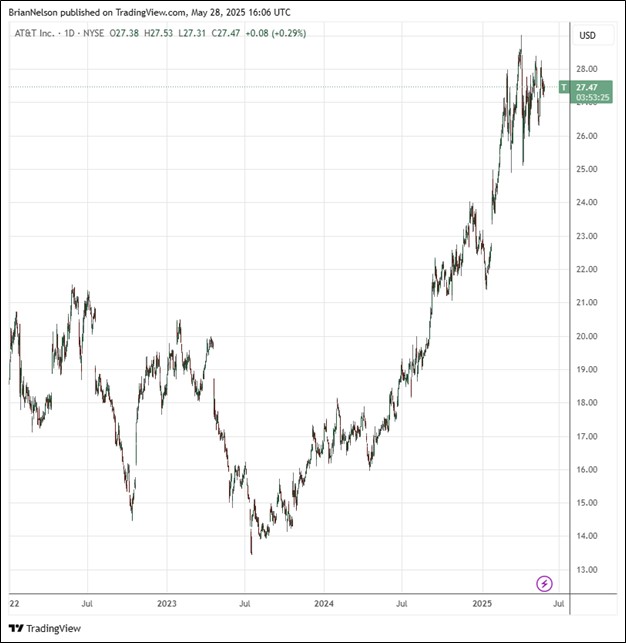

Image: AT&T’s shares have performed well of late.

By Brian Nelson, CFA

AT&T (T) recently reported mixed first quarter results with revenue exceeding the consensus forecast, but non-GAAP earnings per share coming in slightly short of expectations. Revenue came in at $30.6 billion versus $30.0 billion in the year-ago period, while adjusted diluted earnings per share advanced to $0.51 from $0.48 in the year-ago period. Adjusted operating income was $6.4 billion versus $6.0 billion in the year-ago quarter, while operating cash flow totaled $9.0 billion, up from $7.5 billion a year ago. Free cash flow was $3.1 billion versus $2.8 billion a year ago.

Management had the following to say about the quarter:

Our business fundamentals remain strong, and we are uniquely positioned to win in this dynamic and competitive market. We are growing the right way as customers continue to choose AT&T Fiber and 5G wireless for connectivity they can rely on, guaranteed or we’ll make it right. The priorities we laid out at our 2024 Analyst & Investor Day have not changed, and we continue to operate our business to achieve the financial plan and capital returns we outlined in December.

For its full year 2025 outlook, AT&T expects consolidated service revenue growth in the low-single-digit range, with mobility service revenue growth at the higher end of the 2%-3% range. Adjusted EBITDA is expected to grow 3% or better for the year. Capital investment is targeted in the $22 billion range, while free cash flow is expected to be greater than $16 billion for the year. Adjusted earnings per share for 2025 is targeted in the range of $1.97-$2.07. Net debt was $119.1 billion at the end of the quarter. The high end of our fair value estimate range is $34 per share. Shares yield 4% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.