Economic Commentary: US-Listed Chinese Names, 60-40 Stock-Bond Allocation and More

There’s an interesting saying that I came across recently...that hits at the most important component of any fiduciary approach: capital preservation. The saying was “Friends don’t let friends buy and hold.” We’ve always employed the Valuentum strategy, which we believe is much more promising than a traditional buy and hold strategy. – Brian Nelson, CFA

The US-China trade war continues with reports indicating that the White House is considering delisting Chinese (FXI, MCHI, KWEB) companies on US exchanges. Let’s get more of the Valuentum’s team’s thoughts on these developments as well as other topics that have come to the fore. The latest alert to members is a great prompt to get the conversation started. The Valuentum Team:

If we had included any US-listed Chinese names in the newsletter portfolios, they would have been removed some time ago. We don’t like this recent development at all, and importantly, stipulations in many equity agreements of US-listed Chinese firms indicate that investors don’t really have direct ownership in these companies. Stock in Alibaba (BABA), for example, are actually shares in an variable interest entity based in the Caymans that only has a claim on Alibaba’s profits. Backlash from China on whatever the White House might be considering could turn out to be a huge problem for holders of US-listed Chinese names, in our view. We're staying far away.

Callum Turcan: It doesn't look like a trade deal, short of a very narrow deal, is going to materialize anytime soon between the US and China. First, the farm tour was cancelled and now this; looks like talks on October 10 aren't starting out on solid ground.

Matthew Warren: It seems to me like a “cold war” with China had been forming for a long time, but it's heated up quite a bit. The idea used to be that China would open up over time and become more like Western countries (granted this wasn't really happening in many respects), but it could go completely the other way where we have a Balkanized global economy with competing power centers using carrots and sticks to win over "other" countries.

China is likely to accelerate development of products/services to replace what they import from the US or at the very least buy Airbus (EADSY) instead of Boeing (BA). If the US pulls its supply chains out of China, the country very well might go bust. The Fed would have to print money and buy the country’s US Treasuries, or President Trump could make a swift retreat, slap a deal together, and declare victory even if there is no meaningful change agreed to. I think volatility will continue until some of these important questions are answered.

Brian Nelson: Fascinating. The US and China are walking a fine line, and I don’t think we’ll see any deal of any substance before the 2020 election. Even if the two countries cobble something together, it won’t be what President Trump had initially intended, and it will only be for talking points during the election cycle. The point about volatility is an important one, and an issue that we highlight in Value Trap, conditions that may only be exacerbated by price-agnostic trading. Economists including John Mauldin are expecting 2020 to be the most volatile year in history.

From heightened political uncertainty—now with the Democrats launching a formal impeachment inquiry against President Trump—to ongoing worries about the implications of an inverted yield curve, to some $15 trillion in negative-yielding debt around the globe, to growing concerns about an over-inflated commercial real estate market, to general overvaluations of equities as a result of ultra-low yields around the globe, to the Iran/Saudi Arabia tensions, to the US-China trade/currency war, the number of obstacles thrown at the stock market continues to increase.

Callum: When it comes to understated contagion risk and how quickly that can spread, there's no better example than Germany (EWG) and China. Germany exported EUR$93 billion worth of goods and services to China in 2018, while importing EUR$106 billion of Chinese goods and services. As China's economy has clearly slowed down due to the US-China trade war, something a two week reprieve on certain tariffs is unlikely to change, that will hurt demand for exports from Germany which in turn will hurt the industrial heartland of Europe (considering the complex automobile supply chains between Hungary, Austria, and Germany) as a lot of Germany's exports to China are represented by automobiles.

As demand for German auto exports declines and pushes down on already weak economic activity in the country (Germany appears to be entering a recession), that may further frustrate the ECB's plans to use low/negative interest rates to spur economic growth in the EU to prop up inflation. A weaker China leads to a weaker Germany (and depresses growth in Hungary and Austria), which in turn leads to a weaker EU which in turn leads to desperate pleas to monetary policies to reverse the trend.

However, many believe that additional debt accumulation no longer does a good job of stimulating economic growth, meaning low rates may further erode whatever strength remains at the EU's "zombie banks" while not necessarily propping up growth (even if in the short-term equity markets cheered the move).

