Image Source: Kevin Dooley

Target turned in strong comparable sales growth in its 2018 holiday quarter, thanks in part to solid digital sales growth, and department store operator Kohl’s was able to deliver positive comparable sales growth in the final quarter of its fiscal 2018, which led to an impressive two-year stack. Health and wellness retailer GNC continues to struggle.

By Kris Rosemann

Target’s (TGT) Comps Impress

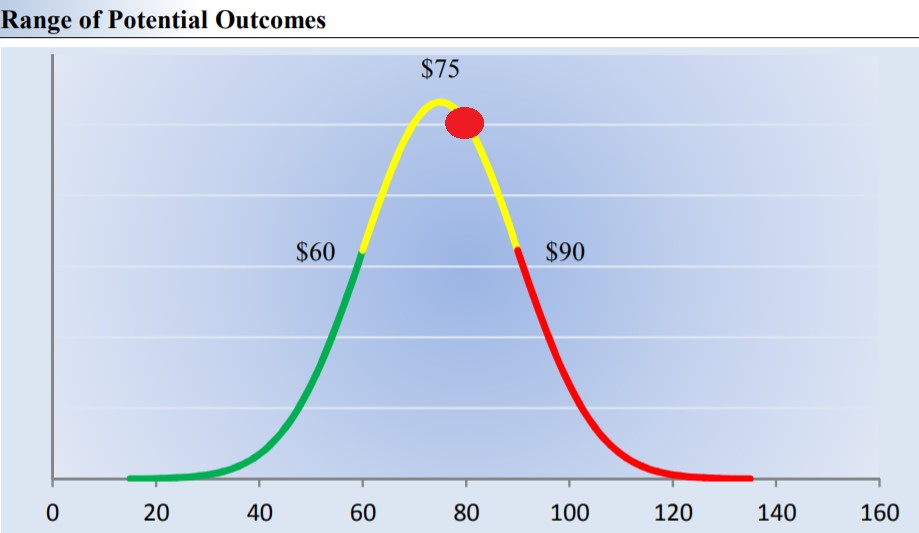

Image shown: The red dot denotes where shares of the company are trading. If it falls on the green part of the fair value estimate distribution, we think shares are undervalued. If it falls on the yellow part of the fair value estimate distribution, we think shares are fairly valued, and if it falls on the red part of the fair value estimate distribution, we think shares are overvalued (as of the time of this publishing).

Target’s comparable sales in the fourth quarter of fiscal 2018, results released March 5, advanced 5.3% on a year-over-year basis, as comparable store sales advanced 2.9% and comparable digital sales grew 31% from the year-ago period. The company’s full-year comparable sales growth of 5% over fiscal 2017 levels was its highest mark since 2005, and it reported market-share gains across all five of its core merchandise categories. Adjusted earnings per share in the fourth quarter came in at $1.53, compared to $1.36 in the year-ago period, but free cash flow generation in the full fiscal year took a 44% step back to ~$2.5 billion (cash dividends paid in the year came in at just over $1.3 billion) as cash flow from operations fell 14% and capital spending rose materially from the prior year.

In fiscal 2019, Target expects comparable sales to grow at a low- to mid-single digit rate over fiscal 2018 levels, and operating income is expected to advance at a mid-single digit rate. Both GAAP and adjusted earnings per share guidance come in a range of $5.75-$6.05 in the fiscal year, compared to fiscal 2018 adjusted earnings per share of $5.39, which marked a record high for the company. Shares yield ~3.4% as of this writing.

Kohl’s (KSS) Comps Continue to Grow

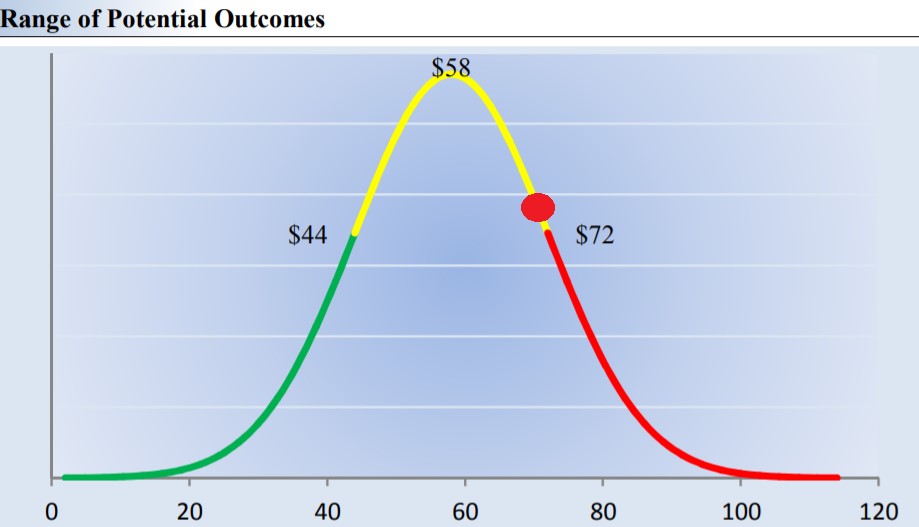

Image shown: The red dot denotes where shares of the company are trading. If it falls on the green part of the fair value estimate distribution, we think shares are undervalued. If it falls on the yellow part of the fair value estimate distribution, we think shares are fairly valued, and if it falls on the red part of the fair value estimate distribution, we think shares are overvalued (as of the time of this publishing).

