Image Source: Walgreens 2Q 2018 Earnings Release

By Alexander J. Poulos

The evolving healthcare landscape has been dealing with the threat of a disruptive new competitor entering the market and considerable political risk. Though the need for healthcare remains impervious to economic forces, a clear deflationary trend has descended on the industry that has affected many of the well-entrenched participants. Let’s examine Walgreens Boots Alliance for clues that a shift in sentiment may have occurred in this well known, yet beleaguered sector. We’re watching Walgreen’s equity very closely.

The Consolidation Trend Continues

One of the often overlooked, but in our view, key dynamics affecting the drug distributers/retailers such as Walgreens Boots Alliance (WBA) is the continued deflationary trends exhibited in the generic drug business. As a quick primer, the pharmacy chains such as Walgreens and its chief rival CVS Health (CVS) generate an outsize portion of its overall margin due to the gross margin of generic medications. This trend is especially notable in the first 90 days of patent loss where one generic manufacturer is granted exclusive marketing approval setting up an uber-profitable spread between the branded and generic price.

The industry is now afflicted by the double-whammy of a lack of notable big name branded products that have recently lost patent protection, along with an overall severe deflationary pricing environment on a stable of generic medications. The deflationary cycle has a two-pronged effect: the first is that it lowers the overall average price per prescription, which is the lifeblood of the industry–as the clear majority of money is generated from the last few prescriptions filled due to high fixed costs of the business. A poignant example of the trend is the decline in year-over-year profitability of CVS Health’s retail pharmacy business due to an unexpected loss of a key contract. CVS was caught flat-footed by the news prior to the recent presidential election, which plagued the entire business in 2017.

The second deleterious effect of the deflationary cycle is the compression on overall margins as payers adjust reimbursements lower which affects overall profitability. For the industry to overcome the deflationary headwind, a notable pick-up in volume accompanied by a decrease in costs is necessary to maintain and grow overall profitability.

