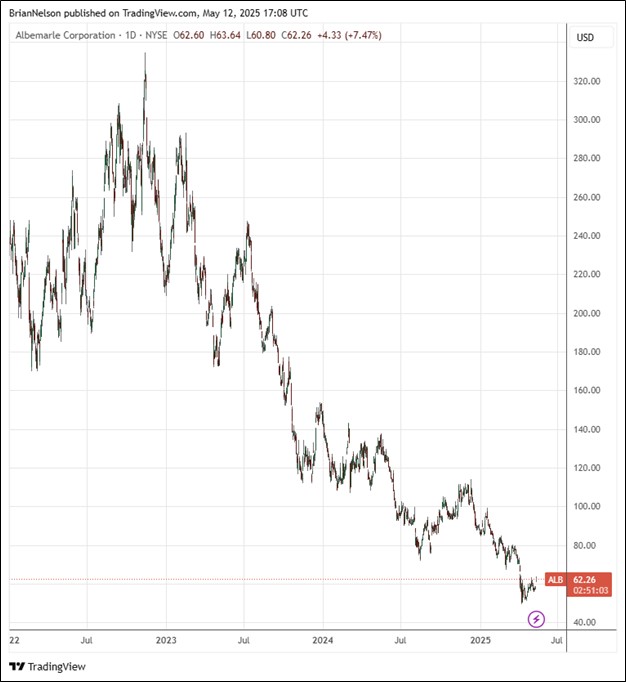

Image Source: TradingView

By Brian Nelson, CFA

Albemarle (ALB) recently reported mixed first quarter results, with revenue coming in slightly lower than forecast, but its bottom-line loss was less than feared. Net sales fell 20.9% in the quarter due to lower pricing in Energy Storage, while adjusted EBITDA fell 8.3% as lower net sales were mostly offset by lower average input costs and ongoing cost reduction efforts. Adjusted diluted loss per share swung to a loss of $0.18 from a gain of $0.26 in the same period last year. Management had the following to say about the quarter:

Our business continues to perform in line with our outlook considerations, including first-quarter adjusted EBITDA of $267 million with strong year-over-year improvements in Specialties and Ketjen. We continue to focus on what we can control – taking decisive actions to reduce costs, optimize our lithium conversion network and increase efficiencies to preserve our long-term competitive position. While the full economic impact of the recently announced tariffs and other global trade actions is unclear, we benefit from our global footprint and the current exemptions for critical minerals; as a result, we are maintaining our full year 2025 outlook considerations.

Albemarle’s cash flow from operations in the quarter came in at $545 million, which included a $350 million customer prepayment. The firm reiterated its view that it has line of sight to breakeven free cash flow assuming current lithium pricing. Albemarle also maintained its full-year 2025 outlook considerations. At year-end 2024 average lithium market price of $9/kg LCE, net sales are targeted in the range of $4.9-$5.2 billion, with adjusted EBITDA in the range of $0.8-$1.0 billion. Though Albemarle continues to struggle with a low lithium price environment, we were encouraged by commentary regarding free cash flow, and the stock remains an idea in the ESG Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.