Kohl’s fiscal 2018 fourth quarter earnings report, released March 5, revealed another quarter of comparable sales growth, which came in at 1% on a year-over-year basis after it reported 6.3% comparable sales growth in the fourth quarter of fiscal 2017, and non-GAAP earnings per share jumped 20% from the year-ago period to $2.24 after excluding impairments, store closures, and other one-time costs in the fiscal 2018 fourth quarter and one-time tax-related gains in the comparable period of fiscal 2017. Free cash flow generation in the full fiscal year leapt 50% from fiscal 2017 levels to $1.5 billion, easily covering cash dividends paid of $400 million in the year, thanks to robust cash flow from operations growth and a reduction in capital spending. The company also declared a ~10% increase to its quarterly payout, and shares carry a forward dividend yield of ~3.8% as of this writing.

In fiscal 2019, Kohl’s expects comparable sales to be flat to up 2% from fiscal 2018, as it continues to focus on driving traffic, and earnings per diluted share guidance comes in a range of $5.80-$6.15, compared to adjusted diluted earnings per share of $5.60 in fiscal 2018.

GNC (GNC) Continues to Slide

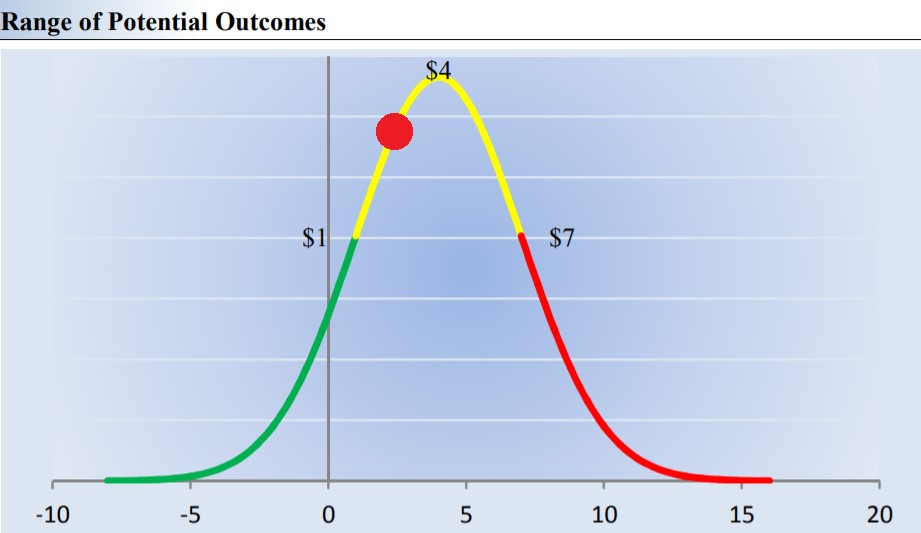

Image shown: The red dot denotes where shares of the company are trading. If it falls on the green part of the fair value estimate distribution, we think shares are undervalued. If it falls on the yellow part of the fair value estimate distribution, we think shares are fairly valued, and if it falls on the red part of the fair value estimate distribution, we think shares are overvalued (as of the time of this publishing).

It has been a challenging few years for health and wellness retailer GNC, as the company has seen its shares fall from nearly $50 in 2015 to the low single digits as of this writing, and the fourth quarter of 2018, results released March 5, marked a continuation of those struggles. Consolidated revenue in the quarter fell nearly 3% on a year-over-year basis, and domestic same-store sales fell 0.6%. GAAP earnings of $0.62 per diluted share were not comparable to the year-ago period due in part to long-lived asset impairments in the fourth quarter of 2017, and cash flow from operations in the full-year 2018 was less than half of the level reported in 2017, which caused free cash flow generation to fall to ~$77 million from ~$188 million in the prior year. The company held nearly $1.2 billion in total debt compared to just over $67 million in cash and cash equivalents at the end of 2018.

Along with its fiscal fourth quarter results, GNC announced the completion of a $300 million strategic investment by Harbin Pharmaceutical Group, which it expects to strengthen its capital structure and accelerate growth plans in China, and it also announced a strategic partnership with International Vitamin Corporation. We’re not holding our breath with respect to these moves providing the company a material shot in the arm as it continues to battle weak demand trends.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.