Image: AT&T is back in the doghouse, as free cash flow generation came in worse than expected during its first-quarter 2023 results. Image Source: AT&T

By Brian Nelson, CFA

It’s unbelievable.

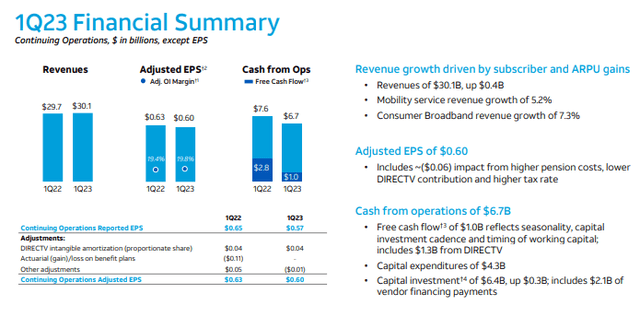

As soon as we started to warm up to AT&T (T) in October of last year, noting that its free cash flow generation was looking a lot better, the company falls off the tracks again. During the first quarter of 2023, AT&T’s cash flow from operations dropped more than $950 million on a year-over-year basis, while capital spending and cash paid for vendor financing soared. Non-GAAP free cash flow came in at $1.0 billion (missing expectations), while the company shelled out $2 billion in dividends during the period.

Excluding cash paid for vendor financing, AT&T’s traditional free cash flow (cash flow from operations less capital expenditures) of $2.34 billion still exceeded cash dividends paid in the period of $2.0 billion, but the 1.16x coverage was nowhere near as encouraging as trends witnessed toward the latter part of 2022, where third-quarter 2022 free cash flow coverage was phenomenal.

AT&T’s forward estimated dividend yield of 5.6% is attractive at face value, but the economics of its business continue to leave a lot to be desired, in our view. Not only is the company saddled with a tremendous amount of net debt to the tune of a whopping $134.7 billion, resulting in an annualized net debt to adjusted EBITDA ratio of 3.22x, but the company operates a capital-intensive model that eats into its operating cash flow.

AT&T has put up 11 straight quarters of 400,000+ postpaid phone net adds and 13 consecutive quarters of 200,000 AT&T Fiber net adds, and domestic wireless service revenue and consumer broadband revenue moved in the right direction in the quarter, but AT&T just can’t figure out how to stabilize free cash flow and grow it. We doubt the market may ever grow comfortable in the sustainability of its payout again, particularly considering the recent dividend cut.

AT&T’s Dividend Cushion stands at -1.2 (negative 1.2), indicating very poor dividend quality, and we have no interest in AT&T’s shares, which are trading at levels first reached decades ago.

NOW READ: Verizon’s Big Share-Price Drop Opens Opportunity for 6.8% Dividend Yield

———-

Tickerized for T, VZ, TMUS, CMCSA, MSI, ANET, CHTR, JNPR, CABO, VSAT, CIEN, UI LITE, LUMN, DISH

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.