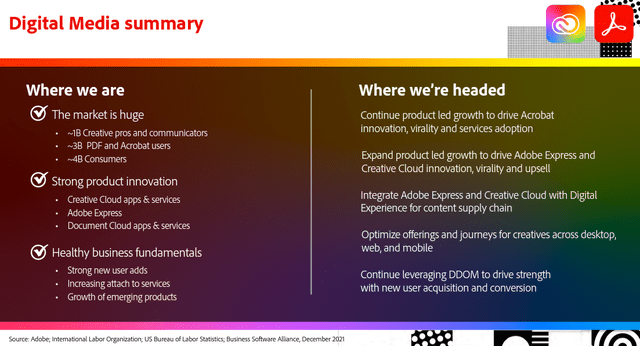

Image: Adobe’s long-term market opportunity is huge. Image Source: Adobe

By Brian Nelson, CFA

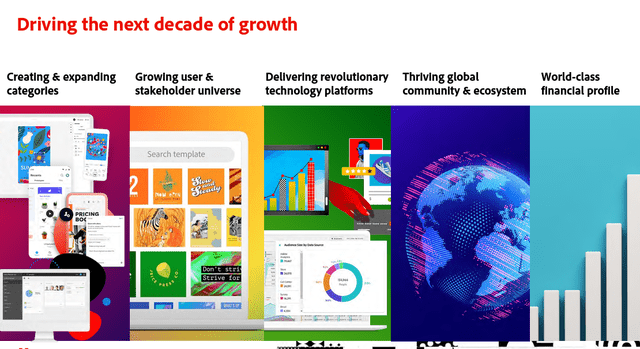

All things considered, fiscal 2022 was a solid year for Adobe (ADBE), as reported in its latest quarterly earnings report December 15. The company generated record revenue, operating income, and operating cash flow, and we loved that management is talking in terms of the “next decade of growth,” not next quarter or even next year. We like executive suites that are positioning their companies for the long run, and we think Chairman and CEO Shantanu Narayen has done a great job leading the charge.

Adobe is among the most well-known software companies due in part to its Adobe Acrobat software. Almost anyone that has applied for a job has used Adobe to “pdf” their resume, and many use the software to “pdf” other documents. The company makes money through licensing via a Software-as-a-Service (“Saas”) model or through subscription and pay-per-use models. The company has two primary areas of strategic growth, per its most recent 10-K:

Digital Media. We provide products, services and solutions that enable individuals, teams and enterprises to create, publish and promote their content anywhere and accelerate their productivity by modernizing how they view, share, engage with and collaborate on documents and creative content. Our Digital Media segment is centered around Adobe Creative Cloud and Adobe Document Cloud, which include Creative Cloud Express, Photoshop, Illustrator, Lightroom, Premiere Pro, Acrobat, Adobe Sign and many more products, offering a variety of tools for creative professionals, communicators and other consumers. This is the core of what we have delivered to users for decades, and we have continually evolved and expanded our business model to provide our customers with a range of flexible solutions that allow them to reach their full creative potential anytime, anywhere, on any device and on projects of all types.

Digital Experience. We provide an integrated platform and set of applications and services through Adobe Experience Cloud that enable brands and businesses to create, manage, execute, measure, monetize and optimize customer experiences that span from analytics to commerce. Our customers include marketers, advertisers, agencies, publishers, merchandisers, merchants, web analysts, data scientists, developers and executives across the C-suite. The foundation of our offering is Adobe Experience Platform, which provides businesses and brands with an open and extensible system for customer experience management that transforms customer data into robust customer profiles that update in real time and uses insights driven by artificial intelligence (“AI”) to enable the delivery of personalized digital experiences across various channels in milliseconds.

For the three months ended December 2, 2022, Adobe’s total revenue advanced 10.1%, while gross profit increased by a similar clip in the period. Operating income was roughly flat on a year-over-year basis in the quarter, but for the fiscal year, operating income advanced 5.1%. For fiscal 2022, non-GAAP diluted net income per share came in at $10.10, up from $10.02 during last fiscal year. Higher income taxes proved to be a headwind during its fiscal 2022, offset in part by buybacks to the tune of 15.7 million shares.

For the three months ended December 2, 2022, cash flow from operations jumped to $2.325 billion (a record) from $2.05 billion, while capital spending stayed relatively flat at $91 million (it was $81 million in the year-ago period). One of the strongest attributes of Adobe’s business model is its asset light operations. By this, we mean that capital spending was just 3.9% of cash flow from operations and 2.0% of sales during the fourth quarter of fiscal 2022.

