Image Source: PepsiCo Inc – IR Presentation

By Callum Turcan

On October 3, PepsiCo (PEP) reported third quarter earnings for fiscal 2019 (12 week period ended September 7) that were positively received by the market as the beverage and snack company beat both consensus top and bottom line estimates. Management reiterated that PepsiCo sees its organic non-GAAP revenues growing by at least 4% annually this fiscal year and that free cash flows would come in at approximately $5.0 billion, enough to cover approximately $5.0 billion in expected dividend payments. While core constant currency (non-GAAP) EPS is still expected to decline by 1% annually this fiscal year, strong apparent underlying demand for PepsiCo’s products creates room for optimism.

Shares of PEP yield ~2.7% and are trading near ~$139 per share as of this writing. Please note that the top end of our fair value estimate range stands at $132 per share of PEP, indicating PepsiCo’s recent rally may have gotten ahead of itself. While the firm’s technicals are relatively strong, PepsiCo is still very much exposed to the slowing global economy and a strong US dollar.

Quarterly Review

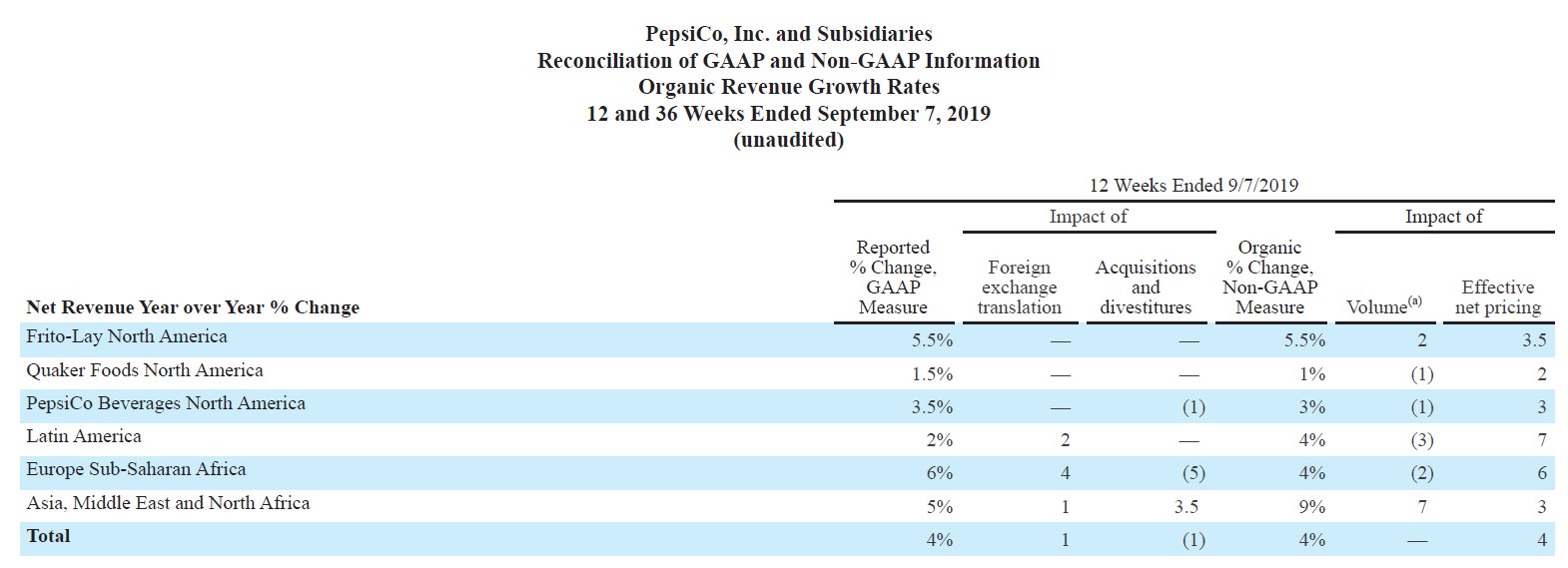

During the third quarter of fiscal 2019, PepsiCo reported that both non-GAAP organic sales growth and GAAP net revenue growth clocked in just north of 4% year-over-year. Foreign currency headwinds shaved 100 basis points off PepsiCo’s GAAP net revenue growth in the third quarter, and the year-to-date negative effect of foreign currency headwinds stands at 200 basis points worth of GAAP revenue growth. Please note that the adjustments PepsiCo makes to its non-GAAP organic sales figure removes the impact foreign currency and net acquisition & divestment activity had on its revenues in a given period.

