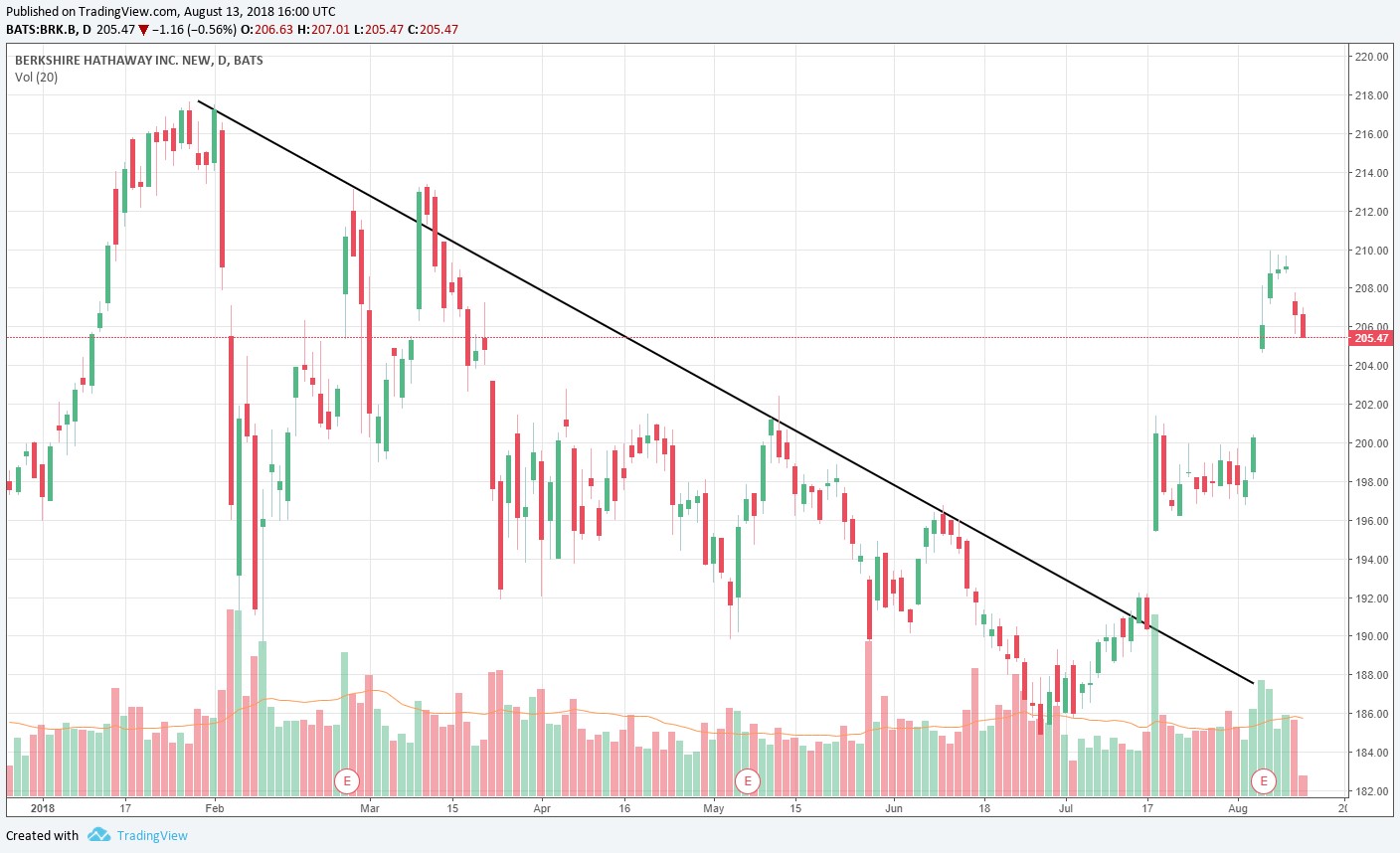

Image shown: Berkshire Hathaway’s shares have broken out following the release of its second-quarter 2018 results.

