Image Source: Intel Corporation – August 2019 IR Presentation

By Callum Turcan

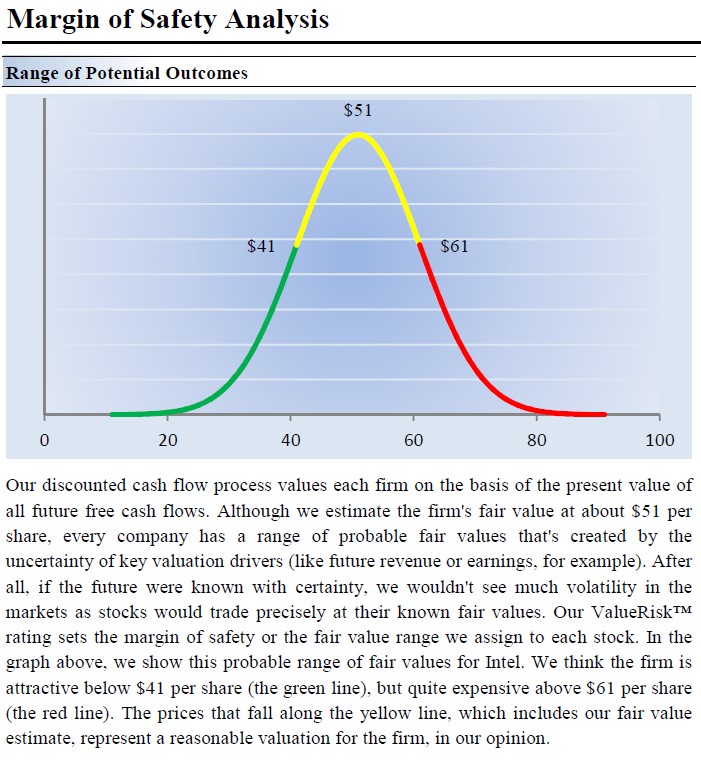

A holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, shares of Intel Corporation (INTC) have been on a strong upward tear since August. We continue to like the company as it appears shares of Intel are converging towards the top end of our fair value estimate range ($61 per share), with INTC trading at roughly $58.50 per share as of this writing. Looking ahead, Intel’s solid 2.1x Dividend Cushion ratio provides support for a quality dividend growth story (we rate Intel’s Divided Growth trajectory as EXCELLENT), and shares of Intel yield ~2.2% as of this writing.

Image Shown: Shares of Intel appear to be converging towards the high end of our Fair Value Range. We continue to like the company in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

Covering the Balance Sheet

Intel ended the third quarter of its fiscal 2019 (period ended September 28) with $12.0 billion in combined cash, cash equivalents, short-term investments, and trading assets. That’s on top of $4.8 billion in equity investments, which now no longer includes semiconductor supplier ASML Holding (ASMLF) as Intel sold off its remaining equity stake in the company (worth $1.1 billion as of December 29, 2018) this fiscal year. Intel continued to own an equity stake in big data software provider Cloudera Inc (CLDR) at the end of its fiscal third quarter. Most of Intel’s equity investments are represented by non-marketable equity securities and equity method investments, with only a relatively small amount represented by marketable equity securities at the end of its latest quarter.

Micron Technology Inc (MU) exercised its right to call Intel’s interest in IM Flash Technologies back in January 2019, a deal that closed on October 31. As of September 28, that 49% non-controlling interest in IM Flash Technologies represented the vast majority ($1.1 billion) of Intel’s equity method investment balance of $1.2 billion. IM Flash Technologies was formed in 2006 by Micron and Intel to develop NAND flash memory and 3D XPoint products. Micron expected to pay Intel $1.5 billion in cash to acquire Intel’s stake in the joint venture, which should show up in Intel’s fiscal fourth quarter report. The monetization of Intel’s non-strategic investments has helped fund its aggressive share buybacks of late.

Additionally, please note that Intel had $3.4 billion in ‘other long-term assets’ on the books at the end of its fiscal third quarter, which according to Intel’s third quarter 10-Q filing for fiscal 2019 are largely represented by corporate debt, financial institution investments (commercial paper, time deposits, etc.), and government debt. Due to Intel’s decision to try to earn a better return on its large cash-like pile, its balance sheet can be a tad less-transparent read than some other companies (but not in a bad way, seeing as Intel has more cash-like holdings than what may be initially perceived).

