While DXC Technology is experiencing top-line pressure due to weakness at its legacy businesses, its digital growth trajectory continues to look promising. Very strong free cash flows and a modest dividend policy leave plenty of room for upside as it relates to future dividend increases, particularly if share buybacks are scaled back.

By Callum Turcan

DXC Technology Company (DXC) can be quickly defined as an end-to-end IT services company that offers anything from cloud application and management services, analytics, and IT security services to traditional application management and maintenance offerings. The company seeks to enable enterprises to not only transition to the digital age but scale up their capabilities with the help of DXC Technology, a process aided by such offerings as analytics (using meta-data obtained through its “robust partner ecosystem” to gain insights into how DXC Technology’s partners can better optimize their operations), Workplace and Mobility (assisting in the rollout of the Internet of Things, IoT, as DXC Technology’s clients utilize more connected devices which in turn drives a need for additional enterprise-level security services), and numerous other offerings.

Shares of DXC yield 1.5% on a forward-looking basis as of this writing after a recent dividend increase (we’ll cover that in a moment). We are very fond of DXC Technology’s free cash flows, its digital portfolio growth (projected at strong double-digits over the coming years), and its stabilizing financial position.

Guidance for FY2020 (DXC Technology’s fiscal year ends in March) points towards the company holding the line this fiscal year after posting lackluster results in FY2019. Please note shares of DXC tumbled from well over $90 per share in September 2018 to roughly $55 per share as of July 8, largely due to investor worries over weak performance at the firm’s legacy businesses offsetting gains at its digital portfolio.

When DXC Technology was created via the combination of Computer Sciences Corporation and the Enterprise Services division of Hewlett Packard Enterprise Company (HPE) in 2017, the company targeted $1.0 billion in synergies within the first year of the deal closing. By the end of year one, DXC Technology aimed to realized $1.5 billion in run-rate synergies. In May 2018, DXC Technology completed the separation of USPS and the combination with Vencore Holding to form Perspecta Inc (PRSP), with shareholders of DXC receiving one share of PRSP for each two shares of DXC they owned.

Free Cash Flow King

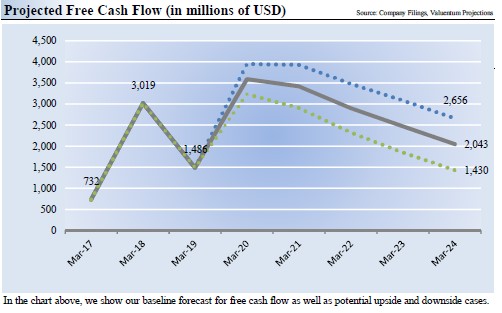

In FY2019, DXC Technology posted $1.8 billion in net operating cash flow. That was down from $2.6 billion in FY2018, keeping in mind working capital movements were responsible for a large chunk of the sharp decline (reduced net income generation was the other culprit). DXC Technology allocated $0.3 billion towards capital expenditures in FY2019, enabling $1.5 billion in free cash flow. We love DXC Technology’s free cash flow potential and forecast that over the next five fiscal years, the company will grow its free cash flow streams by 6.6% CAGR (at the midpoint). That’s a growth rate above both its peer median and industry average.

Image Shown: We expect DXC Technology will continue to be very free cash flow positive over the next five fiscal years, a product of its capex-light business model.

The company’s free cash flows about fully covered its $0.2 billion in annual dividend payments and $1.3 billion in share buybacks in FY2019. Future dividend increases could be made possible through free cash flow growth, its already ample free cash flow generation, and by management shifting towards a capital allocation strategy that puts greater emphasis on catering towards income-seeking investors. On May 23, management raised DXC Technology’s quarterly dividend payment from $0.19 per share to $0.21 per share, good for an annualized payout of $0.84 per share that equates to 1.5% forward dividend yield.

At the end of March 2019, DXC Technology had $2.9 billion in cash on hand. Stacked up against $1.9 billion in short-term debt and $5.5 billion in long-term debt, DXC Technology had a very manageable net debt load of $4.5 billion at the end of FY2019. We caution that this figure could and likely will change materially quarter-to-quarter due to DXC Technology’s acquisition activity. Furthermore, DXC Technology improved its balance sheet from year-end FY2018 levels by reducing its net debt by $0.9 billion. In DXC Technology’s FY2019 10-K, the company noted it had investment grade credit ratings from all three major agencies. Moody’s Corporation (MCO) rated DXC Technology’s unsecured debt at Baa2 back in September 2018.

Sales Pressure

Please keep in mind that DXC Technology’s top-line has been coming under pressure, and we expect that to continue going forward to a lesser degree. During FY2019, DXC Technology reported that its revenue dropped by $1.0 billion from FY2018 levels, down 4.5% year-over-year.

Global Business Services (“GBS”) sales were down 6.2% while Global Infrastructure Services (“GIS”) sales decreased by 3.3%, bringing total revenue down to $20.8 billion in FY2019. The company mentioned that its sales decline was due to weaker performance at its traditional application management & maintenance business and legacy infrastructure services. Foreign exchange movements reduced sales by 1.6% in FY2019, as the US dollar strengthened against the Euro and British Pound.

On the GBS side, the revenue slide is largely due to the shift towards the cloud (accelerated levels of cloud adoption across the globe are making application maintenance and management services, traditional offerings to support IT infrastructure, steadily irrelevant over time). On the GIS side, weaker sales were a product of the shift away from legacy infrastructure environments towards the cloud, however, rising cloud adoption helped drive demand for its own cloud infrastructure and digital workplace offerings.