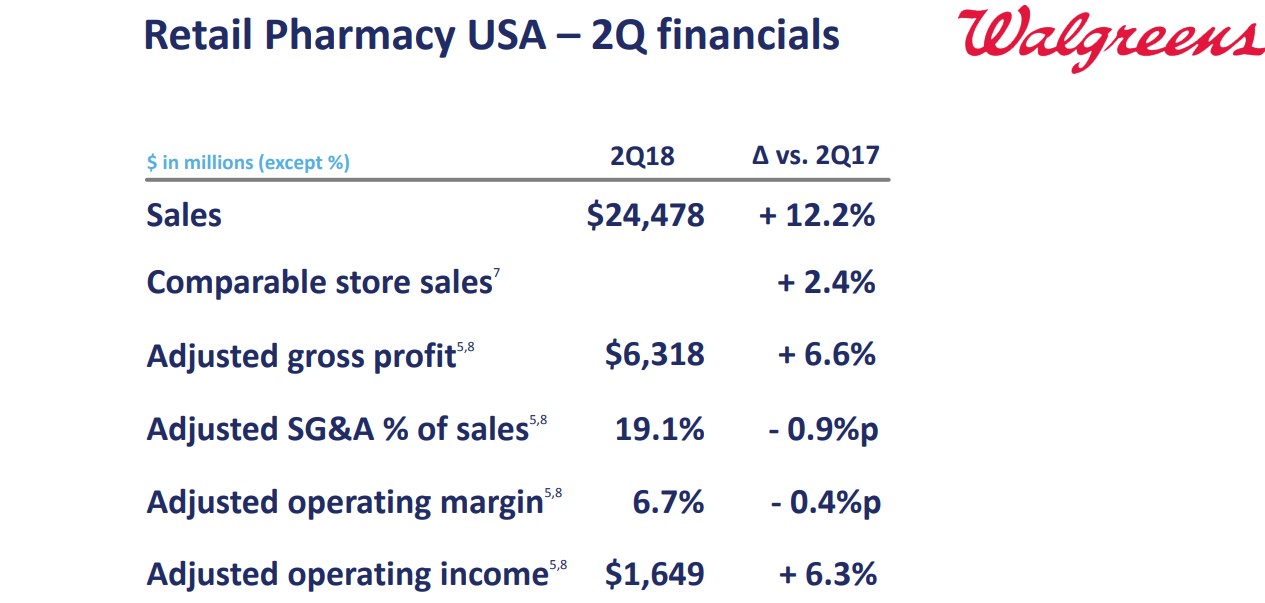

To the credit of the management team at Walgreens, it has not sat idly by as the ground under the industry has shifted. The executive bench has taken proactive moves to reduce overall expenses, while aggressively negotiating to win additional contracts to help mitigate the overall loss in volume a few years ago due the contract impasse with Express Scripts (ESRX). In its fiscal second-quarter 2018 earnings release dated March 28, Walgreens reported an eye popping top-line growth rate of 12.2%, but a further review of the figures denotes expense headwinds, with its adjusted operating margin under pressure (due in part to deflationary trends that continue to impact the industry). A large portion of the jump in top-line growth can be attributed to new contract wins, in addition to the recently approved purchase of 1,932 stores from Rite Aid. Comparable store sales still leapt 2.4%, however.

Walgreens, in a long and protracted battle, won the clearance to purchase 1,932 stores from Rite Aid in a move to further consolidate the industry in part due to the very margin pressures embedded in its fiscal second-quarter 2018 report. We feel the move on the part of Walgreens shows exceptional leadership as the company is positioning itself as a “must have” in any sort of comprehensive nationwide provider network. On the recent conference call, Walgreens disclosed its prescription market share of over 21%, which in our view forms a very large and powerful network free of conflicts. If we turn our gaze to CVS, the company is now transforming itself into a managed care organization (MCO) assuming the proposed Aetna (AET) deal is consummated with a retail store network/PBM coupled with a MCO.

We now view the model put forth by CVS as sub-optimal as it will eventually limit the potential growth of its PBM division as the inherent conflict of interest arises. An MCO is loath to turn over its proprietary customer data to a PBM that is owned by a direct competiton, hence we feel the move to purchase Aetna is a reactionary move due to the dwindling prospects of the PBM business. We commend Walgreens for wisely exiting the PBM business in 2011 as the company correctly viewed the margins in the PBM business as far inferior to the retail pharmacy division. As the MCO’s either build out an internal PBM or acquire an existing competitor the days of the free-standing PBM may be drawing to a close as the market has come to the opinion the incentives for the PBM to effectively drive down costs through direct rebates from the manufacturers is not the optimal model going forward. By Walgreens positioning itself as the largest overall network free of inherent conflicts we believe Walgreens will become the preferred partner of the bulk of the MCO’s outside of Aetna.

Amazon Effect

We have extensively detailed the potential for Amazon (AMZN) to enter the pharmacy market either as a new PBM, online distributer or a combination of both, while potentially building a brick and mortar presence via adding a pharmacy to its Whole Foods chain. The long shadow cast by Amazon is one to watch. We are very intrigued by the recent partnership announced by the powerful trio of JP Morgan Chase (JPM), Amazon and Berkshire Hathaway (BRK.B) with the mandate to radically alter the healthcare sector. Thus far, thanks to a recent interview by the legendary value investor Warren Buffett, the newly formed venture is actively seeking to place a CEO later this year, with a plan to be implemented at some point within the next year after placement. For consumers, we like the idea of additional competition as healthcare spending remains one of the main worries on the minds of many our subscribers and citizens.

Image Source: Walgreens 2Q 2018 Earnings Release

In the case of Walgreens, the company is not taking the risk of a new disruptive entrant lightly. Walgreens expects to spend an additional $500 million on top of the identical amount spent year to date to upgrade systems to take advantage of the expected change in how care is delivered. In our view, the dollar spend signifies a deep commitment on the part of the company to evolve with the ever-changing healthcare landscape—a very wise move.

Conclusion

Walgreens remains a proverbial cash cow as the underlying business continues to generate a copious amount of free cash flow. For the first half of fiscal 2018, Walgreens has generated $2.5 billion of free cash flow, well in excess of the $815 million in cash dividends paid during the period. The ability of Walgreens to generate a high level of free cash flow is the primary reason for its strong Dividend Cushion ratio of 2.3! Walgreens has an impressive streak of an annual dividend hike dating back to 2001, too.

Though we are impressed with the cash flow profile of Walgreen’s, we feel the major uncertainties over its future place in the healthcare arena remains in flux. Major changes are at foot with little in the way to direct us as to which entity has a clear path to sustained profitability. At its current quote, we do feel a tremendous amount of uncertainty is priced into the share price of Walgreen’s, but share-price momentum has been absent. We continue to closely monitor events as they unfold.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent healthcare and biotech contributor Alexander J. Poulos is long Amazon. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.