Image Shown: Tesla Inc saw its share price jump up after reporting solid third quarter earnings in late-October.

By Callum Turcan

On October 23, Tesla Inc (TSLA) posted third quarter 2019 earnings that were positively received by the market. Shares of TSLA moved up sharply higher on the news, and our fair value estimate remains at $259 per share of Tesla. We appreciate the automaker’s drive to eventually become consistently free cash flow positive but given the huge range in its estimated fair value (a product of the firm’s high operating leverage and the nascent nature of the mass market electric vehicle industry), we prefer other investment opportunities out there. Additionally, the top end of our fair value estimate range for Tesla sits at $324 per share, indicating TSLA is fairly valued at ~$313 as of this writing. Please note Tesla does not pay out a dividend at this time.

Quarterly Overview

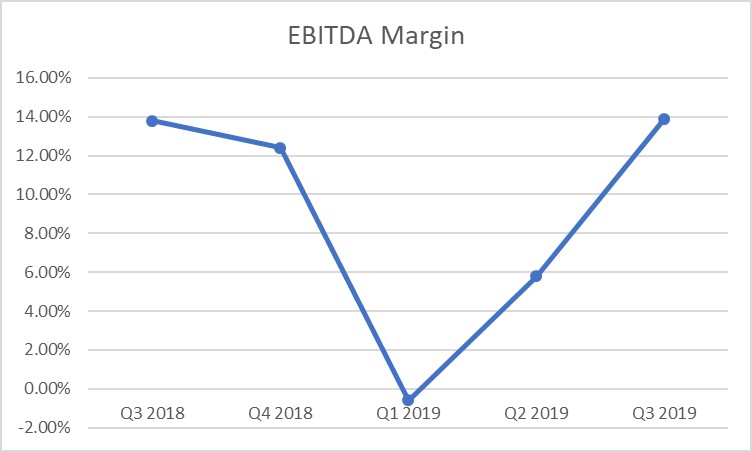

What likely won over investors during Tesla’s latest quarterly update was the sharp recovery in the firm’s trajectory in terms of profitability. In the graphic below, please note the sharp turnaround in Tesla’s EBITDA (earnings before interest, taxes, depreciation and amortization) margin over the past several quarters, particularly since falling precipitously from the fourth quarter of 2018 to the first quarter of 2019.

Image Shown: Tesla’s EBITDA margin rebounds, indicating the automaker’s march towards consistently positive free cash flows resumed in earnest during the second and third quarters of 2019. Image Source: Tesla – Third Quarter 2019 Earnings Presentation – Graph made by the author

In the table down below, note the sharp improvement in Tesla’s ‘Automotive’ gross margin during the third quarter of 2019 on a sequential basis. This segment’s gross margin rose almost 400 basis points quarter-over-quarter, indicating Tesla is doing a better job controlling costs and managing production schedules as it ramps up production of its “mass market” Model 3 offering.

At a starting price of ~$35,000, the Model 3 isn’t really a mass market car but arguably could be viewed as a “mass market luxury vehicle” that is affordable to a larger group of potential customers in North American, European, and East Asian markets (as compared to the relatively small potential customer base Tesla’s more expensive Model S and Model X offerings are targeting). Please note that the revenue figures below take regulatory credits into account, which generally range between $0.1-$0.2 billion per quarter.

Image Shown: Tesla’s ‘Automotive’ gross margin jumped sequentially during the third quarter of 2019, reversing a year’s long slide that won praise from the market. Image Source: Tesla – Third Quarter 2019 Earnings Presentation – Table made by the author

Tesla produced 79,837 Model 3 vehicles during the third quarter of 2019, up 10% sequentially and up 50% year-over-year. Model S/X vehicle production stood at 16,318 during the third quarter of 2019, up 12% sequentially but down 39% year-over-year as Tesla shifted production towards the Model 3 offering. Production of Model S/X fell sharply in the first quarter of 2019 versus production levels seen during the second half of 2018, which coincides with the steep drop in the gross margin of Tesla’s ‘Automotive’ segment during the first half of 2019 relative to the second half of 2018.

During the first nine months of 2019, Tesla generated $1.0 billion in net operating cash flow and spent $0.9 billion on capital expenditures (defined as ‘purchases of property and equipment excluding finance leases, net of sales’). At the end of September 2019, Tesla was sitting on $5.3 billion in cash and cash equivalents (we aren’t looking at restricted cash here), versus $2.0 billion in debt and finance leases maturing within a year and $11.3 billion in long-term debt and long-term finance leases, good for a net debt position of $8.0 billion.

While Tesla was free cash flow positive during the first three quarters of 2019, what the market wants to see is consistently positive free cash flows, something that will need to contend with Tesla’s growth ambitions. For instance, the firm is contemplating opening production facilities in Europe, with construction activities at a yet to be chosen site to begin by 2020. Tesla was free cash flow positive during the first three quarters of 2019 in large part due to reductions in its capital expenditures (relative to 2018 levels).

Concluding Thoughts

Tesla posted solid third quarter performance, and we appreciate its improving profitability metrics. That being said, we still prefer other capital appreciation opportunities out there. In our view, most of Tesla’s upside has already been factored into its stock price, which currently sits near ~$313 per share. We prefer General Motors Company (GM), and GM is a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Interested members can read more about why we like General Motors in this article here.

Auto Making Industry – F GM HOG HMC TSLA TM

Auto Specialty Retailers Industry – AAP AN AZO CPRT GPC KMX KAR MNRO ORLY PAG

Related: CARZ, ADRA, RXI

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. General Motors Company (GM) is included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.