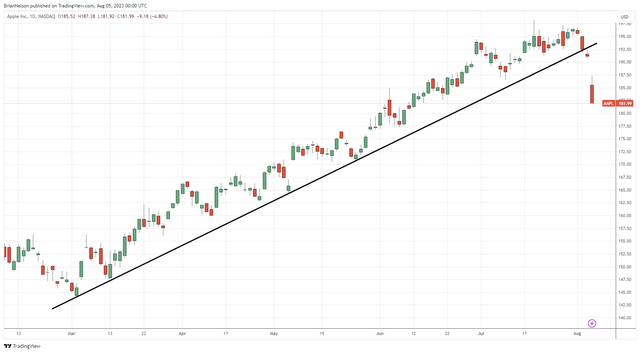

Image: Apple has been a strong performer thus far in 2023, but the stock has broken through its uptrend. Further selling may be ahead of shares. In light of Apple’s weighting across major market indices, investors should expect a modest pullback in the markets.

By Brian Nelson, CFA

On August 3, Apple Inc. (AAPL) reported third-quarter fiscal 2023 results that gave the market a reason to sell its shares. Though the iPhone maker’s quarterly results largely matched the consensus forecasts for both the top and bottom line, year-over-year declines in iPhone, Mac, and iPad sales, while expected, were evident in the quarter, even as its Services business grew meaningfully from last year’s period. A technical breakdown in its uptrend sparked selling after the report, but we continue to be in awe of Apple’s financial prowess that continues to showcase a substantial net cash position and tremendous free cash flow generation.

On the basis of its technical backdrop, we expect a continued pullback in Apple’s shares, and in light of its weighting in many major indices, some near-term weakness in the broader markets should be expected, too. That said, we look forward to the release of the new iPhone15 Pro and expect it and the rollout of the ‘Vision Pro,’ as well as initiatives in artificial intelligence, to propel fiscal 2024 numbers. Though we never like it when a key bellwether is technically breaking down, we’re going to be patient with Apple. We continue to include shares in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

NOW READ: Apple’s ‘Vision Pro’ Not in Our Valuation Model; Expect Upside

NOW READ (July 9, 2023): MUST READ: 17 Capital Appreciation Ideas In A Row!

NOW READ — Questions for Valuentum’s Brian Nelson

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.