Image: Booking Holdings’ free cash flow conversion is about as good as it gets. The company remains a key idea in the Best Ideas Newsletter portfolio. Image Source: Booking Holdings

By Brian Nelson, CFA

We initiated a position in Booking Holdings (BKNG) in the Best Ideas Newsletter portfolio in June due in part to its extremely attractive valuation at that time, of which we highlighted graphically in this April 19 note. Booking Holdings’ price-to-fair value disconnect was rather large back in April following a huge fair value estimate increase around that time. Shares of the company have now surged past our fair value estimate of $3,164, as indicated in post-market trading following its fantastic second-quarter 2023 results, and we’re sticking with Booking Holdings in the Best Ideas Newsletter portfolio for now.

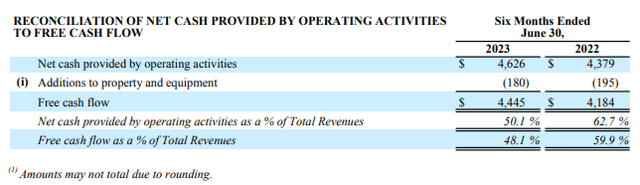

During its second quarter, total revenue advanced 27% on a year-over-year basis, while non-GAAP net income per diluted common share roughly doubled. Through the first six months of the year, net cash provided by operating activities leapt to ~$4.63 billion from ~$4.38 billion in the same period last year, while capital spending dropped to $180 million from $195 million, resulting in considerable free cash flow growth on a year-over-year basis through the first half of the year. Booking Holdings’ cash and cash equivalents stood north of ~$15.2 billion at the end of June, better than its short- and long-term debt tally of ~$14.1 billion, and good for a decent net cash position.

Here is what CEO Glenn Fogel had to say about business momentum in the press release:

In the second quarter, we continued to see robust leisure travel demand, which helped drive stronger than expected room nights and gross bookings results in the quarter. We have seen these strong trends continue into July, and we are currently preparing for what we expect to be a record summer travel season in the third quarter. We are particularly excited about our recently announced generative AI-enabled travel assistants at both Priceline and Booking.com, and look forward to learning which elements customers value the most.

Booking Holdings fits the mold of the type of companies that we’re looking for in this market environment. The company has an asset-light business model that is tied to secular growth trends, all the while it boasts a net cash position and significant free cash flow generation. The company’s outlook also speaks to continued strength as it relates to leisure demand, a key data point suggesting that the broad economic environment remains resilient despite rate increases and the erosion of excess consumer cash savings built up during the COVID-19 pandemic. The quarterly report was welcome news.

NOW READ — Questions for Valuentum’s Brian Nelson

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Tickerized for BKNG, EXPE, SABR, LIND, SOND, H, MAR, FLL, WYNN, MLCO, MGM, PENN, DAL, JETS, ABNB, TRIP, AAL, ALK, UAL, LUV, RCL, CZR, TCOM, CEA, ZNH, HTHT, GHG, INTG, NCLH, CCL, DESP, HGV, TNL, PLYA, LVS, MSC, WYNMF, WYNMY, SCHYY, SCHYF, MCHVF, MCHVY, GXYEF, SJMHF, SJMHY, JBLU, AZUL, TRVG, HA, MESA, SKYW, SNCY, ULCC, ALGT, SAVE, TOUR.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.