Image Shown: Shares of The Walt Disney Company strengthened February 9 in the wake of the media and entertainment giant’s latest earnings report. We include shares of DIS as an idea in the Best Ideas Newsletter portfolio.

By Callum Turcan

On February 9, The Walt Disney Company (DIS) reported first-quarter fiscal 2022 earnings (period ended January 1, 2022) that smashed past both consensus top- and bottom-line estimates. A sharp rebound at its ‘Disney Parks, Experiences and Products’ unit impressed investors and shares of DIS are strengthening nicely in the wake of its latest earnings report. We are big fans of Disney and include shares of DIS as an idea in the Best Ideas Newsletter portfolio. Our fair value estimate stands at $179 per share of Disney with room for upside as the high end of our fair value estimate range sits at $219 per share. Shares are currently trading at ~$155 each at the time of this writing.

Earnings Update

Revenue at its Disney Parks, Experiences and Products unit more than doubled year-over-year last fiscal quarter. The easing of lockdown measures related to the coronavirus (‘COVID-19’) pandemic helped Disney to reopen its theme parks, and apparently customers are returning in droves. Disney reported that the segment-level operating profit from its Disney Parks, Experiences and Products unit flipped from an operating loss of $0.1 billion in the first quarter of fiscal 2021 to a segment-level operating profit of $2.5 billion in the first quarter of fiscal 2022. Historically, Disney’s theme parks have been its cash flow cows, and it appears that is once again becoming the case as the world slowly puts the COVID-19 pandemic behind it.

Pivoting to its ‘Disney Media and Entertainment Distribution’ unit which houses its various video streaming services (including Disney+, Disney+ Hotstar, Hulu, ESPN+, Star+) along with other assets, this segment posted 15% year-over-year revenue growth last fiscal quarter. However, its segment-level operating profit shifted lower 44% year-over-year in the fiscal first quarter, hitting $0.8 billion.

Disney is spending heavily on original content to support paid subscriber growth at its video streaming services, which has been weighing negatively on its bottom-line performance and will continue to do so in the near term. However, this strategy should help Disney build up sizable recurring revenue streams at this part of its business over the long haul, which could eventually become another cash flow cow.

On a GAAP basis, Disney’s revenues grew 34% year-over-year in the fiscal first quarter, hitting $21.8 billion, while its diluted EPS rose to $0.60 last fiscal quarter from $0.01 in the same period in fiscal 2021. Disney is clearly benefiting from the global economy opening back up.

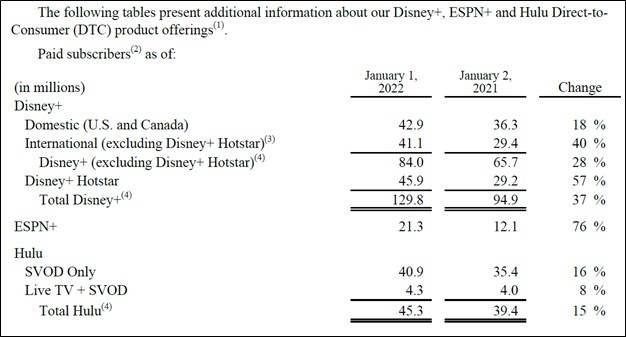

In the upcoming graphic down below, Disney showcases the stellar growth in the paid subscriber bases of its various streaming services seen over the past year, even as households steadily ventured outdoors again. Please note that Disney’s paid subscriber bases at these services grew meaningfully on both a sequential and year-over-year basis last fiscal quarter. Disney recently launched its Star+ service in Latin America and the company markets its Disney+ Hotstar service in several countries, including India and Indonesia. Furthermore, Disney owns 67% of Hulu’s equity and Comcast Corporation (CMCSA) owns the remainder.

Image Shown: Disney’s video streaming services continued to grow their respective paid subscriber bases last fiscal quarter even as the global economy opened back up, a promising sign as it concerns the longer term outlook for this part of Disney’s business. Image Source: Disney – First Quarter of Fiscal 2022 Earnings Press Release

Disney’s biggest weakness is its bloated balance sheet. As of January 1, Disney had a net debt load of $39.7 billion (inclusive of short-term debt) with $14.4 billion in cash and cash equivalents on hand. The company has ample liquidity to meet its near-term funding needs, though the firm will eventually need to pare that burden down. Disney’s free cash flows should swell higher going forward as its theme parks eventually return to something that resembles their pre-pandemic levels of strength, which in turn should enable Disney to de-lever its balance sheet.

Image Shown: Disney has a bloated balance sheet. Image Source: Disney – First Quarter of Fiscal 2022 Earnings Press Release

Concluding Thoughts

We liked what we saw in Disney’s latest earnings update. The company’s traditional cash flow cows (namely its theme parks) are recovering and its future cash flow cows (namely its video streaming services) continue to grow at a robust clip. Disney’s capital appreciation upside potential is quite meaningful, and investors are warming back up to the name as the company is clearly a winner from the global economy opening back up. We value shares at $179 per share each with upside potential to north of $200 per share. Shares are currently trading at ~$155 each at the time of this writing.

Disney’s 16-page Stock Report (pdf) >>

—-

Telecom Services Industry – CMCSA, LUMN, DISH, T, TMUS, VZ, SBAC, AMT, CCI, VIAC

Related: AMZN, DIS, FUBO, NFLX, ROKU, RBLX, TCEHY, BILI, SE, OMC, FOXA, ORAN, TME, AMC, SNAP, TTWO, DISCA, SONY, SSNLF, SSNNF, SSDIY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Crown Castle International Corp (CCI) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.