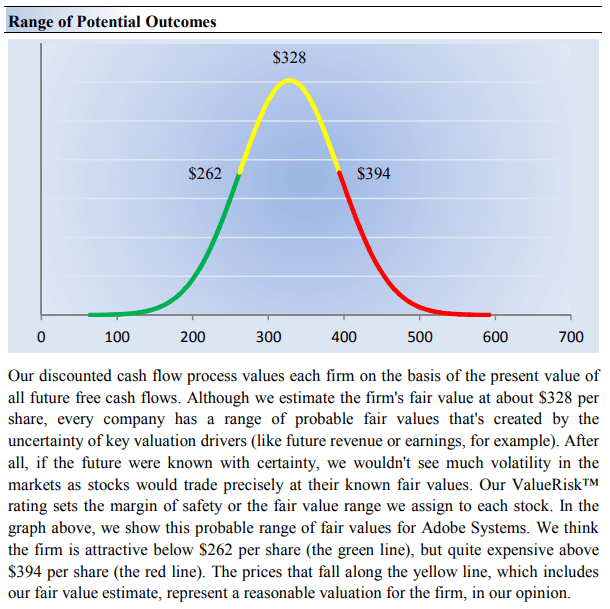

The high end of our fair value estimate of Adobe stands at ~$394 per share, implying upside from its current share price of ~$337. Readers should expect our valuation model to experience some changes in the coming quarters, however, as we factor in the company’s $20 billion proposed acquisition of design collaboration company Figma that is expected to close in 2023. The price tag for its rival is a rather large one, split between half cash and half stock, and we’ll have to see how the numbers shake out in the coming quarters.

It’s not immediately clear the DOJ will give the thumbs up on the Adobe-Figma transaction either.

Image Source: Valuentum

Looking to fiscal 2023 (excluding contributions for its planned acquisition of Figma), Adobe’s total revenue is expected in the range of $19.1-$19.3 billion, while non-GAP earnings per share is targeted in the range of $15.15-$15.45. At the high end of the target revenue range, top-line growth is implied at ~9.6%, while the high end of its non-GAAP earnings per share target means shares are trading at a comparatively rich but reasonable ~21.8x current fiscal year earnings.

Image Source: Adobe

Long-term, we see two areas of tremendous growth for Adobe. First, the company operates in the sweet spot of digital content generation, and it has its hands in a large number of end markets as just about “everyone has a story to tell,” and these storytellers need digital tools like Adobe Creative Cloud to do so.

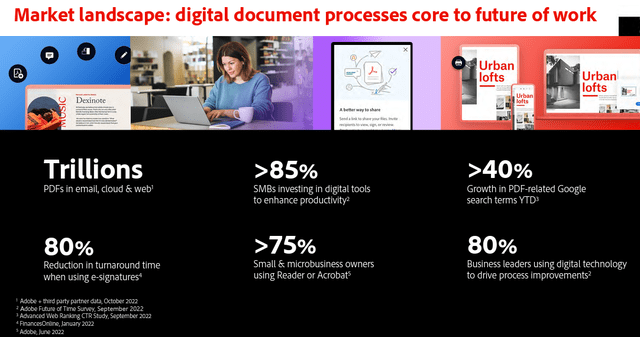

The company’s Adobe Document Cloud business helps to further the processes of many businesses by integrating its pdf technology with other applications to combine workflows. Quite simply, trillions of pdfs are generated each year, and this will only grow as time goes on. Its deal with Figma should further open its total addressable market.

Image Source: Adobe

Second, Adobe has tremendous pricing power. Because many consumers and businesses depend on Adobe and have integrated the company’s technology into their process, switching costs are rather high. We estimate the recent price increase at Acrobat Pro, for example, at 33.3%, which is an enormous hike and should help pad the company’s bottom line and drive considerable free cash flow generation.

Concluding Thoughts

Adobe recently announced a rather large acquisition of rival Figma, and while the price tag is rather steep, we think the deal makes sense strategically. Price increases across Adobe’s suite of products have been impressive, and we estimate the latest price increase at Acrobat Pro to be ~33%, which is a huge year-over-year delta. Given the high switching costs, we think many consumers will have to eat the price increase.

Adobe’s shares trade at a lofty earnings multiple, but it remains one of the best-positioned software stocks in this tumultuous economic environment. A growing recurring (subscription) book of business, considerable operating cash flow growth, and a strong capital structure with investment-grade credit ratings are a few things we like most about Adobe. The high end of our fair value estimate range of Adobe stands at $394 per share.

Adobe’s 16-page Stock Report (pdf) >>

Tickerized for ADBE, DOCU, ADSK, CFLT, CRM, CRWD, DDOG, FTNT, HUBS, INTU, MDB, MSFT, NET, NICE, NOW, BASE, DCT, FSLY, DBX, NEWR, QLYS, SMAR, SPLK, SUMO, ZM, BOX, COUP, NABL, SWI, TDC, TWLO, VEEV, GWRE, ASAN, SMAR

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.