Image source: GE investor presentation

By Kris Rosemann

Though it had long ago become apparent that General Electric (GE) was struggling to generate ample cash flow from its industrial operations, “GE Takes the Plunge, Halves Dividend,” speculation had been running rampant on how new CEO John Flannery would handle the mess of a business he had been handed. Investors may have thought they got the answer in late 2017 when the company announced billions in dollars of divestitures and a dividend reduction, but here we are again, discussing what will become of GE’s once sprawling portfolio of industrial assets.

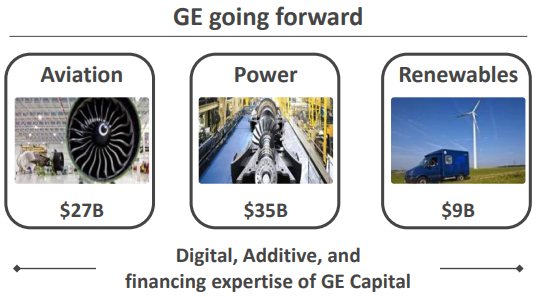

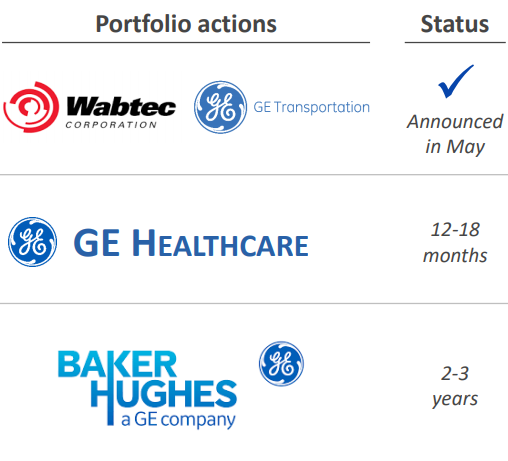

With its dividend reduction in November 2017, GE announced its intention to refine its portfolio to focus on its three core units: aviation, power, and healthcare, which accounted for ~58% of 2016 total revenue. The company is now merging its $4 billion GE Transportation business, spinning off its $19 billion GE Healthcare business, and parting ways with its 62.5% stake in $22 billion business Baker Hughes. For reference, total revenue for GE came in at ~$122 billion in 2017.

Image source: GE investor presentation

After agreeing to merge its GE Transportation unit with Wabtec (WAB) in May, GE’s management plans to turn GE Healthcare into a standalone healthcare company in the next 12-18 months as well as pursue an orderly separation of Baker Hughes (BHGE), which has been under GE’s control for less than a year at this point, over the next 2-3 years. GE’s stake in Baker Hughes is subject to a lock-up period that expires in July 2019. The remaining company expects to realize $500+ million in cost savings from realignment, reductions, outsourcing, and a digital focus following the separations.

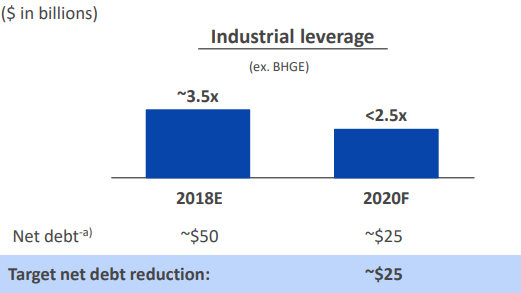

The remaining company will also be focused on debt repayment, with a goal of paying down ~$25 billion in Industrial net debt (excluding Baker Hughes) by 2020 to go along with a net debt-to-EBITDA target of less than 2.5x as it continues to shrink the GE Capital balance sheet. This $25 billion target includes a transfer of $18 billion in healthcare debt and pension deficit to the to-be-formed healthcare company, and management plans to monetize ~20% of GE Healthcare, which will help it realize its ~$9 billion debt and commercial paper reduction target.

Image source: GE investor presentation

However, perhaps most notably for long-time holders of General Electric is the reduction in its aggregate dividend management is planning. The company has stated its plans to have a dividend payout in line with its industrial peers, and Mr. Flannery said on an investor call regarding the announcements June 26, “Given the typically lower payout ratios in the health-care industry this will likely lead to a reduction in the aggregate GE dividend at that time.” Management can slice the dividend cut any way that it likes, attributing it to lower payout ratios in a given sector, but it simply comes down to poor capital stewardship in years past. GE’s Dividend Cushion ratio of 0.1 clearly highlights the combination of weak free cash flow support, even after the dividend cut in November 2017, and a bloated balance sheet.

The General Electric story is yet another example of the value that can be found in Valuentum’s Dividend Cushion ratio, and we continue to encourage readers to regularly take time to check up on the Dividend Cushion ratios of their portfolio holdings. Do you know where your holdings’ Dividend Cushion ratios are?

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.