By Brian Nelson, CFA

Warren Buffett is one of the greatest qualitative teachers of the discounted cash-flow (DCF) model, also known as enterprise valuation, without saying as much. He doesn’t like dividends in part because he knows they are a reduction to the intrinsic value of Berkshire Hathaway (BRK.A) (BRK.B). He understands that there are not really “value” and “growth” stocks because growth is but a component of valuation. An entity that is growing free cash flow at a pace much larger than that of another company should warrant a higher valuation multiple, of course. Valuation multiples tell us very little about a company’s intrinsic value. That’s what the DCF is for.

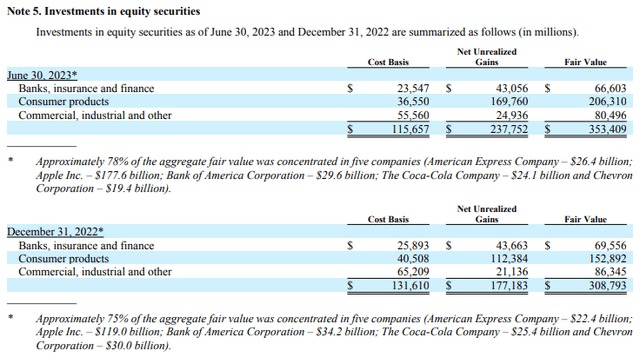

Image: Apple has been a blessing for Berkshire Hathaway. Image Source: Berkshire Hathaway’s second-quarter 2023 10-Q

Often attributed mostly to the economic moat concept, Buffett and his approach to investing are more aligned with the DCF process and enterprise valuation than that of any other investor, in our view. It is probably then not surprising that Apple Inc. (AAPL) is a big component of the Oracle of Omaha’s investment portfolio, despite its lofty valuation multiples. Berkshire Hathaway released second-quarter results August 5, and in the report, the firm noted the value of its stake in Apple had increased to $177.6 billion at the end of the second quarter, up from ~$119 billion at the end of last year. Berkshire has benefited greatly from its position in Apple, and here’s what Warren Buffett recently had to say about Apple at Berkshire’s annual event:

The good thing about Apple is (Berkshire) can go up (in our ownership stake). They keep buying their stock; instead of our owning 5.6%, if they get down to…15.25 billion of shares outstanding, without our doing anything we got 6%. Our criteria for Apple isn’t different than the other businesses we own; it just happens to be a better business than any we own. And we put a fair amount of money in it…and our railroad business is a very good business, but it is not remotely as good as Apple’s business. Apple has a position with consumers where they are paying $1,500 or whatever it may be for a phone, and these same people pay $35,000 for having a second car, and if they had to give up their second car or give up their iPhone, they’d give up their second car. I mean it’s an extraordinary (product). We don’t have anything like that that we own 100% of…but we’re very, very, very, happy to have 5.6% or whatever it may be percent (of Apple), and we’re delighted every tenth of a percent that it goes up.

Berkshire Hathaway fits the bill of the types of companies we’re looking for in this market environment. The company holds a nice cash position on the books, to the tune of ~$147.4 billion, while notes payable and other borrowings stood at ~$125.3 billion–good for a solid net cash position. Operating cash flow advanced to ~$21.1 billion through the first six months of the year (up from ~$15.4 billion from the same period last year), while purchases of property, plant, and equipment came in at ~$8.4 billion (up from ~$6.8 billion), good enough for free cash flow generation of ~$12.7 billion year-to-date in 2023 (up from ~$8.5 billion). Berkshire’s strong net cash position and impressive free cash flow generating profile are big reasons why we continue to like shares in the Best Ideas Newsletter portfolio.

NOW READ: A Market Pullback Should Be Expected; Focusing on Generating Alpha

NOW READ: Apple’s ‘Vision Pro’ Not in Our Valuation Model; Expect Upside

NOW READ (July 9, 2023): MUST READ: 17 Capital Appreciation Ideas In A Row!

NOW READ — Questions for Valuentum’s Brian Nelson

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.