Brian: Great insights Callum. As we serve a great many advisors, it seems that there has been a growing concern about the traditional 60-40 stock-bond portfolio. Many financial advisors may be expecting too great of stock returns in the future, all the while bond returns and yields may be comparatively too low after fees to offer the type of return necessary to achieve long-term portfolio goals for clients.

We’re actively seeking out solutions for our financial advisor members, and many have opted to add the High Yield Dividend Newsletter publication to their memberships to capture a higher yield component in their client portfolios. Though higher-yielding equities are comparatively riskier, we think the group will continue to be in vogue as the markets remain open to new capital raises and as investors seek such high yield plays in the absence of alternatives.

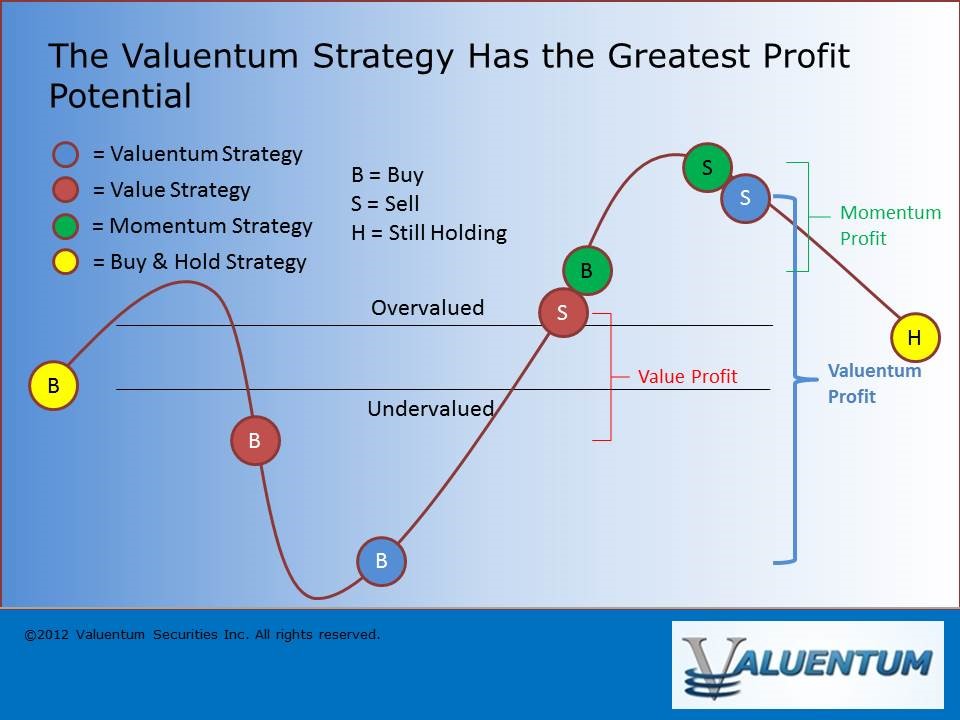

There’s an interesting saying that I came across recently, too, that hits at the most important component of any fiduciary approach: capital preservation. The saying was “Friends don’t let friends buy and hold.” We’ve always employed the Valuentum strategy, which we believe is much more promising than a traditional buy and hold strategy.

Image shown for informational/illustration purposes only.

Callum: This reminds me of a segment in Value Trap. Specifically as it relates to capital preservation, two of the single biggest risks to an investor's portfolio is catching the “falling knife” (buying stocks that look "undervalued" because of weak technical performance, which generally is a sign of market participants reducing their future discounted free cash flow expectations) and riding the market downwards without having a large enough cash position to take advantage of price-agnostic trading (the herd effect if you will) pushing down the valuation of quality companies that are still likely to generate similar discounted future free cash flows regardless of equity markets shifting lower.

Capital preservation is key to maintaining strong long-term returns on any given portfolio, which is why being actively engaged with the investing process is essential when we are this late in the business cycle. I really find the 7-year expected returns by asset class put forth by GMO interesting [U.S. large cap stocks and U.S. small cap stocks are expected to fall 3.7% and 1.5%, respectively]. It highlights the view that while the market has been on a tear over the past decade, that is unlikely to remain the case given how monetary policy has already gone above and beyond the call of duty.

Furthermore, when economist John Mauldin says the 60/40 portfolio is a way of hedging overvalued stocks (product of a low-to-negative interest rate environment) with overvalued bonds (due to monetary policy pushing up the value of bonds), I couldn't help but chuckle a bit.

