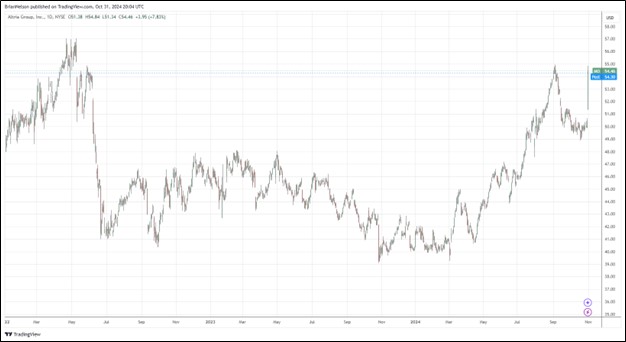

Image: Altria’s shares have recovered nicely during 2024.

By Brian Nelson, CFA

Altria (MO) reported better-than-expected third quarter results on October 31. Revenues net of excise tax increased 1.3% as the company experienced higher net revenues in its Oral Tobacco Products segment, while adjusted diluted earnings per share advanced 7.8%, to $1.38, which was $0.03 better than the consensus forecast. Management had the following to say about the quarter:

Altria delivered outstanding results in the third quarter. The smokeable products segment delivered solid operating companies income growth behind the resilience of Marlboro, and in the oral tobacco products segment, our MST brands continued to drive profitability while on! maintained momentum in the marketplace. We also continued to reward shareholders through a growing dividend and share repurchases while making investments in pursuit of our Vision.

We also announce today a new Optimize & Accelerate initiative designed to modernize our processes, which we believe will accelerate progress toward our Vision, and we reaffirm our guidance to deliver 2024 full-year adjusted diluted EPS in a range of $5.07 to $5.15. This range represents an adjusted diluted EPS growth rate of 2.5% to 4% from a base of $4.95 in 2023.

NJOY consumables reported shipment volume growth of 15.6% versus the prior-year quarter, to 10.4 million units. NJOY devices reported shipment volume doubled versus the prior-year period, to 1.1 million units. NJOY gained 2.8 percentage points of market share in the U.S. multi-outlet and convenience channel in the quarter.

In the quarter, revenues net of excise taxes increased 1.2% in its Smokeable Products segment, with adjusted segment operating companies’ income [OCI] advancing 7.1% primarily due to higher pricing. Revenues net of excise taxes increased 5.8% in its Oral Tobacco Products segment, while adjusted segment OCI increased 2% in the quarter. The company noted that it expects the initial phases of its Optimize & Accelerate initiative to deliver at least $600 million in cumulative cost savings over the next five years.

In the third quarter, Altria repurchased 13.5 million shares for a total cost of $680 million. Through the first nine months, Altria bought back 67.6 million shares for a total of $3.1 billion. As of the end of last quarter, it has $310 million remaining under its current buyback program.

Altria paid dividends of $1.7 billion and $5.1 billion during the third quarter and the first nine months, respectively. The 4.1% increase in its dividend in August marked the 59th increase during the past 55 years. Management’s guidance calls for a mid-single-digits annual increase in its per-share payout through 2028. We liked Altria’s operating income growth in its Smokeable Products segment in the quarter, and we’re fans of its plans for the dividend the next few years. Altria remains a key idea in the High Yield Dividend Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.