Image Shown: Shares of Intel Corporation have resumed their upward climb after stumbling during the middle of 2019. We continue to like the name in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

By Callum Turcan

Intel Corp (INTC) is another one of our favorite companies and is included in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. After coming under fire during the middle of 2019, INTC is back on a nice upward trajectory. The top end of our fair value range estimate sits at $61 per share of INTC, indicating there’s plenty of room for Intel to run higher. Shares of INTC yield 2.2% as of this writing, and we view the company’s dividend growth trajectory as stellar (we give Intel an EXCELLENT Dividend Growth rating which is supported by its GOOD Dividend Safety rating, a product of its 2.1x Dividend Cushion ratio).

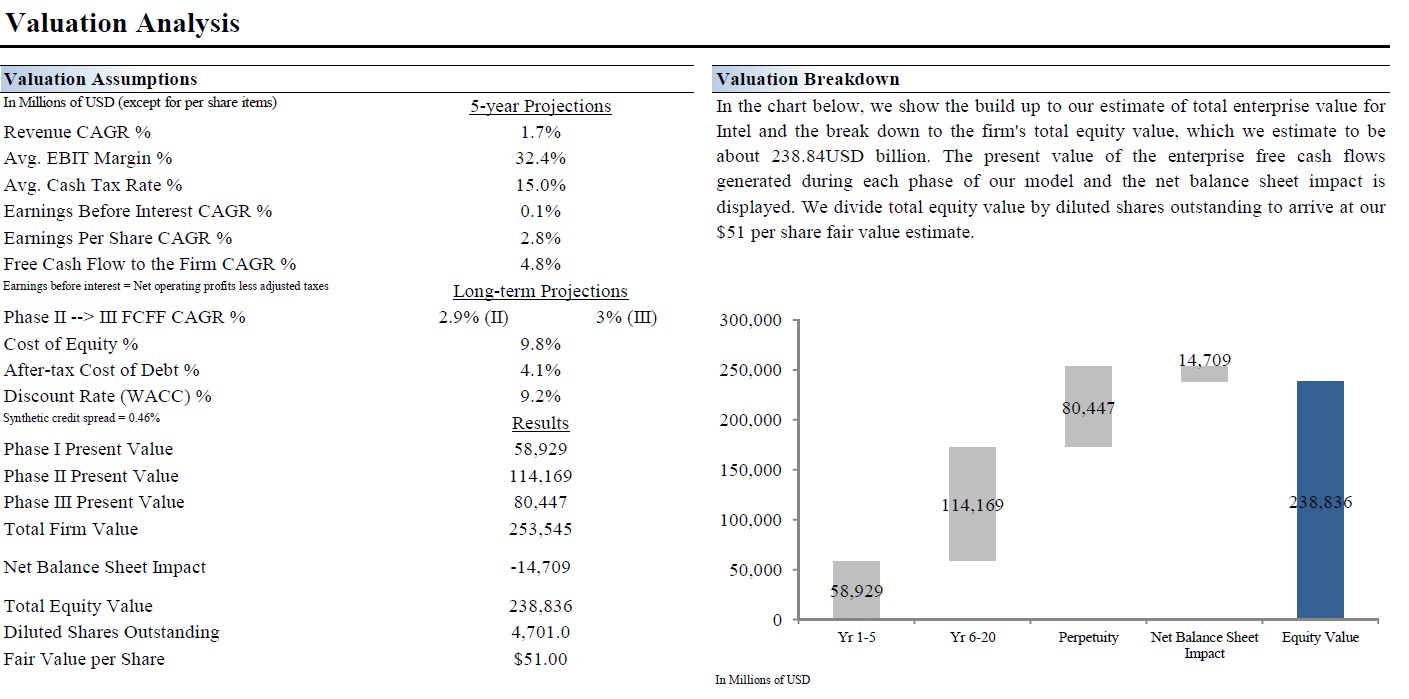

For reference, Intel’s fiscal 2018 ended on December 29, 2018, and Intel’s third quarter of fiscal 2019 ended on September 28, 2019. In the graphic down below, from our 16-page Stock Report covering Intel (which can be accessed here), we highlight the valuation assumptions we used when modelling out the company’s future expected financial performance.

Image Shown: The valuation assumptions we used to arrive at a fair value estimate of $51 per share of INTC. Should Intel showcase signs that the company is outperforming these assumptions, shares of INTC could test the upper end of our fair value estimate range, which currently sits at $61 per share.

Better Cost Structure

From fiscal 2016 to fiscal 2018, Intel’s GAAP operating expenses dropped from $23.1 billion to $20.4 billion. Please note that Intel’s R&D expenses as a percent of revenue declined by ~225 basis points during this period; however, total R&D expenses still rose by 7% to $13.5 billion. Additionally, Intel’s cost structure improvements came from the end of substantial restructuring and other charges (which swung from a $1.7 billion expense in fiscal 2016 to a $0.1 billion gain in fiscal 2018), and meaningful reductions in corporate overhead (marketing, general and administrative expenses declined by over 19% during this period).

