Image Source: Goldman Sachs 3Q2019 Earnings Presentation

By Matthew Warren

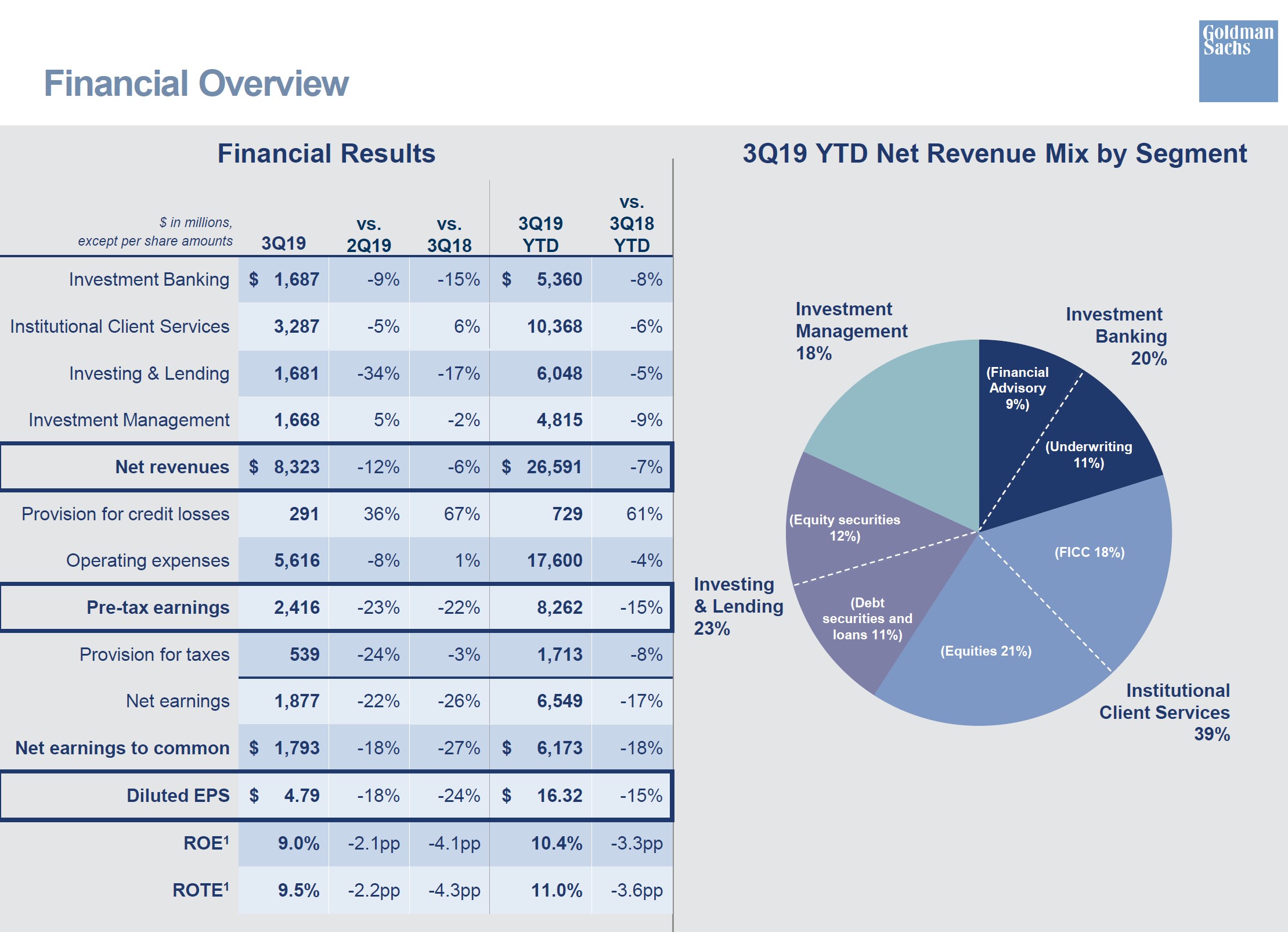

Goldman Sachs (GS) reported third-quarter results October 15. The bank missed analyst consensus estimates for revenue by $10 million, and GAAP EPS of $4.79 per share missed by $0.09. Overall firm revenues dropped 6% versus the year-ago period, operating expenses increased 1%, net earnings were down 26%, and diluted EPS tumbled 24%. The weakness was most pronounced in investment banking where revenues fell 15% versus last year’s quarter and Investing & Lending where revenues plummeted 17%. Goldman Sachs generated a sub-par return on equity (ROE) of 9% (down 2.1 percentage points versus last year) and return on tangible equity (ROTE) of 9.5% during the quarter.

While Goldman management tried to explain away the revenue weakness by pointing out that it is still leading many of the “league tables,” the year-over-year comparisons did look weaker than its peers this quarter. Since quarterly comparisons can be noisy, one must watch over longer periods for the broader trend. Management also tried to explain the negative operating leverage by talking about its investment in platforms as opposed to people.

The bank is building out its retail platform Marcus as well as its institutional platform Marquee, as well as covering the expenses surrounding the launch of the Apple Card. Specifically, they put the ROE drag at 60 basis points (0.60%) in the quarter, with this year being the biggest investment year. Management will be giving a strategic update in January to dig into these issues in greater detail and to give more guidance about how analysts and investors can hold them accountable to these investment programs.

Our overall take on Goldman Sachs is that, given the lower amount of leverage the bank is able to employ under the current regulatory regime, it is very difficult for it to replicate the mid-to-high teens return on equity it put up in the go-go years leading up to the Global Financial Crisis. Goldman Sachs is now a bank holding company and is trying to add deposits to bring funding costs down toward those of their money-center peers. This is a difficult ask and a long road, though we note it has certainly made progress bidding up for deposits.

While lower leverage means less risk, we still don’t like the equity holdings (private and public) sitting on the balance sheet of this leveraged institution. We also don’t like the large exposures to investment banking and trading, two businesses that are highly cyclical, market dependent, and low return on capital. We are maintaining our $200 fair value estimate at this time, and we won’t be adding Goldman Sachs to any newsletter portfolio anytime soon. Bank of America remains our favorite big bank at the moment.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.