Image Source: Oracle Corporation – Financial Analyst Meeting Presentation, September 2019

By Callum Turcan

On December 12, Oracle Corporation (ORCL) reported second quarter earnings for its fiscal 2020 (period ended November 30, 2019). Massive share repurchases reduced Oracle’s diluted outstanding weighted-average share count from 3,908 million in the first half of fiscal 2018 to 3,370 million in the first half of fiscal 2019. That played a key role in boosting Oracle’s EPS performance (diluted GAAP EPS was up 12% year-over-year in the first half of fiscal 2020) as its revenues were broadly flat during this period. We continue to like Oracle in our Dividend Growth Newsletter portfolio given the strength of its free cash flow profile and promising outlook. Shares of ORCL yield 1.7% as of this writing, and its strong Dividend Cushion ratio of 2.7x provides for a solid payout growth trajectory. Shares of Oracle sold off initially on its weaker than expected sales performance last quarter, but we remain optimistic on its future potential as we’ll cover in this note.

Quarterly Overview

At the end of November 2019, Oracle was sitting on $24.5 billion in cash and cash equivalents along with $2.9 billion in marketable securities. Short-term debt of $1.0 billion and long-term debt of $50.7 billion gives Oracle a net debt load of $24.2 billion, which we view as very manageable given its sizable free cash flows. Oracle’s net debt load has been rising of late, which is due to management preferring to use a combination of debt and free cash flow to buy back stock as mentioned previously.

In the first half of fiscal 2020, Oracle’s free cash flows of $5.8 billion easily covered $1.6 billion in dividend payouts. Shares repurchased under its buyback program came out to $10.0 billion during this period (another $0.6 billion was spent on ‘shares repurchased for tax withholdings upon vesting of restricted stockâ€Âbased awards;’ however, Oracle also raised $0.6 billion from common equity issuances). Though large, the tally was still down from the whopping $19.4 billion Oracle spent buying back its stock in the same period last fiscal year–only including shares bought back under its repurchase authority and not for other purposes.

On the topic of buybacks, we would consider share repurchases a good use of capital in the event stock is being bought back at a discount to its estimated intrinsic value (based on discounted free cash flow analysis based on reasonable valuation assumptions) and that the financial strength is there to support such efforts (that leverage ratios, net cash/debt positions, and free cash flow profiles, the limiting factors, are kept in mind). Our fair value estimate for shares of ORCL stands at $55, with room for upside under more favorable valuation assumptions (which could materialize in the event Oracle’s pivot towards secular growth trends, and away from sleepy old businesses, continues in earnest). The top end of our fair value range estimate sits at $66 per share.

For Oracle, as its buybacks (particularly those over the past couple of years) have largely been conducted at a nice-to-modest discount to its estimated intrinsic value, we view these repurchases as a good use of capital. Going forward, as shares of ORCL have firmed up substantially in calendar year 2019, we caution that repurchases will need to be moderated.

