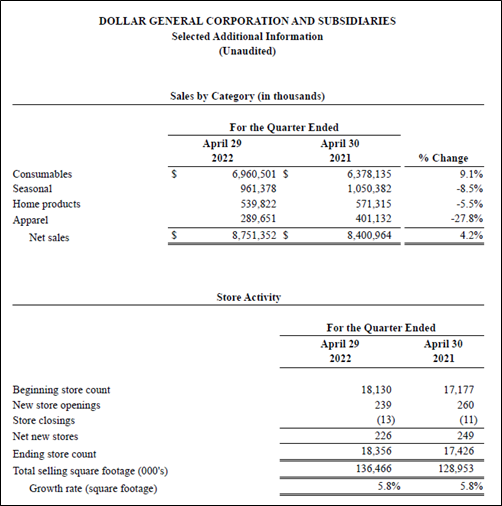

Image Shown: Dollar General Corporation’s GAAP net sales rose in the first quarter of fiscal 2022 on a year-over-year basis due to growth in its net store count. Image Source: Dollar General Corporation – May 2022 8-K SEC Filing

By Callum Turcan

On May 26, Dollar General Corporation (DG) reported first quarter earnings for fiscal 2022 (period ended April 29, 2022) that beat both consensus top- and bottom-line estimates. Even in the face of major supply chain issues and inflationary headwinds, Dollar General modestly increased its net sales and same-store sales growth guidance for fiscal 2022 and maintained its other forecasts.

We include Dollar General in our Best Ideas Newsletter portfolio as we are big fans of its resilient business model, strong cash flow profile, and its various strategic initiatives including rolling out new store concepts, expanding into Mexico, improving its distribution operations, upgrading its digital operations, adding checkout kiosks and additional cooler/freezer capacity to its stores, and adding new offerings to its stores (including produce, frozen foods, and non-consumable items). Our fair value estimate sits at $234 per share of DG with room for upside.

Earnings Update

In the fiscal first quarter, Dollar General’s GAAP net sales grew by 4% year-over-year as growth in its net store count offset a marginal decline in its same-store sales. Dollar General’s same-store sales were negatively impacted by a decline in customer traffic which was largely offset by growth in its average transaction amount. An increase in same-store consumable sales offset declines in its other categories (seasonal, apparel, and home products), though this dynamic weighed negatively on its margins as sales of non-consumable products generally carry stronger gross margins than sales of consumable products.

Dollar General’s GAAP gross margin shifted lower by ~150 basis points year-over-year in the fiscal first quarter due to unfavorable product mix shifts, inflationary pressures from higher product costs and distribution expenses, and increased inventory damages. These factors were only partially offset by higher inventory markups. Rising SG&A expenses as a percentage of net sales along with declines in its gross margin saw Dollar General’s GAAP operating margin shift lower by ~230 basis points year-over-year in the fiscal first quarter. Its GAAP diluted EPS came in at $2.41 in the fiscal first quarter, down from $2.82 in the same period the prior fiscal year as a decline in its GAAP net income was only partially offset by a 4% reduction in its outstanding diluted share count.

Guidance Update

The discount retailer is contending with multiple headwinds, along with difficult year-over-year comparisons due to the banner performance Dollar General put up in fiscal 2020 and fiscal 2021, though its guidance for fiscal 2022 remains strong. Dollar General now expects to generate 10.0%-10.5% annual net sales growth (up from 10.0% previously) in fiscal 2022 due primarily to a combination of forecasted same-store sales growth, ongoing growth in its net store count, and the favorable uplift from an extra reporting week. Please note that fiscal 2022 includes a 53rd week, with the extra week expected to add ~200 basis points to its annual net sales growth figure.

Management reiterated Dollar General’s plans to spend $1.4-$1.5 billion on capital expenditures this fiscal year to complete 2,980 real estate projects including opening 1,110 new stores, 1,750 store remodels, and relocating 120 stores, among other initiatives. Additionally, Dollar General now expects to generate 3.0%-3.5% annual same-store sales growth in fiscal 2022 (up from 2.5% previously).

Furthermore, Dollar General maintained its diluted EPS growth guidance of approximately 12%-14% on an annual basis in fiscal 2022, with the 53rd week adding ~400 basis points to that growth forecast. Dollar General reiterated plans to repurchase $2.75 billion of its stock this fiscal year. We appreciate the company’s confidence in its near term performance.

Financial Considerations

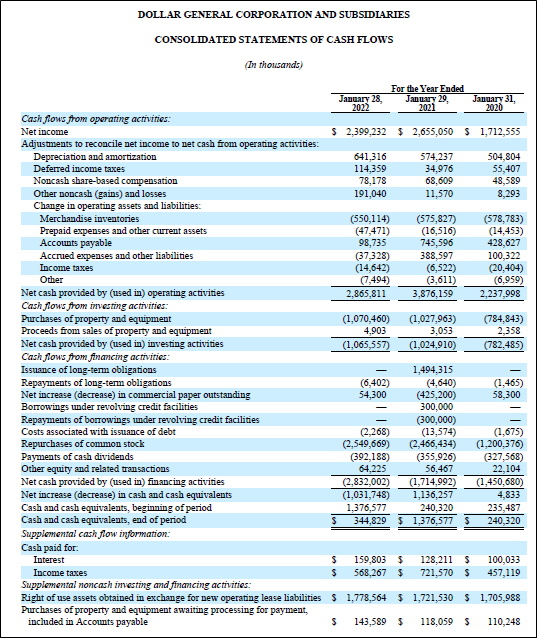

Dollar General generated $168 million in free cash flow and spent $125 million covering its dividend obligations in the fiscal first quarter, along with spending $747 million buying back its stock. The company experienced an enormous build in its working capital last fiscal quarter (due primarily to Dollar General bulking up its merchandise inventories) though the firm was still able to generate substantial positive free cash flows.

One of Dollar General’s biggest downsides is its net debt load, which stood at $4.5 billion (inclusive of short-term debt) at the end of its fiscal first quarter along with other non-cancellable financial liabilities. We view that burden as manageable given its ability to generate substantial normalized cash flows. Dollar General generated ~$2.0 billion in annual free cash flow on average from fiscal 2019-2021 and its run-rate dividend obligations stood at ~$0.4 billion in fiscal 2021.

However, in our view, we think it would be prudent for management to remove their foot from the gas pedal as it concerns the firm’s share repurchase program. Dollar General is contending with various exogenous shocks while pursuing multiple strategic initiatives and the firm has a net debt load to consider. Improving its financial strength would be a better use of its capital in the current environment.

Image Shown: Dollar General is a solid free cash flow generator. Image Source: Dollar General – Fiscal 2021 Annual Report

During Dollar General’s latest earnings call, management had positive qualitative comments on the discount retailer’s push into Mexico, its first store international expansion. The firm aims to open up to ten stores in Mexico by the end of fiscal 2022 and maintained that goal during its latest earnings update. We are keeping a close eye on its international expansion efforts given how, if successful, these efforts could significantly extend Dollar General’s growth runway though these are still early days.

Concluding Thoughts

As a discount retailer, Dollar General is contending with myriad headwinds though its underlying business is holding up quite well. We continue to view its capital appreciation upside potential quite favorably, and its dividend program offers incremental upside potential. Shares of DG yield ~1.0% as of this writing.

—–

Tickerized for DG, DLTR, FIVE, BIG, OLLI, PRTY, RAD, GO, TJX, ROST, ANF, VSCO, BOOT, BURL, GES, CURV, URBN, DECK, SHOO, BBW, PLCE, LE, CVS, WBA

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Related: SPY, VDC

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.