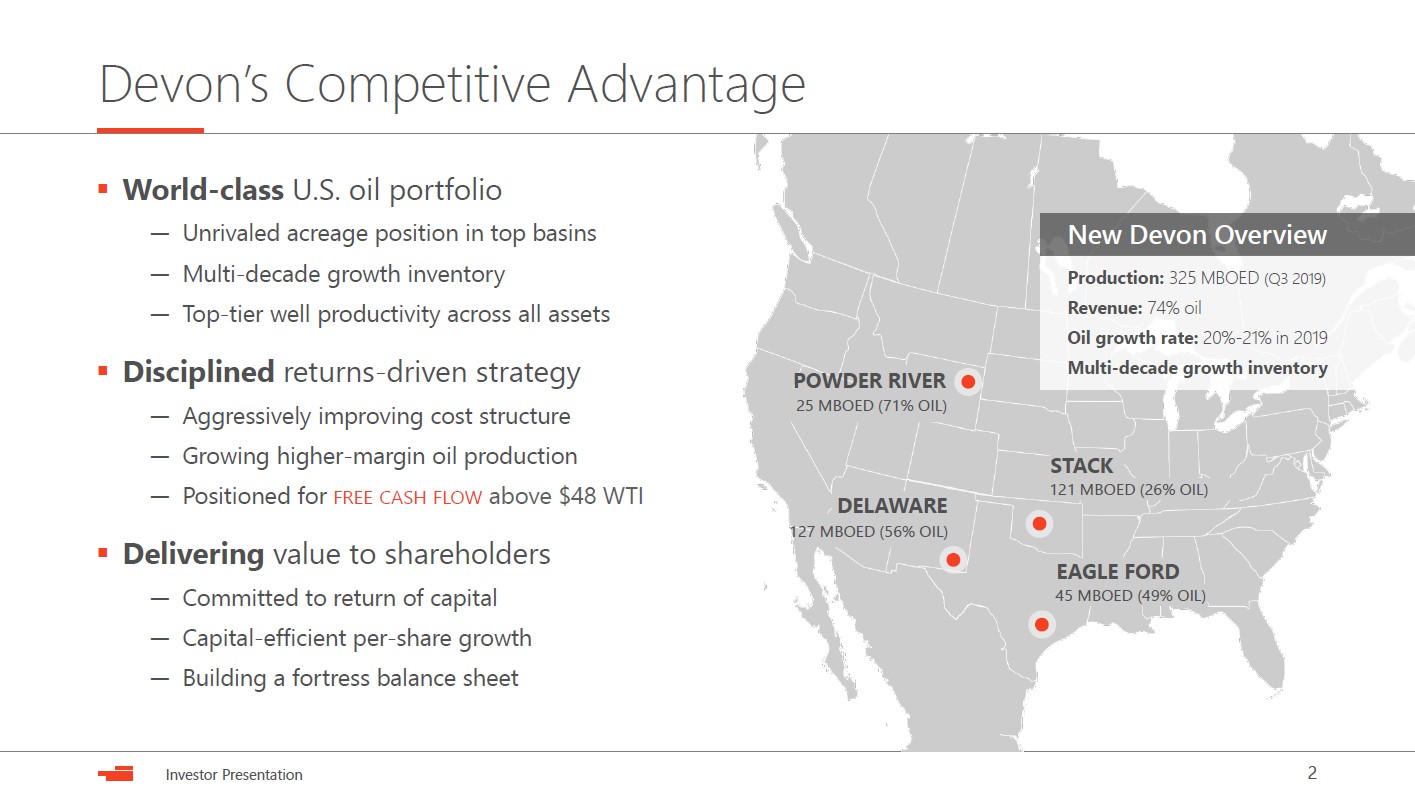

Image Shown: An overview of Devon Energy Corporation’s remaining asset base, which consists of upstream oil and gas operations spread across four major unconventional plays in the US. Image Source: Devon Energy Corporation – December 2019 IR Presentation

By Callum Turcan

Times are tough in the oil & gas patch, especially for upstream producers of raw energy resources like Devon Energy Corporation (DVN). Not only are global oil prices low, which drags down natural gas liquids pricing for products like propane and butane, but North American natural gas supplies are trading at rock-bottom prices as well. Devon Energy has attempted to cope by divesting less economical assets and shifting all of its focus towards its best well locations, a process known as high-grading. Due to the recent strength in WTI, shares of DVN have started to march towards the upper end of our fair value range estimate and currently yield 1.4% as of this writing. Devon Energy is placing a great focus on developing “liquids-rich” plays, which refers to developing well locations with high crude oil and natural gas liquids production mixes.

Hefty Debt Load and Tough Business Model

Over the past several quarters, Devon Energy has been placing a much greater emphasis on buying back its stock than growing its production base given the ongoing weakness in raw energy resource prices. Within its third quarter of 2019 earnings report the company noted:

“Through Oct. 31, 2019, Devon had repurchased 147 million shares, or approximately 28 percent of outstanding shares since 2018, at a total cost of $4.8 billion, under its $5 billion authorization [which has since been upsized]. In the third quarter, the company completed $550 million of share repurchases and returned $35 million of additional capital to shareholders through its quarterly dividend.”

Additionally, please note Devon Energy spent more on share buybacks than capital expenditures during the first nine months of 2019. However, in our view, Devon Energy would be better served paying down its debt than buying back shares, especially now that DVN trades at the upper end of our fair value estimate range and given the fickle nature of raw energy resource prices.

Devon Energy exited September 2019 with a $2.9 billion net debt load (inclusive of short-term debt). During the first nine months of 2019, net operating cash flows of ~$1.55 billion barely outpaced capital expenditures, meaning the $0.1 billion in dividends paid out during this period were largely funded by the company’s balance sheet (as were share buybacks).