As Intel’s employee headcount grew by over 1% from fiscal 2016 to fiscal 2018, reaching 107,400, it’s clear these savings aren’t coming from simply having a smaller workforce. The company’s 2016 restructuring program saw Intel pivot away from chips for PCs and towards chips for data centers and connected devices (including chips that support the adoption of the Internet of Things or ‘IoT’ trend). Part of that strategy included shutting down facilities that were no longer relevant to Intel’s long-term growth trajectory, boosting efficiency and reducing costs. Additionally, better marketing strategies and cheaper advertising campaigns, cost procurement savings, headcount rationalization in certain areas, and other factors likely played a key role here.

Resilient Free Cash Flows

During the first nine months of Intel’s fiscal 2019, its GAAP operating expenses were down ~2.5% year-over-year, indicating the company’s cost structure improvement continues to bear fruit. While Intel’s GAAP revenues have come under fire this year (down modestly year-over-year), in large part due to the US-China trade war and geopolitical concerns as it relates to US firms doing business with Huawei, management has made strides in bolstering the long-term trajectory of Intel’s free cash flows. Intel generated $23.3 billion in net operating cash flow during the first nine months of its fiscal 2019, up nicely year-over-year. Free cash flows of $11.7 billion easily covered $4.2 billion in dividend payments during this period, but note $10.1 billion in share buybacks were partially funded by the balance sheet. For reference, Intel’s annual dividend payments averaged ~$5.2 billion from fiscal 2016 to fiscal 2018.

Share buybacks reduced Intel’s outstanding diluted share count (on a weighted-average basis) from 4,875 million to 4,701 million from fiscal 2016 to fiscal 2018. That had fallen down further to 4,507 million as of the first three quarters of Intel’s fiscal 2019. During the third quarter of Intel’s fiscal 2019, the company repurchased 92 million shares through its ongoing buyback program at an average price of $48.78 per share according to management’s commentary. As the midpoint of our fair value range estimate sits at $51 per share, we view those buybacks as a good use of capital.

Near-term Outlook Improving

During the firm’s third quarter conference call with investors, management raised Intel’s top-line outlook for the full fiscal year:

“As a result of our strong Q3 operating performance and momentum into Q4, we are increasing our revenue outlook for 2019 by $1.5 billion to $71 billion. We expect revenue from our data-centric businesses to be flat to slightly up for the full year and expect our PC-centric business to be flat to slightly down both improving versus prior guidance.”

After this guidance boost, Intel is now expecting marginal sales growth in fiscal 2019 (assuming ~$71.0 billion in revenues) versus fiscal 2018 levels of $70.8 billion in GAAP revenues. Things are improving and Intel’s near-term outlook is getting brighter, which is likely why investors flocked back to the name. Here are some additional comments from management from Intel’s latest quarterly conference call:

“Operating margin for the year is expected to be approximately 32.5%, up 0.5 point from our prior guide. Full year expectations for gross margin are unchanged at approximately 60%. We expect Q4 gross margin to be down two to 2.5 points sequentially as we continue to ramp 10-nanometer and will have sold through the previously reserved inventory consistent with prior expectations…

We are raising gross CapEx by $0.5 billion to $16 billion, as a result of increased 10-nanometer and 7-nanometer investments. And we are raising our free cash flow guide by $1 billion to $16 billion [keeping the stronger revenue forecast in mind].

Let’s turn to Q4. After adjusting for the impact of trade related pull-ins in DCG [Data Center Group], we expect Q4 revenue of $19.2 billion, up 3% year-over-year and flat sequentially. Data-centric businesses are expected to be up 6% to 8% year-over-year on continued cloud recovery and sequential NAND pricing growth. Our PC-centric business is expected to be flat to slightly down year-over-year. We expect Q4 operating margin of approximately 33.5% and a tax rate of 13.5%.”

The modest year-over-year increase in capital expenditures (Intel’s forecasted capital investment of ~$16.0 billion in fiscal 2019 is up from 2018 levels of $15.2 billion) is reasonable in our view, and please note the company still increased its free cash flow outlook for fiscal 2019 last quarter (on the back of stronger expected sales performance). Management now forecasts Intel’s free cash flows will hit ~$16.0 billion in fiscal 2019 (up ~$1.0 billion from previous estimates), which is significantly higher than its fiscal 2018 free cash flows of $14.3 billion (when defined as net operating cash flow less capital expenditures).

Concluding Thoughts

Intel is appealing from both a capital appreciation and income growth standpoint, which is why we include the company in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. As Intel’s outlook continues to improve, shares of INTC could continue to march up towards the top end of our fair value estimate range. Members interested in reading about why Intel’s balance sheet is stronger than it first appears should check out this article here. Additionally, members that wish to read more our other favorite Best Ideas Newsletter portfolio holdings should check out this article here.

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Software Security Industry – CHKP FEYE IMPV PANW PFPT SYMC VRSN

Related: MU

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Intel Corporation (INTC) is included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.