Image Source: Picture taken by the author.

By Callum Turcan

A holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolio, Intel Corporation (INTC) reported earnings on July 25. The semiconductor boosted full-year revenue guidance by $0.5 billion to $69.5 billion while increasing non-GAAP EPS up to $4.40 (from $4.35 previously) for fiscal year 2019, keeping in mind Intel’s top- and bottom-lines are expected to weaken modestly on a year-over-year basis due to poor performance at its data center segment. Management reiterated that Intel still expects to generate $15.0 billion in free cash flow in fiscal year 2019 after spending $15.5 billion on capital expenditures. We like Intel’s free cash flows and income growth trajectory. Shares of INTC yield ~2.7% as of this writing.

Please note Intel’s second quarter 2019 ended on June 29, 2019. At the end of the second quarter, Intel’s $11.9 billion cash & cash equivalents offset a portion of its $28.8 billion in total debt, providing for a manageable net debt balance of $16.9 billion. Intel’s strong free cash flow generation provides for solid dividend coverage, with its Dividend Cushion ratio standing at 2.1x. Additionally, we like the growth trajectory of Intel’s per share dividend payout. In 2006, Intel paid out a quarterly dividend of $0.10/share. Its quarterly payout has more than tripled since then.

Bowing Out

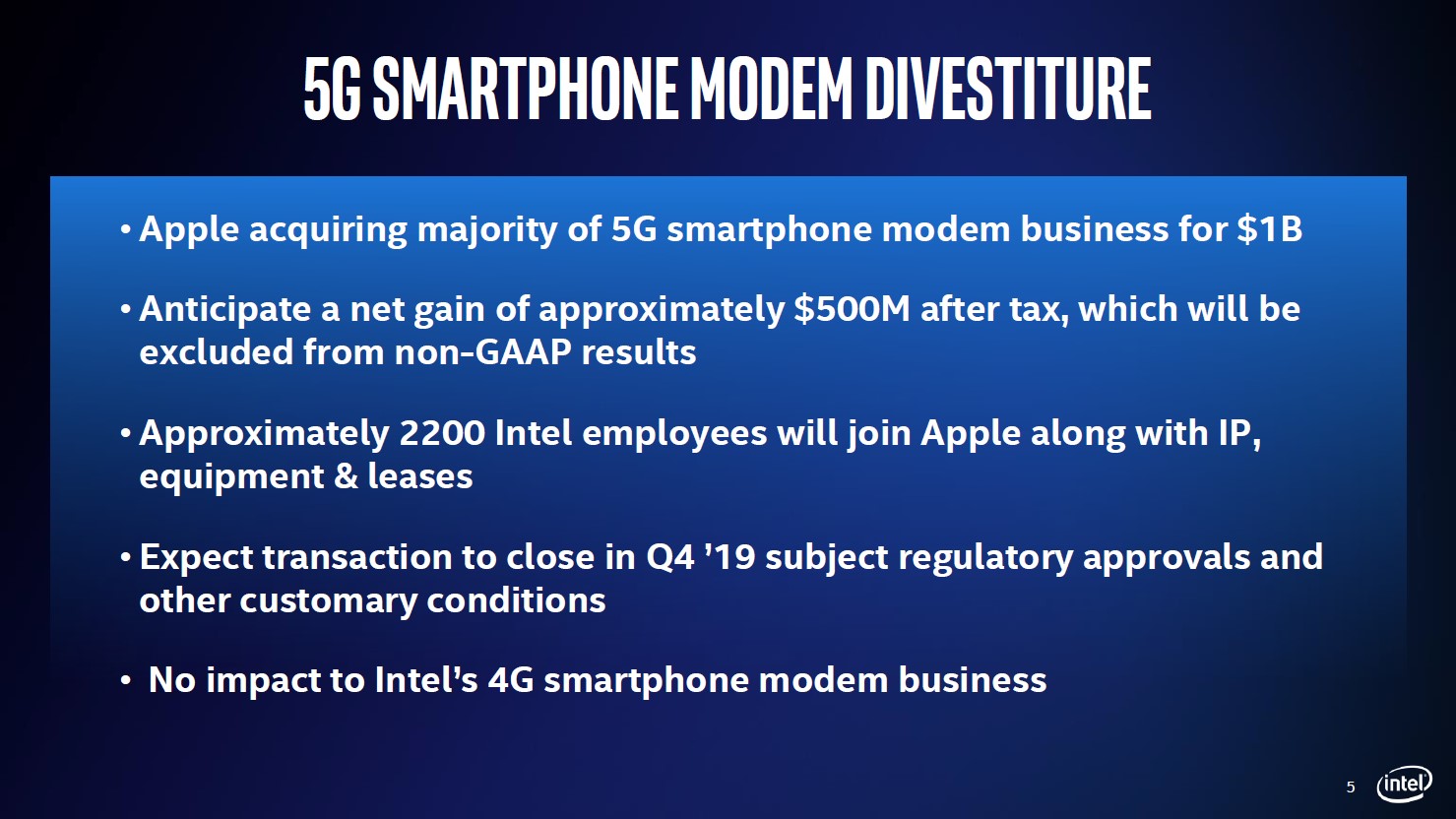

Intel is selling its 5G smartphone modem business to Apple Inc (AAPL) in a deal reportedly worth $1.0 billion. As Apple had reached a paradigm-shifting deal with Qualcomm Inc (QCOM), it was clear Intel’s smartphone modem business was no longer relevant. We would have loved to see Intel steal market share from Qualcomm but accept that this was likely the next best outcome as Apple’s six-year deal with Qualcomm to acquire modems for its iPhones and iPads effectively removed Intel’s only significant customer in this space. This was an underperforming division of Intel historically. Management mentioned (emphasis added):

“While the 5G network opportunity meets each of our investment criteria, the 5G smartphone opportunity does not. This is why we decided to exit the 5G smartphone modem business and conduct an analysis of our options for the remaining parts of that portfolio. Today, we announced the sale of the majority of our 5G smartphone modem business to Apple. This deal preserves Intel’s access to critical IP we have developed. It enables us to focus on the more profitable 5G network opportunity where we are growing and winning share. Another growth market we’re gaining share is the Internet of Things.” — Bob Swan, CEO of Intel, on the firm’s second quarter FY2019 conference call

Image Shown: An overview of Intel’s deal to sell its 5G smartphone modem business to Apple. Image Source: Intel – IR Presentation

5G Network Ambitions

Part of this pivot includes rolling out its 10nm Snow Ridge base station SoC (system-on-chip) offering, which is for telecommunications providers, with production slated to begin next year. ZTE Corporation (ZTCOY) and Ericsson (ERIC) have already signed up as customers, but note that trade wars and other concerns (particularly for ZTE) could get in the way of potential orders being filled. Management thinks Intel can take 40% of this market by 2022:

Our investments should allow us to play a larger role in our customers’ success. And finally, they must show a clear path to profitability and attractive returns. Network infrastructure, which is transforming as the industry transitions to 5G, is one of our most important areas of investment and we are laser-focused on this opportunity. This business is growing at a 40% CAGR since 2014 from just over $1 billion in revenue to more than $4 billion last year.

The network cloudification that comes with 5G expands our opportunity in the core network and at the edge, as more data moves closer to where it is created. We expect to be in production on Snow Ridge, Intel’s 10-nanometer system-on-chip technology for 5G base stations early next year. We’ve already announced that two large telecom equipment manufacturers have committed to this architecture and we’re on track to 40% share in this market segments by 2022. — Intel’s CEO during the firm’s second quarter 2019 conference call

Snow Ridge and the coming investment binge in 5G infrastructure provides Intel a great growth runway to offset weakness elsewhere, such as at its data center segment. As 5G infrastructure is built out across the globe, that will better enable the emerging internet of things (“IoT”) revolution. In theory, this could create a virtuous cycle where increased global data consumption spurs demand for 5G network chips which in turn allows for IoT-capable devices to be used to their full potential, driving demand for chips to make the IoT revolution possible thus bolstering data consumption driving demand for 5G network chips…

Beyond its 5G network growth strategy, Intel has posted strong growth at its IoT segment, which has seen its revenue surge by 31% from FY2016 to FY2018. Segment operating income rose from $0.6 billion to $1.0 billion during this period as Intel’s IoT segment operating margin jumped by ~620 basis points. During the second quarter of FY2019, Intel’s IoT segment continued to perform well with sales up double-digits year-over-year.

Data Center Segments Continues to Slide

As you can see in the graphic below, Intel’s data center division has been underperforming recently. This is a common theme across the semiconductor industry as weakening global business confidence has led to a sharp slowdown in data center and related tech infrastructure investments, hurting the performing of companies like Intel. We don’t think there’s much Intel can do to reserve this trend in the short-term. Broadcom Inc (AVGO) cut its guidance due in large part to exogenous shocks impacting its financial trajectory, which we covered in this piece here. Intel cited weakness in Chinese demand (influenced in large part by geopolitics between the US and China) and from cloud providers as demand cools off after an explosive period of growth.

Image Shown: Intel’s data center segment has been coming under a lot of pressure lately, with the segment’s top-line and operating margins both marching lower. The company is seeking growth elsewhere to offset that weakness while waiting for an industry-wide turnaround. Image Source: Intel – IR Presentation

Concluding Thoughts

We still like Intel but are closely monitoring the news for any material changes to the ongoing US-China trade war, particularly as it relates to how that could impact Intel’s future financial performance. Our fair value estimate for Intel stands at $53/share.

Broad Line Semiconductor Industry – AMD AVGO CY FSLR FORM INTC MLNX NXPI ON SIMO STM TXN VSH

Related ETFs: SOXL, SOXX, SMH, USD, PSI, XSD, SOXS, SSG, FTXL, XTH

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Intel Corporation (INTC) and Apple Corporation (AAPL) are both included in the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.