Generating free cash flow in the future will be tough considering the steep production declines unconventional wells face. Output from unconventional wells generally experience decline rates in the 45%-80% range in the first year and produce most of their estimated ultimate recovery (‘EUR’) during the first few years of production. That forces unconventional upstream players like Devon Energy to continuously pour large sums into drilling and completion activities, a process that requires running large capital expenditure budgets just to keep the existing production base stable. Only materially higher and sustained increases in raw energy resource prices can change this paradigm, and that’s no given.

Making matters worse, Devon Energy has already developed many of its Tier 1 well locations in the Eagle Ford and STACK/SCOOP plays, and a substantial amount of those situated in the Permian Basin, which makes the “shale treadmill” even harder to beat going forward as less prolific well locations must be developed (meaning a greater number of wells need to be turned online each year to keep output flat, which requires ever-larger capital expenditures). Devon Energy has a less developed position in Wyoming’s Powder River Basin, but those well locations are generally less economical than those in the Permian Basin.

Last year, Devon Energy sold off the bulk of its midstream operations (in particular, its equity stake in the general partner and master limited partnership of Devon Energy’s midstream spin-off) and used the proceeds to buy back stock, which also removed EnLink Midstream LLC (ENLC) from its balance sheet. The firm’s capital expenditure budget is primarily represented by upstream capital investments, but occasionally there are some modest infrastructure investments that may be required to turn new wells online.

The cash flow that’s effectively being front-loaded by Devon Energy’s divestment program should go towards further debt reduction efforts, in our view. Devon Energy has already made great strides on this front, cutting its net debt load down to $2.9 billion at the end of the third quarter of 2019 from $10.8 billion (inclusive of short-term debt) on a consolidated basis (included its midstream-level debt) at the end of December 2015. Part of that included removing EnLink and its heavily indebted balance sheet from Devon Energy’s financials.

Additional deleveraging activities could substantially improve Devon Energy’s dividend coverage, which is weak. The upstream company’s Dividend Cushion ratio sits below zero due to its net debt load and sits at -0.6x currently (negative 0.6x). We view Devon Energy’s dividend growth trajectory as weak, and any per share dividend growth is unlikely to be sustainable.

Goodbye Barnett, Hello Additional Buybacks

Devon Energy announced on December 17 that the firm was going to sell off its remaining Barnett shale assets (very uneconomical natural gas-heavy upstream operations) to Banpu Kalnin Ventures (‘BKV’) for $770 million. BKV already has a significant presence in Appalachia. According to its press release, BKV is backed by substantial equity commitments from Thailand-based Banpu Public Company Limited (BNPJY) which operates power generation, utility, and energy trading businesses in Southeast Asia, the US, and elsewhere.

What makes this deal particularly noteworthy is that the Barnett play is one of the regions that helped kick-start the North American Energy revolution, particularly as it relates to “fracking” and the related boom in US raw energy resource production. Devon Energy bought Mitchell Energy back in 2001 for $3.1 billion in cash and stock (Devon Energy also took on roughly $0.4 billion in Mitchell Energy’s debt as part of the deal), which is when it acquired the large Barnett footprint Devon Energy is now divesting. The late George Mitchell, who founded Mitchell Energy, is often regarded as one of the “fathers of fracking” due to his efforts (along with his engineering team and all the others involved) in seeking to unlock natural gas from the Barnett shale play in Texas in the 1980s and 1990s, which included utilizing hydraulic fracturing technology.

Unfortunately, when fracking took off in Appalachia and elsewhere, North American natural gas prices started tanking by the early 2010s as production surged. That made the Barnett play, which wasn’t very productive to begin with relatively speaking, unattractive and capital largely left the area. While the Barnett shale might have been the spark the lit the torch, it was a combination of the extremely prolific Appalachian region (home to the Marcellus and Utica shale plays, which together produce over 30 billion cubic feet of natural gas per day) and associated natural gas production (natural gas produced alongside oil and natural gas liquids) from plays within the Permian Basin and elsewhere that ultimately saw Henry Hub (the preeminent US natural gas pricing benchmark) collapse under a supply tsunami.

When Devon Energy announced it was selling its remaining Barnett position, that marked the end of its high-grading process (which also included Devon Energy exiting Canada’s oil sands patch earlier this year). Like with past transactions, management intends on using the proceeds to buy back stock, and in conjunction with the divestment, raised Devon Energy’s total share buyback capacity to $6.0 billion by approving another $1.0 billion in share repurchasing authority ($0.8 billion of that is contingent on the Barnett deal closing). As mentioned previously, in our view, those proceeds would be better spent if allocated towards deleveraging activities.

Concluding Thoughts

Though Devon Energy has been aggressively buying back its stock of late, shares of DVN are barely up year-to-date as of this writing. The yield on Devon Energy’s shares is relatively low, the company’s outlook remains mired by the shale treadmill and subdued raw energy resource prices, and its dividend coverage is incredibly weak. While nearer term WTI futures have perked up recently (trading around $60-$61 per barrel from January 2020 – May 2020), the back end of the futures curve remains subdued (December 2020 WTI futures are trading at $56-$57 per barrel as of this writing) implying that the upstream industry is far from out of the woods yet.

———-

Oil & Gas (Majors Industry) – BP COP CVX RDS.A RDS.B TOT XOM

Refining Industry – HES HFC MPC PSX VLO

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Related: ENLC, BNPJY, XLE, VDE

Tickerized for our energy ETF coverage.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Magellan Midstream Partners L.P. (MMP), and Enterprise Products Partners L.P. (EPD) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.