, supply chain hurdles, and other exogenous shocks. The company’s various growth and optimization initiatives underpin Dollar General’s bright longer term revenue growth outlook and could lead to substantial margin expansion over the long haul as well, a powerful combination as it concerns future free cash flow growth. We continue to like Dollar General as an idea in our Best Ideas Newsletter portfolio.

—–

Tickerized for DG, DLTR, FIVE, BIG, OLLI, PRTY, RAD, GO, TJX, ROST, ANF, VSCO, BOOT, BURL, GES, CURV, URBN, DECK, SHOO, BBW, PLCE, LE, CVS, WBA

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on VRTX. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.