Image: Albemarle is a low-cost producer of lithium derivatives, an end market that is expected to experience tremendous demand in the coming years.

By Brian Nelson, CFA

On August 2, Albemarle Corp. (ALB) reported excellent second-quarter 2023 results that showed net sales advancing 60% and adjusted diluted earnings per share more than doubling in the quarter. For the full-year 2023, net sales are now expected to be between $10.4-$11.5 billion (was $9.8-$11.5 billion) thanks in part to continued strength in electric vehicle (EV) demand. Our fair value estimate for Albemarle stands at $257 per share, well above where shares are currently trading. We think the market is underestimating not only its growth potential but also mid-cycle levels of profitability.

Albemarle is a key producer of lithium derivatives, which are used in lithium batteries across a plethora of consumer products and EVs, as well as in the industrial, chemical, and pharmaceutical industries, among others. The company’s bromine-based applications are used in fire safety solutions as well as in certain plastics and insulation, while the company’s catalysts are applied in the oil refining business. The strength in EVs is expected to continue for years to come, and Albemarle has an enviable low-cost position as a key supplier.

For full-year 2023, the firm’s adjusted EBITDA is expected in the range of $3.8-$4.4 billion (was $3.3-$4 billion) driven in part by continued strong sales growth but also margin improvement. Its adjusted EBITDA margin is expected to come in a full three percentage points better during the year than its prior forecast (37%-38%, was 34%-35%). Higher lithium market index pricing is a key driver behind the upward momentum in its ‘Energy Storage’ segment, bolstered by volumes that are now expected at the high end of its expected growth range (40%). Its outlook for its ‘Specialties’ division will be weighed down by weaker levels of profitability across consumer and industrial end markets, but overall, things are looking great.

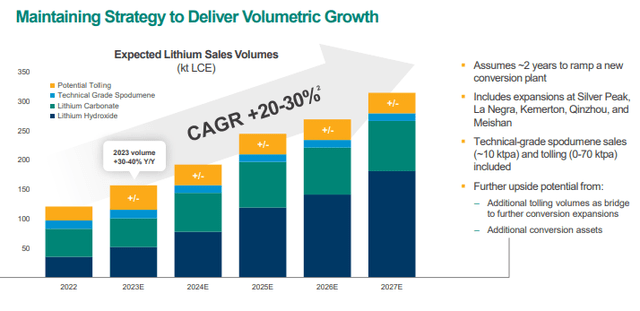

Albemarle’s adjusted diluted earnings per share is now targeted in the range of $25-$29.50 per share for 2023 (was $20.75-$25.75), and we like the huge upwardly revised range in this department. Though free cash flow will come in a bit lower than expected on the year due to working capital changes and higher capital spending, Albemarle remains one of the best growth stories on the market today. The company ended June with $1.6 billion in cash and cash equivalents and $3.5 billion in total debt, resulting in a modest net debt position, but one that we’re not worried about given the trajectory of growth ahead of the company. Lithium sales volumes are expected to be robust for years to come, and the firm may very well be a potential takeout candidate from none other than Exxon Mobil (XOM), which is building one of the largest lithium factories in Arkansas.

NOW READ — Questions for Valuentum’s Brian Nelson

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Tickerized for ALB, LAC, LIT, LTHM, PLL, LITM, SQM, GM, RIVN, ION, SGML, REMX, HMB, XOM

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.