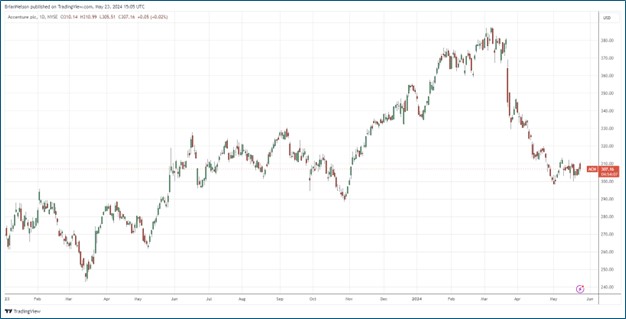

Image: Accenture is facing revenue growth pressure, but the company’s financials remain resilient.

By Brian Nelson, CFA

Back on March 21, Accenture (ACN) reported mixed second quarter fiscal 2024 results, with revenue missing top-line expectations and non-GAAP earnings per share beating the consensus forecast. “Accenture is a leading global professional services company that helps the world’s leading businesses, governments and other organizations build their digital core, optimize their operations, accelerate revenue growth and enhance citizen services—creating tangible value at speed and scale (Form 10-K).”

During the second quarter, Accenture’s revenues were roughly flat in U.S. dollars and local currency compared to the same period a year ago. Adjusted operating income came in at $2.16 billion, which was down from the $2.19 billion it recorded in the second quarter of fiscal 2023. Adjusted earnings per share was $2.77 in the quarter, reflecting a modest increase of 3% from $2.69 in the second quarter of the year-ago period. The company recorded its second-highest ever mark for new bookings, which came in at $21.6 billion in the quarter.

Management emphasized an uncertain macro environment in its quarterly report commentary:

In an uncertain macro environment, we remain the trusted partner to our clients for reinvention with a record 39 clients with quarterly bookings of over $100 million. We also extended our early lead in generative AI with $1.1 billion in new bookings in the first half of the year. And we are investing to serve the needs of our clients and expand our growth opportunities with $2.9 billion of capital deployed in the first half in strategic acquisitions. Thank you to our more than 740,000 people around the world for your dedication to delivering value for our clients.

Accenture remains an asset-light free cash flow generating machine. During the second quarter, operating cash flow came in at $2.1 billion, while it spent just $110 million in capex, resulting in free cash flow of $1.99 billion. Though this was down from the same period last year, the measure remains robust. Accenture ended the quarter with a $4.9 billion net cash position on the books. We like Accenture’s free cash flow generating abilities and its strong balance sheet. It also is benefiting from generative AI as it registered $1.1 billion in generative AI new bookings during the first half of its fiscal year.

The challenge with Accenture as an investment-idea consideration rests in its outlook for fiscal 2024, which was revised lower recently. When it updated guidance in March, Accenture lowered its revenue growth outlook to the range of 1%-3% in local currency, which compared to 2%-5% previously. It also lowered its adjusted operating margin to 15.5% from a range of 15.5-15.7% previously. The adjustments resulted in management fine-tuning its adjusted earnings per share guidance to the range of $11.97-$12.20 from $11.97-$12.32 previously, which reflects 3%-5% growth over its fiscal 2023 mark. Free cash flow is expected in the range of $8.7-$9.3 billion for fiscal 2024.

We’re concerned about Accenture’s downward financial guidance revisions in March and pressure on demand growth for its IT and consulting services, but Accenture’s free cash flow generation remains robust, its balance sheet remains solid, and new bookings growth remains healthy with exposure to AI. Accenture pays a healthy dividend, and the firm continues to buy back stock. The company checks a lot of the boxes that we’d be looking for in a new idea, but we’d like to see evidence of revenue growth improvement before growing interested in adding the company to any newsletter portfolio. We remain on the sidelines for now.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.