We continue to believe Berkshire Hathaway belongs in the simulated Best Ideas Newsletter portfolio. Warren Buffett and Charlie Munger have more flexibility to pursue share buybacks, and we’d be flat-out surprised if Berkshire were to buy Southwest outright. Berkshire’s cash balance continues to grow, and we think a stake in Facebook might be the best opportunity for a part of the equity security allocation.

By Brian Nelson, CFA

Berkshire Hathaway (BRK.A, BRK.B) reported solid second-quarter results August 4 that sent the stock roaring higher, and B-shares of the equity are now but a stone’s throw away from all-time highs of ~$218, trading at ~$206 at the time of this writing.

The conglomerate that Warren Buffett founded many decades ago delivered in the quarter, with Berkshire Hathaway’s shareholders’ equity advancing to $358.1 billion at the end of the most recently-completed June quarter from $348.3 billion at the end of the year. On a GAAP basis, operating earnings were up sharply during the first half of the year, coming in at $12.2 billion versus $7.7 billion in the year-ago period. Obviously, there are a lot of moving parts to the conglomerate, but there weren’t any surprises that would cause us to change our opinion on the company’s prospects.

Aside from the Warren Buffett at the helm, part of the reason why we like Berkshire so much is that it holds one of our favorite industrial ideas in Precision Castparts. This gem-of-a-company makes metal castings and airfoils that you find in the engines of commercial and defense aircraft, and it has exposure across fasteners and other high-value-add content within almost every commercial aircraft in service today. Precision Castparts was once an idea in the simulated Best Ideas Newsletter portfolio, but our good friend Uncle Warren took it off the public markets, unfortunately.

At the end of the second quarter of 2018, Berkshire Hathaway held ~$111 billion in cash and short-term US Treasury bills across its balance sheet (insurance and other; railroad, utilities, and energy; finance and financial products). We think the relatively lofty cash balance on the books at Berkshire Hathaway indicates that the Buffett-Munger duo remain very cautious in jumping into new equity investments at present, more than 9 years from the March 2009 panic bottom. Mr. Market is asking for too much, and Uncle Warren knows this. Language in the recent 10-Q continues to emphasis the importance of buying back stock, but only at a discount to intrinsic value:

For several years, Berkshire had a common stock repurchase program, which permitted Berkshire to repurchase its Class A and Class B shares at prices no higher than a 20% premium over the book value of the shares. On July 17, 2018, Berkshire’s Board of Directors authorized an amendment to the program, permitting Berkshire to repurchase shares any time that Warren Buffett, Berkshire’s Chairman of the Board and Chief Executive Officer, and Charlie Munger, a Vice-Chairman of the Board, believe that the repurchase price is below Berkshire’s intrinsic value, conservatively determined. The program continues to allow share repurchases in the open market or through privately negotiated transactions and does not specify a maximum number of shares to be repurchased. However, repurchases will not be made if they would reduce the total value of Berkshire’s consolidated cash, cash equivalents and U.S. Treasury Bills holdings below $20 billion. The repurchase program does not obligate Berkshire to repurchase any specific dollar amount or number of Class A or Class B shares and there is no expiration date to the program.

We wouldn’t expect a large buyback announcement anytime soon given the recent rise in Berkshire stock price, but the new amendment does give Buffett and Munger more flexibility to repurchase shares, something that we think will more likely happen during difficult economic times than during times such as these. Speculation has been swarming that Warren Buffett could scoop up Southwest (LUV), but we’re not so sure. Uncle Warren generally has not liked the structural characteristics of the airline business in the past, and while he has bought stakes in a number of airlines, we don’t think it makes much sense to take on ever-increasing exposure to one end market, especially airlines. There are myriad other companies he could consider, including one of our favorites, Facebook (FB).

Podcast: Warren Buffett Is Back Into Airlines, Should You?

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.