By Brian Nelson, CFA

On October 31, Advanced Micro Devices (AMD) reported solid third-quarter results with revenue advancing 4% on a year-over-year basis and non-GAAP earnings per share coming in slightly better than expectations, with net income up more than four-fold, to $299 million. Management expressed excitement about demand for its Ryzen 7000 series PC processors and noted that its data center business is progressing well thanks to its 4th Gen EPYC CPU portfolio and Instinct MI300 accelerator shipments across various markets, including artificial intelligence [AI]. Here’s what CEO Lisa Su had to say about AI on the conference call:

In PCs, there are now more than 50 notebook designs powered by Ryzen AI in market, and we are working closely with Microsoft on the next generation of Windows that will take advantage of our on-chip AI Engine to enable the biggest advances in the Windows user experience in more than 20 years…

…Based on the rapid progress we are making with our AI road map execution and purchase commitments from cloud customers, we now expect Data Center GPU revenue to be approximately $400 million in the fourth quarter and exceed $2 billion in 2024 as revenue ramps throughout the year. This growth would make MI300 the fastest product to ramp to $1 billion in sales in AMD history. I look forward to sharing more details on our progress at our December AI event…

…Turning to our Client segment. Revenue increased 42% year-over-year and 46% sequentially to $1.5 billion. Sales of our Ryzen 7000 processors featuring our industry-leading Ryzen AI on-chip accelerator, grew significantly in the quarter as inventory levels in the PC market normalized and demand began returning to seasonal patterns…

…As the PC market returns to seasonal patterns, we believe we are well positioned to gain profitable share in the premium and commercial portions of the market based on the strength of our product offerings. We are focused on accelerating our leadership AI capabilities across our entire product portfolio, executing on our hardware and software road maps and expanding our enterprise computing footprint. I look forward to sharing more details on our AI progress in a few weeks at our together we advance AI event.

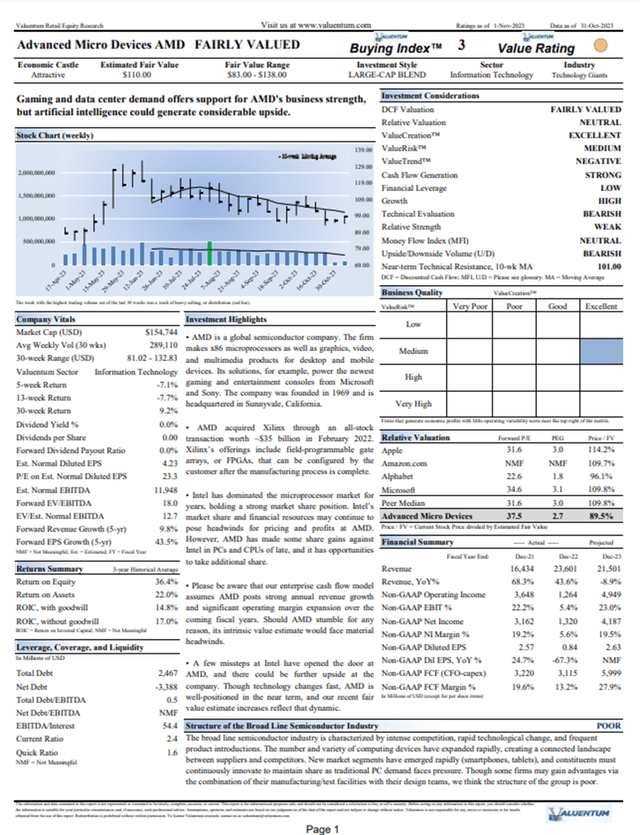

Looking to the fourth quarter, the company expects to experience “strong growth in Data Center and continued momentum in Client,” though its Gaming revenue is anticipated to experience some weakness. Fourth-quarter revenue is expected to hit $6.1 billion at the midpoint, approximating growth of 9% on a year-over-year basis, while its non-GAAP gross margin is expected to be ~51.5%, significantly higher than what it achieved in the most recent quarter (~47%). We recently refreshed our valuation model of AMD, and our updated fair value estimate stands at $110 per share.

Please select the image below to download its 16-page stock report.

Tickerized for holdings in the SMH.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.