Matthew: I think it's tricky to make the 60/40 call or the bond allocation call in general. There is a huge macro bet one is making, whether investors acknowledge it or not. Bonds are either in a bubble due to QE (quantitative easing) programs over the past decade and the "threat" of additional QE, or the collapse in rates is actually a symptom of deflationary impulses that are bubbling up and spreading from Japan to Europe and now potentially to the US.

I am in the latter camp. People are blaming negative rates in Japan and more recently in Europe as causing the bid for bonds and collapse in rates in the U.S. My hunch is that this is incorrect. It would have happened sooner. It was when emerging signs of economic weakness and the trade war erupted that the rate structure collapsed in the US. To me, I read that as a severe risk of malaise and deflationary pressures spilling over into the US. The trade war is increasing the risk of a deflationary bust in China. If deflationary pressures ramp up around the world, the European banks will come under more pressure, and these institutions don't have the earnings power to take much more pressure. The "solution" of negative rates just puts more pressure on Euro bank earnings power.

Is my hypothesis correct? If so, investors may actually want to own U.S. long bonds. One may also want to own bond-like equities, preferred, etc. [The Exclusive publication highlights preferred ideas at times, and the High Yield Dividend Newsletter offers ways to capture exposure to preferred issuances in a diversified manner.] The market has been bidding up those securities rightly so in my mind. Of course, selectivity matters a lot because if a dividend gets cut as it did at Tailored Brands than the yield pick-up was nothing more than an illusion. This is a key risk to watch for in today's markets. Valuentum's Dividend Cushion ratio could not be more important in differentiating between real yield opportunities and mirages.

If I am wrong and US bonds are overvalued due to QE and the "threat" of additional QE, then you can play one of two games. One can either "not fight the Fed" and try to outguess where the Fed is going. Look at the massive focus on every word out of every voting and non-voting Fed member by the market! Or, one can avoid long duration bonds and wait for the bubble to eventually burst. Career risk might come take your seat in the meantime. This is why the tug of war of the two narratives is so intense. People literally have their careers on the line, especially if they have to make these decisions about how much bond duration to put into their portfolio (institutional money) and/or their retail clients' portfolios.

Switching gears a bit--the banks have all been harping about how they are trying to write less construction loans as they don't like the risk/reward at this point in the cycle. We have been looking for short ideas related to this theme: equities with US non-residential construction as its main end market with a bonus if a weak business and/or too much leverage.

Callum: Interesting theme Matt. According to the St. Louis Fed, US non-residential spending is already moving lower (from the peak in April).

Brian: I do think non-residential construction may be in some trouble. Many are saying that commercial construction is experiencing a dangerous bubble. Many, including Boston Fed’s Eric Rosengren, have flagged “risks to economy in WeWork-style model. From Reuters:

I am concerned that commercial real estate losses will be larger in the next downturn because of this growing feature of the real estate market, which could ultimately make runs and vacancies more likely due to this new leasing model…The basic model provides you the opportunity to, in effect, not be required to pay your lease off. Eventually if there are enough vacancies in that building it means that banks are going to take losses. It will not be until a recession that this evolving model will be truly tested. The fact that the shared office model relies on small-company tenants with short-term leases, combined with the potential lack of recourse for the property owner, is potentially problematic in a recession. – Rosenberg (excerpted from Reuters)

Matthew: If WeWork (WE) goes bankrupt (“How WeWork spiraled from a $47 billion valuation to talk of bankruptcy in just 6 weeks.”), this could be a major negative catalyst for the commercial real estate market. Apparently, WeWork is one of the largest lessors in several major cities around the US and Europe (“with over $47 billion in lease liabilities, WeWork is already one of the world’s largest lessees, trailing only oil exploration giants Petrobras and Sinpec”).

Callum: Good point Matt. In the High Yield Dividend Newsletter portfolio, we have a 10% weighting in the Vanguard REIT ETF (VNQ) and in the DGN portfolio we have a modest weighting in Realty Income (O), so those portfolios don't look too exposed to WeWork's problems but something to keep in mind.

Join the conversation. What do you think about the latest US-China trade war, buy-and-hold and the 60-40 portfolio, as well as serious problems looming in the commercial real estate market? [Commentary also tickerized for top holdings in the VNQ.]

0 Comments Posted Leave a comment