Let’s have a look at some recent reports from a few of our favorite businesses in the industrials sector: Danaher, Dover, Eaton, Emerson, Illinois Tool Works, Ingersoll-Rand, Lennox, Parker-Hannifin, and Roper.

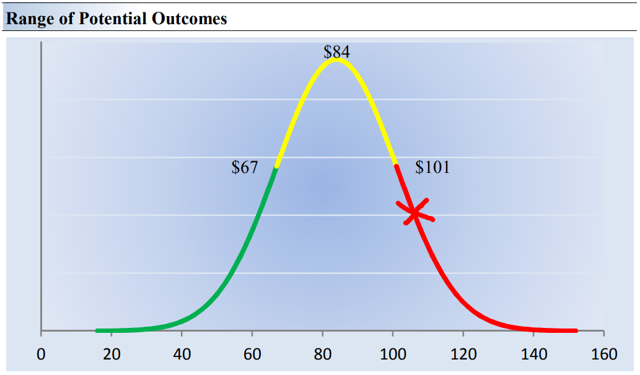

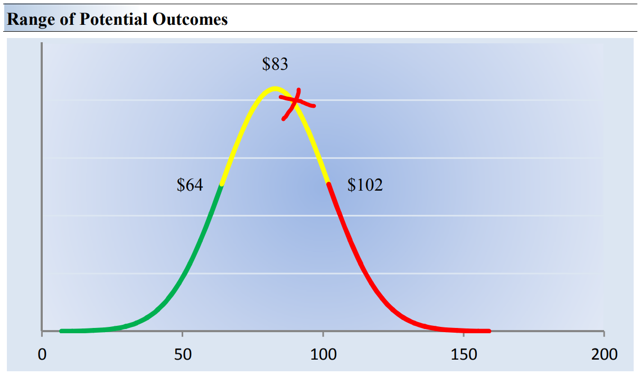

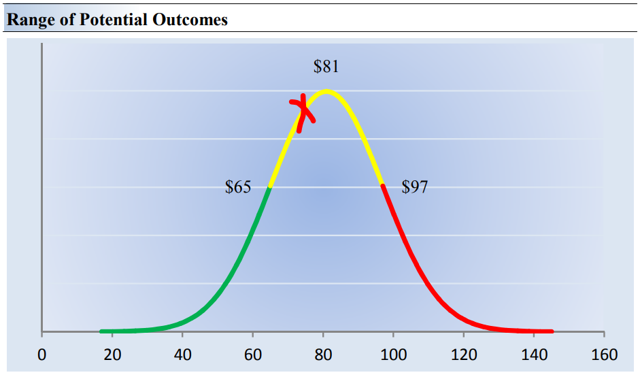

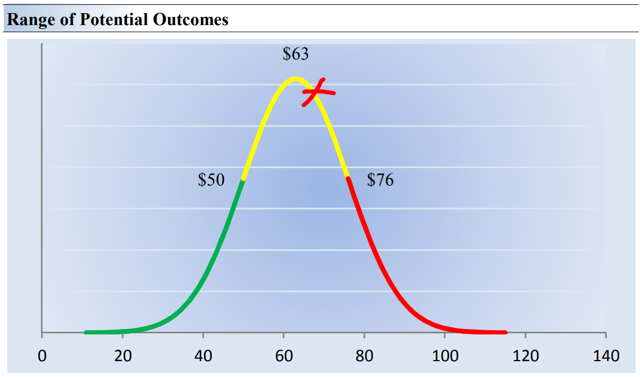

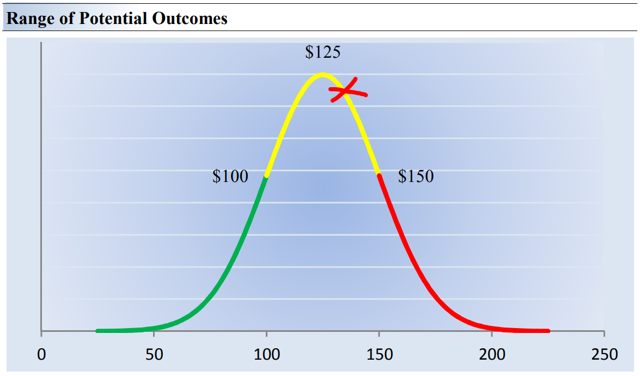

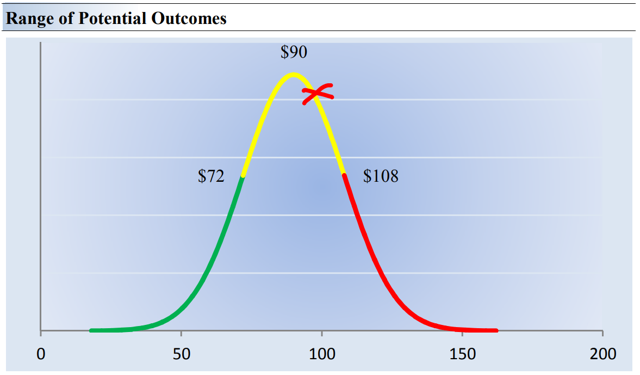

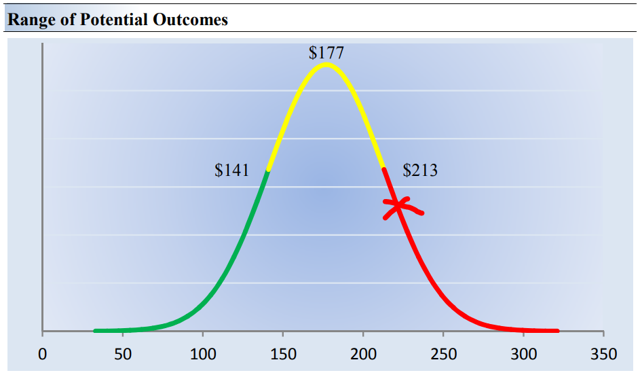

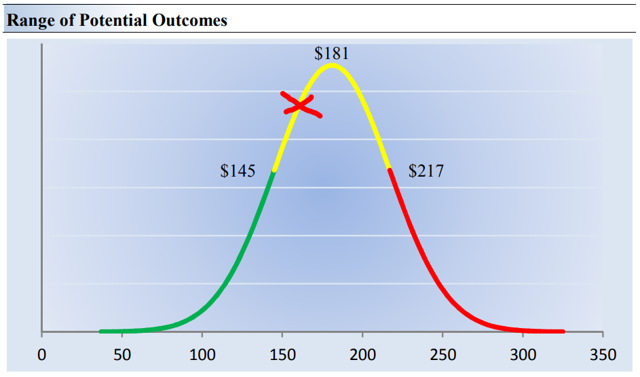

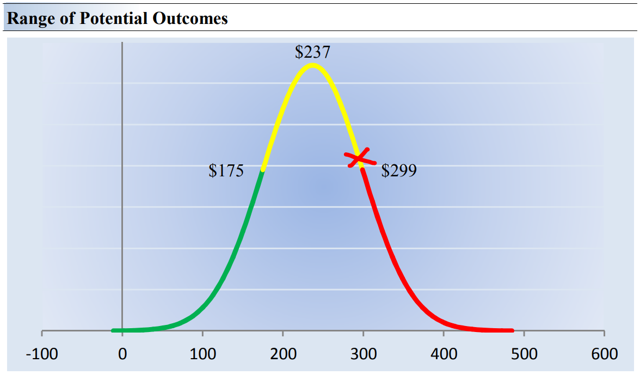

[Red X denotes the company’s share price, as of the time of this writing, on the fair value distribution chart. We view shares as undervalued if the Red X is in the green, fairly valued if the Red X is in the yellow, and overvalued if the Red X is in the red. The images found below can be found on page 6 of each company’s 16-page stock report.]

By Brian Nelson, CFA

Danaher’s Business System Is a Key Cultural Asset

On January 29, Danaher (DHR) released fourth-quarter 2018 results that came roughly in line with our expectations. For the period, revenue advanced 5.5% on a year-over-year basis, while non-GAAP adjusted diluted earnings per share came in 7.5% higher than the year-ago period, to $1.28. The company continues to executive well with respect to product innovation, and its acquisition strategy is bearing fruit. For the full year 2019, Danaher expects 2019 non-GAAP adjusted diluted earnings per share to be in the range of $4.75-$4.85, up from $4.52 per share last year, a 7%+ increase at the high end of the range. We continue to be big fans of Danaher and the “power of the Danaher Business System.” Danaher’s equity is trading near 52-week highs at the moment. Shares look a bit pricey (the Red X is in the red zone).