Image Shown: A breakdown of Intel’s balance sheet line items, specifically as it relates to its cash-like assets in the asset section seen at the upper portion of this financial note provided by management. Image Source: Intel – 10-Q Filing, Third Quarter Fiscal 2019

Intel exited its fiscal third quarter 2019 with $5.2 billion in short-term debt and $23.7 billion in long-term debt on the books. We view Intel’s net debt load as very manageable given its sizable free cash flows and hefty cash-like balance.

During the first three quarters of fiscal 2019, Intel generated $11.7 billion in free cash flow (up from $11.2 billion in the same period a year ago) while spending $4.2 billion covering its dividend payments (broadly flat with last year’s levels due to share repurchases considering Intel’s per share payout grew modestly during this period). Intel has been aggressively repurchasing shares of late, spending $10.1 billion during the first nine months of fiscal 2019 buying back its stock (up from $8.5 billion in the same period a year ago). For reference, Intel had 4.43 billion weighted-average outstanding shares on a diluted basis during the third quarter of its fiscal 2019, down sharply from 4.65 billion in the same period a year ago.

Covering Internet of Things Upside

By 2022, Intel sees the Internet of Things (‘IoT’) creating a ~$30 billion total addressable market (‘TAM’) for its Internet of Things Group (‘IOTG’) that the semiconductor is very excited about. In 2018, Intel’s IOTG launched its Vision Accelerator Design Products hardware and Distribution of OpenVINO software toolkit to assist its clients in adopting artificial intelligence (‘AI’) and other applications. While just a small portion of Intel’s business right now, the firm’s IOTG has grown its revenues from $2.1 billion in fiscal 2014 to $3.5 billion in fiscal 2018. During this period, Intel’s IOTG has grown its operating income from $0.6 billion to $1.0 billion, keeping in mind Intel is investing heavily in this segment.

Some of the areas Intel’s IOTG is targeting includes retail (using big data analytics gathered from a retailer’s customers to enhance that retailer’s inventory management and marketing programs), industrial (predictive maintenance is a big opportunity), and construction (creating smart energy management systems). Intel’s IOTG offers end-to-end solutions to its clients, leveraging the computing power of Intel’s semiconductor offerings to unlock efficiencies and insights in any industry. Here’s what Intel’s 2018 10-K filing had to say about this segment:

“IOTG utilizes adjacent products across Intel while making the investments needed to adapt products to the specific requirements for our vertical segments. We offer end-to-end solutions with our wide spectrum of products, including Intel Atom ® and Intel ® Xeon ® processor-based computing, wireless connectivity, FPGAs, Movidius VPUs, and developer tools such as the OpenVINO™ software toolkit.

IOTG product development focuses on addressing the key challenges businesses face when implementing Internet of Things solutions, including interoperability, connectivity, safety, security, industrial use conditions, and long life support. IOTG enables a global ecosystem of industry partners, developers, and innovators to create solutions based on our products that accelerate return on investment and time-to-value for end customers. These Intel ® Internet of Things Market Ready Solutions are vetted and tested in the market, scalable, repeatable, commercially available, and fully supported through our ecosystem partners. These solutions can help streamline operations, automate manual tasks, provide insights from data, and more.”

Going forward, Intel’s IOTG plans to continue launching new products that are both scalable and able to address big commercial needs. That could include new offerings that cater towards the transportation, healthcare, and automotive industries.

Concluding Thoughts

Image Shown: A visual representation of our fair value estimate range for shares of INTC, from our 16-page Stock Report covering Intel that can be accessed here—->>>>

We continue to like Intel in both our newsletter portfolios and see the company’s investments in the IoT space (and elsewhere) supporting decent free cash flow growth over the coming years. As Intel continues to monetize portions of its non-strategic equity and debt investments, expect a lot of those proceeds to go towards buying back its stock. That should help see shares of INTC continue converging towards the upper end of our fair value estimate range.

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Software Security Industry – CHKP FEYE IMPV PANW PFPT SYMC VRSN

Related – MU CLDR

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Intel Corporation (INTC) is included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.