Image Shown: Apple Inc put up another strong earnings report for the quarter ended March 2022. We continue to like Apple as an idea in our newsletter portfolios.

By Callum Turcan

On April 28, Apple Inc (AAPL) reported earnings for its second quarter of fiscal 2022 (period ended March 26, 2022) that beat both consensus top- and bottom-line estimates by a wide margin. Apple also increased its dividend by 5% on a sequential basis and authorized an additional $90.0 billion in share repurchases in conjunction with its latest earnings update.

We are big fans of Apple and include shares of AAPL as an idea in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Shares of AAPL yield ~0.5% as of this writing and we see room for Apple to push through substantial payout increases going forward. Additionally, the top end of our fair value estimate range sits at $204 per share of AAPL, well above where Apple’s stock price is trading at as of this writing indicating it has ample capital appreciation upside potential as well.

Earnings Update

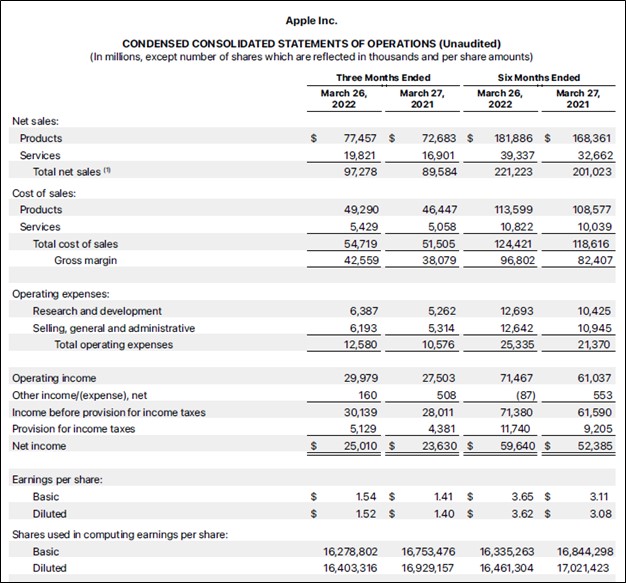

Apple reported record quarterly revenue from its ‘Services’ segment last fiscal quarter (includes its digital services, AppleCare services, payment services, and advertising revenues)which hit $19.8 billion, while its ‘Products’ segment (includes sales of its hardware offerings) posted record revenue for the quarter ended in March 2022 of $77.5 billion (keeping in mind Apple’s quarter that ends in December benefits from the holiday shopping season). Its GAAP revenues grew 9% year-over-year last fiscal quarter with its Services revenues up 17% and its Products revenues up 7%.

We appreciate that demand for Apple’s offerings remains robust across the board. Its sales in the Americas region outperformed last fiscal quarter and were up 19% year-over-year. Looking at its hardware offerings, Apple reported nice revenue growth at its iPhone, Mac, and its Wearables, Home, and Accessories offerings, though sales of its iPad fell year-over-year last fiscal quarter. As the world puts the worst of the coronavirus (‘COVID-19’) pandemic behind it, demand for various consumer electronics will likely shift as households resume outside activities in earnest, though Apple’s hardware remains in high demand.

Strong revenue growth at its high-margin Services segment (which had a gross margin of 70.6% last fiscal quarter) along with its substantial pricing power helped Apple to grow its GAAP gross margin by ~125 basis points year-over-year in the fiscal second quarter, bringing it north of 43.7%. Apple’s GAAP operating income rose 9% year-over-year and its GAAP operating margin climbed higher ~10 basis points to reach just over 30.8% last fiscal quarter. The company’s R&D and SG&A expenses rose by a brisk clip in the fiscal second quarter on a year-over-year basis as Apple continues to invest heavily in the business, a strategy we are very supportive of.

Apple’s GAAP diluted EPS came in at $1.52 last fiscal quarter, up 9% year-over-year, and its outstanding diluted share count dropped 3% year-over-year during this period. Its provision for corporate income taxes rose materially and its other income line-item dropped significantly last fiscal quarter on a year-over-year basis, which weighed negatively on its GAAP net income growth, though that figure still rose 6% year-over-year due to strong performance at Apple’s underlying operations.

During the first six months of fiscal 2022, Apple generated $69.8 billion in free cash flow, up from $57.0 billion in the same period last fiscal year. Apple spent $7.3 billion covering its dividend obligations along with $43.1 billion buying back its stock via its share repurchase program during the first six months of fiscal 2022, activities that were fully covered by its stellar free cash flows. The company exited the fiscal second quarter with a net cash position of $72.7 billion (inclusive of short-term debt and noncurrent marketable securities).

Apple’s management team recently cautioned that supply chain hurdles will continue to weigh negative on the firm’s operations and financial performance for the foreseeable future. With that in mind, underling demand for Apple’s offerings remains strong and the company has ample pricing power. We expect that Apple will be able to offset supply chain hurdles and inflationary pressures going forward by growing its high-margin Services segment and implementing pricing increases were feasible.

Concluding Thoughts

Apple is a free cash flow cow with a bright growth outlook and a fortress-like balance sheet. We view its combination of share repurchases and dividend increases as a great way to make the most of its strong financial position by returning “gobs” of cash back to investors. The company’s share buybacks are a good use of capital as Apple’s stock has been trading below our estimate of its intrinsic value for some time, especially under more optimistic assumptions of its longer term growth runway. We are huge fans of Apple and continue to like the company as an idea in the newsletter portfolios.

Apple’s 16-page Stock Report (pdf) >>

Apple’s Dividend Report (pdf) >>

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for AAPL, various technology-related ETFs, and Chinese-related ETFs.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.