Dover’s Organic Growth Momentum and Backlog Remains Solid

Dover (DOV) released its fourth-quarter results January 29. Organic growth was solid during the period, coming in at 6.2%, and fourth-quarter adjusted earnings per share was recorded at $1.43 per share, advancing 25% over the year-ago period. Dover’s GAAP numbers were a bit messy as a result of one-time items, but operationally, things looked good. Broad-based demand strength in Engineered Systems and Fluids was apparent, offsetting weakness in Refrigeration & Food Equipment. Management pointed to “solid momentum” and “solid order backlogs across most of (its) portfolio.” Dover’s free cash flow for 2018 was $618.2 million, representing roughly 9% of cash conversion of revenue. The company set full-year adjusted earnings per share guidance for 2019 in the range of $5.65-$5.85, much better than the $4.97 mark it recorded for 2018. Total sales growth for 2019 is targeted at 2%-3%, which we think is achievable. We’ll be watching how well it integrates its acquisition of Belanger (a car-wash equipment maker). Shares are bumping up against all-time highs. We think Dover’s equity is fairly valued at the moment (the Red X is in the yellow zone).

Eaton Showcases Strong Organic Growth and Margin Improvement

Eaton (ETN) reported fourth-quarter results January 31, and we liked what we saw. Revenue during the period leapt 5%, and it would have been even better had it not been for currency headwinds. The company’s segment margin performance was solid, too, not only growing 100 basis points over the fourth quarter of last year, but also coming in 20 basis points above the midpoint of its previously-issued guidance. Eaton expects organic growth to be in the range of 4%-5% during 2019, and segment margins to continue to improve over last year, to the tune of a 40 basis-point enhancement. 2019 earnings per share is expected in the range of $5.70-$6.00 versus the $5.39 per-share mark last year. Eaton’s shares have bounced back a bit since the December 2018 lows, but are still off from their 52-week highs. We think shares are fairly valued at the moment (the Red X is in the yellow zone).

Emerson’s Order Rates Continue to Be Solid But Worries About China Remain

Emerson’s (EMR) fourth-quarter report, issued February 5, showed that business is going quite well. Net sales advanced 9%, while GAAP earnings jumped more than 20%, to $0.74. Trailing three-month underlying orders were also solid, advancing in the 5%-10% range during the fourth quarter, with December levels at about the midpoint of that range. The company’s outlook for 2019 also was solid, though it did note that its Commercial & Residential Solutions business is feeling “the crosswinds of weakening consumer demand in China that began in the second half of 2018.” Net sales growth for the year is expected in the 7%-10% range, while GAAP earnings per share is targeted at $3.60-$3.75, up $0.05 from previously-issued guidance. Free cash flow for 2019 is expected to come in at ~$2.5 billion, a very healthy level. Emerson’s equity is trading just shy of the midpoint of its 52-week range at the moment. Emerson’s shares are fairly valued, in our view (the Red X is in the yellow zone).

Illinois Tool Works’ ROIC Is Fantastic

Illinois Tool Works (ITW) issued decent fourth-quarter earnings February 1. The company registered organic growth of 1% in the period, while its operating margin advanced 70 basis points, to 24%. The company is a solid economic-value generator, with management’s internal estimate of after-tax return on capital reaching 28%+ during 2018, well above its cost of capital. It also grew free cash flow 10%, while returning $3 billion in cash back to shareholders with respect to dividends and share repurchases. Though 2019 is looking to be another strong year, raw-material cost headwinds and weakness in auto builds in major economies will be significant hurdles. Management guided first-quarter 2019 results below consensus, but it did reiterate its 2019 earnings-per-share target in the range of $7.90-$8.20 per share. Shares have faced pressure during the past year. Shares look priced about right on the market (the Red X is in the yellow zone).

Ingersoll-Rand’s Bookings Growth Is Impressive, Free Cash Flow Conversion to Bounce Back

Ingersoll-Rand’s (IR) fourth-quarter report, released January 30, came in roughly on par with what we were looking for, but it was nonetheless impressive. During the period, organic revenue advanced 8%, while adjusted continuing earnings per share improved to $1.32 per share in the fourth quarter, up 29%. Ingersoll-Rand’s bookings during the final quarter of 2018 leapt 16% as it pointed to strength in its Climate and Industrial divisions. On a full-year basis, adjusted continuing earnings per share was $5.61, and management is looking to grow that measure to the range of $6.15-$6.35 during 2019. Free cash flow dipped a bit during 2018, but Ingersoll-Rand’s free cash flow conversion of adjusted net income has averaged about 110% during the past four years. Its earnings quality remains solid, and 2018 was just a year where capital spending came in a bit higher than usual. The company expects to deliver 100% free cash flow conversion in 2019. With a strong bookings backdrop and ongoing operating-margin improvement, we expect Ingersoll-Rand to hit its targeted guidance for this year. The company’s equity price has rallied significantly since the December 2018 market sell off. Shares look fairly valued at the moment (the Red X is in the yellow zone).

