Image: Berkshire Hathaway reduced its equity stake in Apple by a sizable margin.

By Brian Nelson, CFA

Berkshire Hathaway (BRK.A) (BRK.B) recently reported second quarter results. The insurance and industrial conglomerate’s total revenue nudged up modestly 1.2% during the second quarter, while net earnings attributable to Berkshire Hathaway shareholders dropped to $30.4 billion from $35.9 billion in the same period a year ago, as investment gains weren’t as large as they were in the same period last year.

Berkshire Hathaway ended the quarter with $276.9 billion in cash and short-term investments in U.S. Treasury bills, up from $167.6 billion at the end of last year. For the first six months of the year, cash flow from operations came in at $24.2 billion, up from $21.1 billion in the same period a year ago. Capital spending was $8.9 billion in the first half of the year versus $8.4 billion in the same period a year ago. Free cash flow during the first six months of 2024 was $15.2 billion.

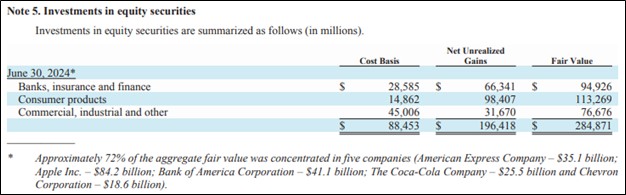

In addition to the big news regarding Berkshire Hathaway’s massive cash balance position, the firm also reduced its equity stake in Apple (AAPL). As of June 30, 2024, its Apple stake stood at $84.2 billion down from $174.3 billion at the end of 2023. We’re not reading much into the reduced stake in Apple given its prior outsized weighting within Berkshire’s portfolio, and we’re viewing the move as merely profit-taking on a big winner.

All things considered, Berkshire Hathaway continues to execute well across its business portfolio, free cash flow continues to move in the right direction, while Buffett remains prudent with his portfolio management decisions. Shareholders’ equity at the end of June was $608 billion, implying that shares are trading at a 1.6x book value, not cheap. Still, we like shares as a key holding in the Best Ideas Newsletter portfolio.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.