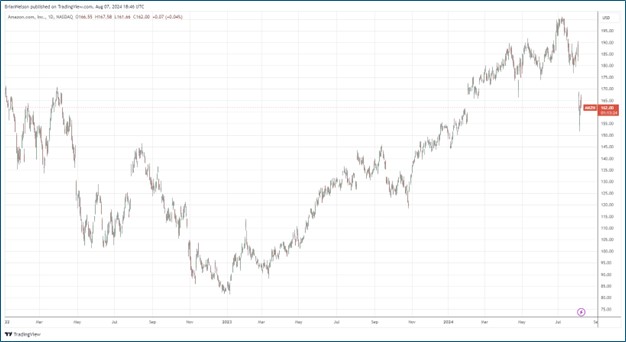

Image: Amazon traded aggressively lower following its second-quarter results.

By Brian Nelson, CFA

On August 1, Amazon (AMZN) reported mixed second quarter results for the period ended June 30, 2024, with revenue coming up short but GAAP earnings per share beating consensus. Adjusting for foreign currency, net sales advanced 11% led by 19% growth in AWS segment sales, which came in higher than expectations of 17.6% growth.

Operating income advanced to $14.7 billion in the second quarter, up from $7.7 billion in the same period a year ago. AWS segment operating income increased more than 70% on a year-over-year basis. Net income increased to $13.5 billion in the second quarter compared to $6.7 billion in the second quarter of 2023. Management spoke positively about AWS and its opportunity in artificial intelligence:

We’re continuing to make progress on a number of dimensions, but perhaps none more so than the continued reacceleration in AWS growth. As companies continue to modernize their infrastructure and move to the cloud, while also leveraging new Generative AI opportunities, AWS continues to be customers’ top choice as we have much broader functionality, superior security and operational performance, a larger partner ecosystem, and AI capabilities like SageMaker for model builders, Bedrock for those leveraging frontier models, Trainium for those where the cost of compute for training and inference matters, and Q for those wanting the most capable GenAI assistant for not just coding, but also software development and business integration.

Amazon has become a cash cow again. Operating cash flow jumped 75% to $108 billion for the trailing twelve months compared to $61.8 billion for the twelve months ended June 30, 2023. Free cash flow increased to $53 billion for the trailing twelve months, compared to $7.9 billion for the trailing twelve months ended June 30, 2023. Looking to the third quarter, net sales are expected to increase 8%-11%, while operating income is expected to be between $11.5-$15 billion, compared to $11.2 billion in the third quarter of 2023.

Though Amazon missed second-quarter revenue consensus estimates, and the midpoint of its third-quarter revenue and earnings guidance came in below the consensus forecasts at the time, we continue to point to aggressive growth at AWS coupled with the firm’s strong free cash flow generation as reasons to not be bearish on the stock. We won’t be adding Amazon to any newsletter portfolio as we are already quite tech-heavy, but the company’s share price slide could provide an entry point on a name with strong fundamental momentum.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.