Lennox’s Shares Hovering at All-Time Highs

Lennox (LII) showed that it had a fantastic 2018 when it reported fourth-quarter results February 5. The company noted that it achieved record revenue, profit and cash generation during the 2018 (free cash flow was $410+ million for the full year compared to $227 million last year). Lennox reiterated its 2019 outlook for revenue growth in the range of 3%-7%, with adjusted earnings per share from continuing operations expected between $12-$12.60 per share, significantly better than the $9.42 mark it achieved in the last fiscal year. Lennox plans to repurchase $350 million worth of shares in 2019, and we’d expect some portfolio optimization during the year (e.g. the divestiture of its Kysor Warren refrigeration business). Shares of Lennox are bumping against all-time highs, and the company handled the December 2018 swoon quite well. Shares aren’t cheap (the Red X is in the red zone).

Parker-Hannifin’s Aerospace Segment a Gem

It was business as usual during the calendar fourth quarter (fiscal second quarter) at Parker-Hannifin (PH). The company’s quarterly update, released January 31, showed that organic sales leapt 6%, while adjusted total segment operating margins advanced 170 basis points, to 16.6%. Adjusted earnings per share came in at $2.51 in the period, compared with adjusted earnings per share of $2.15 in last year’s quarter. Orders for its Aerospace Systems Segment leapt 10% for the trailing 12-month period ending December 2018. Sales and operating earnings for that division advanced 12% and 39%, respectively, during its fiscal second quarter of 2019 (calendar fourth quarter). For its fiscal 2019 (ending in June), Parker-Hannifin raised its guidance for earnings from continuing operations, to the range of $11.04-$11.54 per share ($11.35-$11.85 on an adjusted basis). It did note “signs of moderating end market demand and the impact of a stronger U.S. dollar,” but earnings momentum continues. Parker-Hannifin’s equity has bounced a bit in the past few weeks, but it still remains below 52-week highs set in September 2018. Though its Red X is still in the yellow zone, Parker-Hannifin’s shares may offer the best opportunity, strictly price-to-fair-value speaking.

Roper’s Free Cash Flow Conversion Tremendous

Roper (ROP) reported solid fourth-quarter results February 1. Revenue advanced 12% with most of it coming from organic growth (9 percentage points), while its adjusted gross margins expanded 90 basis points, to 63.5%. The company’s operating cash flow surged 26% and its free cash flow grew at an even better pace, good enough to amount to tremendous free cash flow conversion of 32% of adjusted revenue. Management pointed to “outstanding execution across (its) software, network and product businesses,” and we’d look for the company to be acquisitive of high-quality recurring revenue software businesses. Roper’s outlook for the first quarter of 2019 came in better than consensus, and it set full-year 2019 adjusted diluted earnings per share in the range of $12-$12.40, which compares to the $11.81 mark in fiscal 2018. We like the expected pace of growth, but we’ll be paying close attention to its business portfolio as the company continues to shed and acquire new businesses. Roper’s shares are getting back on track after trading off significantly during the December sell off. Roper’s shares aren’t necessarily cheap as they border on being overvalued (the Red X is very close to the red zone).

The images in this article represent the probability distribution of what Valuentum believes to be the most likely true fair value of each company. The Red X‘s represent where shares of the companies are currently trading at the time of this writing. Each of these images (excluding the X) can be found on page 6 of each company’s stock report. Please be sure to always compare the company’s fair value estimate to its current price. We provide real-time chart functionality on each company’s stock landing page.

Building Materials: CSL, EXP, KOP, LPX, MAS, MHK, MLI, MLM, OC, OSB, RYN, TILE, USG, VMC

Distributors – Industrial: AIT, AXE, FAST, GWW, MSM, WCC

Electrical Equipment – Industrial: ABB, AME, AOS, CPST, ETN, FELE, LFUS, ROK

Engineering & Construction: ACM, EME, FLR, GVA, JEC, KBR, MDR, PWR

Related ETFs: XLI, VIS, FIDU, ITA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.