PepsiCo reported GAAP revenue growth across the board in the third quarter as you can see in the graphic below. The company’s ‘Frito-Lay North America’ and ‘Asia, Middle East and North Africa’ segments were favorably impacted by both meaningful volume and net pricing increases on a year-over-year basis, resulting in strong GAAP and non-GAAP revenue growth at each segment. On the other hand, GAAP revenues at PepsiCo’s ‘Latin America’ and ‘Europe Sub-Saharan Africa’ segments were significantly hampered by foreign currency headwinds and year-over-year declines in volume, which were offset by favorable net pricing increases and specifically for the ‘Europe Sub-Saharan Africa’ segment, the net positive impact of A&D activity (due primarily to PepsiCo acquiring all of SodaStream’s outstanding shares in December 2018 in a deal worth $3.2 billion net of cash acquired).

Image Shown: A breakdown of PepsiCo’s GAAP and non-GAAP sales performance during the third quarter of fiscal 2019. Image Source: PepsiCo – Third quarter fiscal 2019 earnings press release

Powerful Long-Term Upside

Going forward, PepsiCo is in the process of acquiring all of South Africa-based Pioneer Foods’ outstanding stock in an all-cash transaction worth approximately USD$1.7 billion when the deal was announced in July 2019. PepsiCo sees the deal closing during the first quarter of calendar year 2020. Foreign currency headwinds aside, emerging and developing markets represent PepsiCo’s most promising source of long-term upside. While PepsiCo’s North American operations (seen through solid performance at its ‘Frito-Lay North America and ‘PepsiCo Beverages North America’ segments) are doing well on both the snack and beverage fronts, the growing global middle class consumer represents a source of upside like no other.

According to data from Economist Intelligence Unit cited by the Brookings Institution, consumer spending on food beverages, and tobacco in Africa rose from USD$500 billion in 2011 to USD$850 billion in 2016. Total retail spending in Africa rose from USD$1,000 billion to USD$1,420 billion during this period, and many analysts expect total retail spending in Africa will surpass USD$2,000 trillion over the coming years. Factors driving this trend include urbanization, rising incomes, and favorable demographics (a large and growing cohort of young people).

Brookings cites data from Deloitte when highlighting the expected paradigm shifting changes in income distribution and income growth across the African continent through 2030. In particular, Brookings notes that the cohort of workers in Africa that make between USD$2-USD$20 per day is expected to rise from 376 million in 2013 to 582 million by 2030, while the cohort of those making north of USD$20 per day is expected to grow from 63 million to 116 million during this period. Growth is expected in the cohort making up to and less than USD$2 per day as well, indicating this paradigm shift will likely last long past 2030 as economic development and growing access to middle class opportunities continues to fundamentally alter Africa’s economic landscape over the decades to come.

PepsiCo’s purchase of Pioneer Foods is a way to grow its exposure to this powerful upside. We would like to stress, however, that the vast majority of the value of equities comes from the mid-cycle and perpetuity part of the discounted free cash flow analysis, meaning the expected discounted free cash flows generated beyond year 5 of the forecasting period. By growing its ability to cater to African consumers PepsiCo is effectively demonstrating how to augment its growth trajectory through international acquisitions, behooving PepsiCo’s future expected discounted free cash flows in a meaningful way (a potential reason why shares of PEP continue to climb higher).

Concluding Thoughts

To be clear, we are still late in the business cycle in many developed nations (Eurozone, UK, Japan, America, and China) and chances of a global recession in the medium-term continue to build. PepsiCo’s third quarter performance was positively impacted by strong consumer spending in North America, namely the US, and that won’t necessarily remain the case going forward. Recent data indicates US services activity is slowing down alongside industrial activity, which could pressure future employment growth, income growth (or lack thereof), and ultimately consumer spending levels. PepsiCo still has its eyes on the ball in the face of exogenous shocks (i.e. the US-China trade war and the potential for an EU-US trade war) as management targets secular growth trends in emerging and developing markets, but we still think the company’s valuation is stretched after its impressive year-to-date rally.

Non-alcoholic Beverages Industry – KO CCEP KDP MNST FIZZ PEP

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.