Geographically speaking, year-over-year sales declines were realized across the board. We forecast that DXC Technology’s revenue will decline by a CAGR of 0.2% (at the midpoint) over the next five years as its digital and cloud-based growth story contends against declining sales at legacy operations.

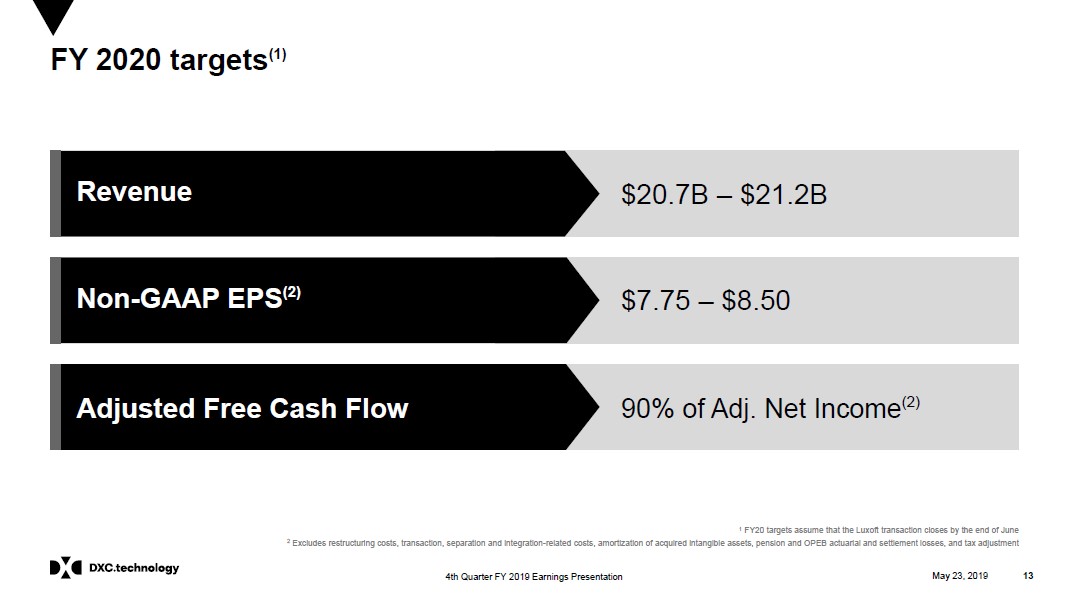

Management expects DXC Technology will post $20.7 billion-$21.2 billion in revenue during FY2020, which leaves room for very modest top-line growth at the upper end of that range. Keep in mind that includes an expected foreign currency headwind of $0.25 billion due to the strong US dollar. Adjusted non-GAAP EPS is estimated to be $7.75-$8.50, down somewhat (at the midpoint) from the $8.34 in adjusted non-GAAP EPS DXC Technology reported in FY2019. Adjusted free cash flow is expected to be 90% of its adjusted income as DXC Technology forecasts the company will continue to be very free cash flow positive this fiscal year.

Image Shown: DXC Technology forecasts that its revenue in FY2020 will either be broadly flat or grow very modestly compared to its FY2019 performance. Image Source: DXC Technology – IR Presentation

To offset top-line weakness, or simply the lack of expected revenue growth, DXC Technology is targeting upside through acquisitions. On January 7, 2019, DXC Technology agreed to acquire Luxoft Holdings by purchasing all of its outstanding shares for $2.0 billion in cash. Luxoft is “a significant player in outsourced engineering services, cloud and devops” with an eye on IoT, UX/UI, blockchain, and analytics. At the time the deal was announced, Luxoft’s revenue over the last four reported quarters was just over $0.9 billion and that was the product of “strong, double-digit compound annual growth rate (‘CAGR’) over the last three years.” On June 14, the deal closed.

Part of the reasoning behind this acquisition, and DXC Technology’s numerous others (such as its acquisition of Molina Medicaid Solutions from Molina Healthcare Inc (MOH) to gain better exposure to America’s healthcare sector, along with other purchases including M-Power Solutions, TESM, BusinessNow, the service business of EG A/S, and Argodesign), was to “add digital talent and skills to our workforce, enhance our capabilities and better serve clients.” Synergies are expected to be realized by cross-selling different products across its customer base.

Talent and digital skills acquisition represent an important part of the rapidly evolving IT landscape. Without talent, DXC Technology has little to offer its clients. At least a quarter of DXC Technology’s workforce is skilled in next-gen concepts.

DXC Technology’s digital revenue grew by 22% in constant-currency terms during the final quarter of FY2019 according to management, and was up almost 16% for the full fiscal year. How successful DXC Technology is in its own transformation rests on its digital prowess, which is why talent-based acquisition activity is important when considering its corporate strategy.

Concluding Thoughts

While DXC Technology is experiencing top-line pressure due to weakness at its legacy businesses, its digital growth trajectory continues to look promising. Very strong free cash flows and a modest dividend policy leave plenty of room for upside as it relates to future dividend increases, particularly if share buybacks are scaled back. As DXC Technology sports a relatively modest net debt load (backed by investment grade credit ratings), future dividend increases, share buybacks and acquisitions are all possible. Our Fair Value Estimate for DXC Technology sits at $81 per share, with shares of DXC trading at $55 as of this writing. DXC Technology is on our radar. We’re waiting for shares to turn higher.

IT Services Industry – Cognizant Technology Solutions Corporation (CTSH), DXC Technology Inc (DXC), Infosys Limited (INFS), Jack Henry & Associates Inc (JKHY), Wipro Limited (WIT)

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.