Revenue and Operating Cost Analysis

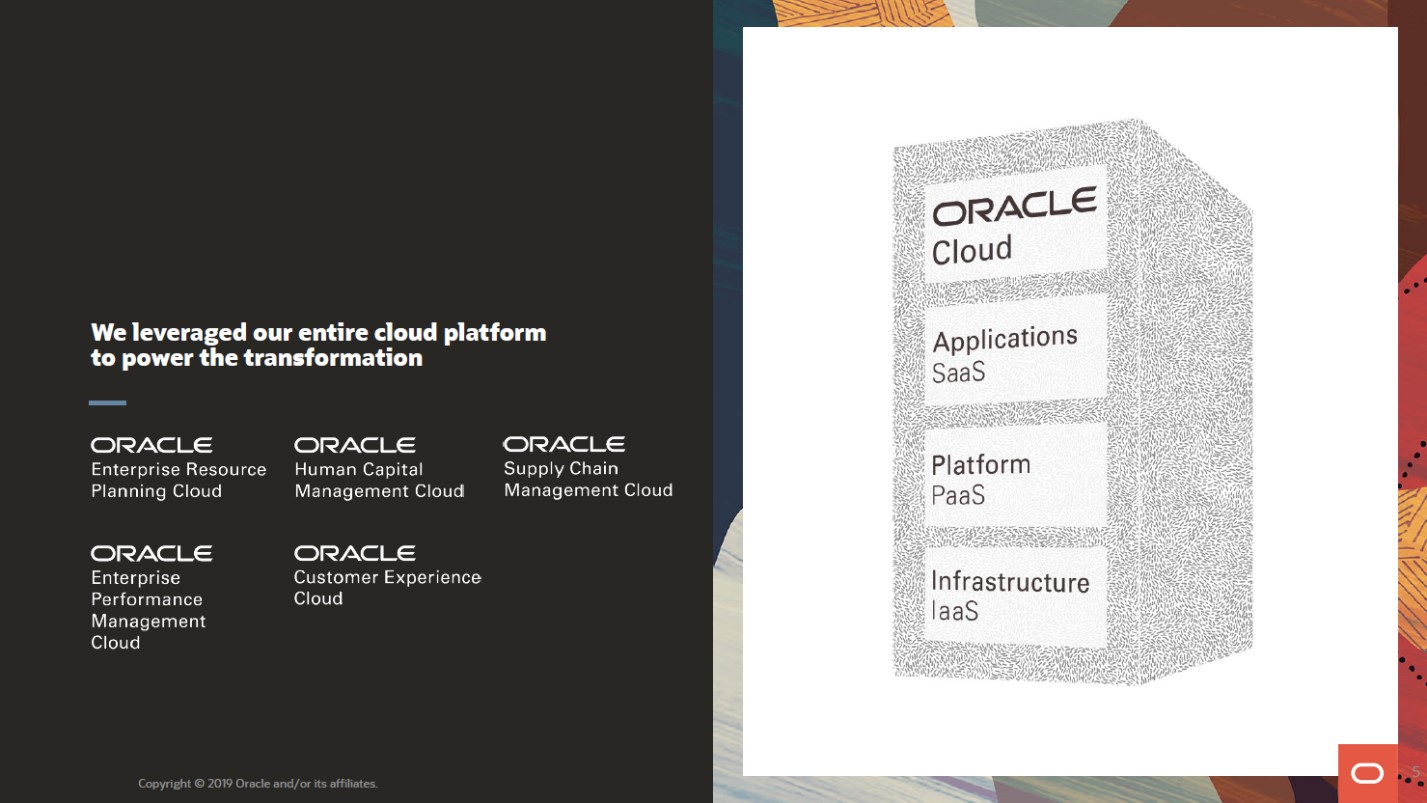

From the second quarter of fiscal 2019 to the second quarter of fiscal 2020, Oracle’s GAAP revenues grew by just 1%. During the first half of fiscal 2020, Oracle’s GAAP revenues were broadly flat year-over-year. Growth at Oracle’s ‘cloud services and license support’ segment was offset by weakness at its ‘cloud license and on-premise license’, ‘hardware’, and ‘software’ segments. Oracle’s Fusion ERP and NetSuite ERP cloud application businesses performed well, with sales up double-digits year-over-year, while its Oracle Autonomous Database offering is seeing strong demand for data warehousing and online transaction processing-related services.

Management pursued cost reductions to help offset various headwinds elsewhere, but here we would like to highlight that we appreciate Oracle’s commitment to R&D as that’s how the company can stay ahead of its major enterprise Software-as-a-Service (‘SaaS’) peers like Salesforce Inc (CRM). Oracle’s R&D spending as a percent of GAAP revenues remains around 15%-16%.

During the first half of fiscal 2020, Oracle’s GAAP operating expenses decreased by 1% year-over-year allowing for the firm’s GAAP operating income to rise by 3% to $6.1 billion (GAAP operating margin climber higher by almost 85 basis points year-over-year). Reduced sales and marketing expenses and restructuring costs played a key role in propping up Oracle’s operating margins, as did reduced hardware expenses (which is largely/entirely a product of weaker hardware sales). Oracle is currently embarked on a cost structure improvement program which predominately revolves on allowing business units that cater to offerings in terminal decline to shrink, and instead focusing towards offerings supported by secular growth trends. Workforce rationalizations are a part of this strategy.

We like Oracle’s cost structure improvements because the company isn’t sacrificing its future upside (i.e. slashing R&D and other investments down to a crisp in a desperate bid to juice near-term financial performance) but instead is simply transitioning towards the future of IT. Enterprise SaaS offerings are the future; on-site hardware-oriented enterprise data application management offerings are the past. Oracle seeks to integrate hardware and software offerings to create a more seamless experience for its clients and to boost productivity/efficiency, keeping in mind the software side of things is where the real meat is here. From supply chain management to human resources to sales to marketing and more, Oracle has a whole suite of enterprise SaaS offerings that can meet many needs.

M&A Commentary

Oracle perpetually seeks to augment its cloud computing upside and enhance its existing/future offerings through M&A activity. On October 2, Oracle acquired CrowdTwist, defined as “the leading cloud-native customer loyalty solution to empower brands to offer personalized customer experiences” which “offers over 100 out-of-the-box engagement paths, providing rapid time-to-value for marketers to develop a more complete view of the customer.” What CrowdTwist seeks to provide its clients is a more innovative way to retain customers and boost customer loyalty with an eye towards the hospitality, retail, and food & beverage industries. Now Oracle is integrating those offerings into its own operations.

Back in March 2018, Oracle acquired Zenedge to enhance its network security capabilities to contend with the very real threat rising cybersecurity threats pose businesses all around the globe. The future sales performance of cloud-based and dynamic cybersecurity offerings are supported by very powerful growth tailwinds. Zenedge, now a part of Oracle Dyn Web Application Security, offers bot management, AI-driven web application firewalls, API protection, malware protection, and distributed denial of service (‘DDoS’) protection services.

Looking ahead, it’s likely Oracle will continue to pursue bolt-on acquisitions to further grow its enterprise SaaS offerings and secure its competitive position. Bigger deals remain to be seen.

Concluding Thoughts

Oracle is moving in the right direction and has multiple levers it can pull to generate upside. We continue to like its impressive free cash flow profile and see its net debt load as very manageable. From fiscal 2017 to fiscal 2019, Oracle’s annual free cash flows averaged $12.9 billion while its annual dividend obligations averaged $2.9 billion. Going forward, management has an enormous amount of room to push through dividend increases, and please note Oracle’s quarterly per share dividend doubled from early-2015 to early-2019. Share count reductions make per share dividend growth significantly easier. We continue to like Oracle in our Dividend Growth Newsletter portfolio.

Software Industry– ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: AMZN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Oracle Corporation (ORCL) and Microsoft Corporation (MSFT) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.