Image Shown: The performance of the VanEck Vectors Oil Refiners ETF (CRAK) since its launch in August 2015.

We’ve witnessed our fair share of fits and starts from energy resource pricing during the past few years, but could the global crude markets finally be rebalancing? Let’s talk about our thoughts on whether the outlook for energy resource pricing is improving in a sustainable way.

By Kris Rosemann and Brian Nelson, CFA

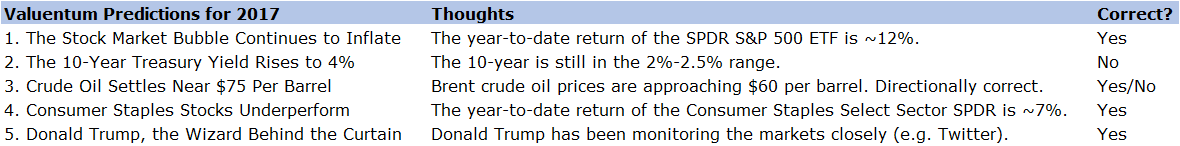

It may have taken longer than we initially anticipated, but crude oil prices (USO) appear to be on the verge of making a sustained recovery, though we always caution that sentiment can change on a dime, especially in the speculation-heavy commodity price markets. If you recall, we thought the price of a barrel of “Texas tea” might reach the ~$75 range by the end of 2017 in our “5 Shocking Stock Market Predictions for 2017,” released late last year. Some are now calling for $80 per barrel. We’re still waiting and watching crude oil prices, but three of the five “predictions” have been spot on, even if we’ve been well off the mark on our expectations of the 10-year Treasury yield.

Here’s a short table of how the five “predictions” for 2017 have panned out thus far (3.5 to 4 out of 5 isn’t too bad).

Image Source: Valuentum

As of September 25, 2017, West Texas Intermediate is now officially being called “in a bull market,” having now bounced 20%+ from the June 2017 lows, and Brent crude hit its highest point since July 2015. We’ve witnessed our fair share of fits and starts from the black liquid in the past few years, but could the global crude markets finally be rebalancing, just in time for the end of the year? Let’s talk more about our thoughts on whether the outlook for energy resource pricing is improving in a sustainable way.

On September 22, the Joint OPEC-Non-OPEC Ministerial Monitoring Committee, or JMMC, announced it had achieved 116% conformity in the month of August, a record high for the group since the implementation of the agreement at the beginning of 2017. Most have viewed the lofty levels of conformity as optimism from within the JMMC that the production cap agreement is having its intended effect, and as a result that an extension of the agreement is likely. We’ll be looking to see if the group pushes the end of its arrangement from March 2018 through the end of 2018 at OPEC’s next scheduled meeting in late November.

Though the JMCC has noted that some countries “are yet to achieve 100% conformity,” such an extension may not only materially increase the optimism of energy resource-minded investors, potentially providing a short-term bounce in crude prices (as we’ve witnessed numerous times during the past few years), but it may help to continue to drive a number of underlying trends that point to a sustained rebound in crude prices. Along with the potential of an extension of the production-cap agreement, US stockpiles of total crude oil and petroleum products have declined from last year, one of the key intended effects of the production cap agreement, and the International Energy Agency recently upped its global oil forecast for 2017.

Though higher-than-expected demand is a welcome positive for energy markets, the falling stockpiles may have yet to be fully incorporated by the market. For one, US crude oil inventories hit an all-time high in April 2017, months after the production cap agreement was initiated, but now that the production cap agreement has had a chance to become established–and conformity has generally been strong–stockpiles have begun to decline, and with the prospects of a production cap agreement extension through the end of 2018, investors have bid up the price of crude oil in a way we haven’t seen in some time.

A reduction in US distillate stocks has also helped drive refinery demand for crude. In the US, Hurricane Harvey has had a material impact on refinery operations as the storm disrupted roughly one quarter of the country’s refining capacity but left crude supply largely untouched. The short-term build in crude stockpiles and simultaneous drop in refining demand should lead to materially higher refining margins, and demand, as producers work to replace the lost productivity. The VanEck Vectors Oil Refiners ETF (CRAK) has advanced more than 20% year-to-date, according to YahooFinance data. The ETF lists Phillips 66 (PSX), Valero (VLO), Marathon Petroleum (MPC), and Andeavor (ANDV) among its top holdings.

Though there will always be volatility in the commodity markets, we expect crude oil prices to continue their recent climb, at least as long as optimism surrounding another potential JMMC production cap agreement persists. Energy producers around the world have reduced their cost bases and have optimized their operations through the course of the most recent downturn in energy resource pricing, and breakeven costs are much lower than just a few short years ago. Many have been planning for a “lower-for-longer scenario,” and while the days of sustained $100 crude oil prices may very well be gone forever, a more efficient global production force may not need such price levels to achieve the profits to which it has grown accustomed. The Energy Select Sector SPDR ETF (XLE) is one of our favorite, diversified income ideas tied to the global energy markets, and the ETF is included in the Dividend Growth Newsletter portfolio at the time of this writing.

Energy Equipment & Services (Large): BHGE, FTI, HAL, NBR, NOV, SLB, TS, WFT

Energy Equipment & Services: CLB, DRQ, FI, HLX, HP, OII, OIS, PDS, PTEN, SPN

Energy Equipment & Services – Offshore Drilling: ATW, DO, ESV, NE, RDC, RIG, SDRL

Oil & Gas – Major: BP, COP, CVX, PTR, RDS, TOT, XOM

Refiners: ANDV, HES, HFC, INT, MPC, MUR, MUSA, PSX, VLO

Related: PXE, IEO

Related: UNG, OIL, UGAZ, UWT, UCO, DGAZ, DWT, SCO, BNO, BOIL, DBO, GAZ, DTO, USL, KOLD, UNL, DNO, OLO, SZO, DCNG, OLEM, OILK, WTIU, OILX, WTID, USOI, GAZB