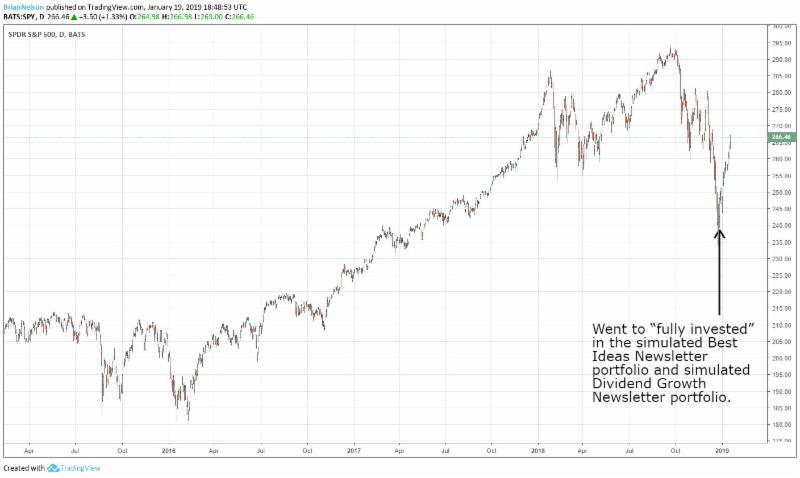

Image shown: The markets continue to rally significantly since the near-term bottom in December. Here’s the email we sent to members December 26.

No changes to simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio (contact us if you missed the latest notification regarding the simulated High Yield Dividend Newsletter portfolio). This article was sent to members via email January 19. That email can be accessed at the link that follows this article.

Conference Call Monday, January 28, 11amET/10amCT. We’ll talk about website navigation, how to use the stock and dividend reports, and dig deep into our capital-appreciation and dividend growth methodology. Details to follow, but add this date/time to your calendar.

Read what some of our members have been saying about our research and analysis as well as the first review of our new book, Value Trap! Don’t forget to leave your review of Value Trap. I’m so grateful. The book has been the #1 New Release on Amazon for the category of Valuation.

Note that we’ve moved to “fully-invested” in the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio at what seems so far to be a very opportune time (almost near the December bottom, see image above). Part luck, but you know how hard we’re working.

Facebook (FB) and Alphabet (GOOG, GOOGL) are now rated 10 on the Valuentum Buying Index. Both have a lot of political and regulatory risks, but we think both free-cash-flow generating, moaty powerhouses with fantastic balance sheets only grow stronger as regulatory barriers to entry are heightened. Our favorite idea remains Visa (V).

Brian Nelson, CFA

Trust you are doing great.

We’ve been covering a lot of ground recently, and I hope that you are enjoying the content. The past few weeks have been among the busiest times since our founding.

From one of the most volatile months in the history of the stock market in December 2018 to the release of the Dividend Growth Newsletter, High Yield Dividend Newsletter, Exclusive publication, quarterly publications and Best Ideas Newsletter, to the stock and dividend report triage on the website, if you’ve been away for the past month, you have some catching up to do.

Oh — did I not mention that we also released our very first book, Value Trap: Theory of Universal Valuation? 350 pages chock-full of footnotes, with a Preface, Notes, Bibliography, and Index. Members save 25% off a digital copy at the Valuentum store here, but if you’d like a paperback, it can be purchased through Amazon here. I’d like to make sure that you don’t miss anything, so I’ve listed our latest releases below:

January Dividend Growth Newsletter (pdf)

Purchase Value Trap: Theory of Universal Valuation (digital copy, Valuentum bookstore)

January High Yield Dividend Newsletter – contact us

January Exclusive publication – contact us

January DataScreener – contact us

January Ideas100 – contact us

January Dividend100 – contact us

January Best Ideas Newsletter (pdf)

Many of you have been asking about signed copies of Value Trap: Theory of Universal Valuation, and we’ll look to add that option to the Valuentum store soon, once logistics can be arranged. I can’t begin to tell you how much hearing this means to me, not only that you are enjoying the book, but also that you want a signed copy. I’ve always dreamed about signing autographed baseballs and bats, or something like that, perhaps as a major league baseball player, but this is a close second. Thank you for this experience. I appreciate it so much.

A few things that are worth mentioning. For starters, on December 26, we notified members of the Best Ideas Newsletter and Dividend Growth Newsletter that we were moving those simulated portfolios to a zero cash “weighting,” a big decision. As you know, for most of the history of these simulated newsletters, their cash “weightings” have been in the double-digits. For example, at the end of 2017, both were close to 30%.

You know the markets tumbled in 2018, and for us to then call what looks to be very close to a near-term bottom is very fortuitous. Yes, there was some luck involved, but when you see all the work that we do (just in the links in this email), you know that there is more to it than just that. We’re expecting a binary outcome for the markets from here, either a melt-up or a meltdown, and we’re being very careful not to miss the melt-up, while we watch closely to add portfolio protection.

Also, Facebook (FB) and Alphabet (GOOG, GOOGL) are now rated 10 on the Valuentum Buying Index. This is a big deal. We continue to like both companies, and both are at the “highest-weighted” rung in the simulated Best Ideas Newsletter portfolio. Political and regulatory risk is running wild, and Amazon is encroaching on their advertising turf, but both continue to grow like weeds while throwing off tremendous free cash flow. Visa (V), however, is our top idea. Very few other companies post the operating margin that Visa does (60%+). It has a fantastic business model.

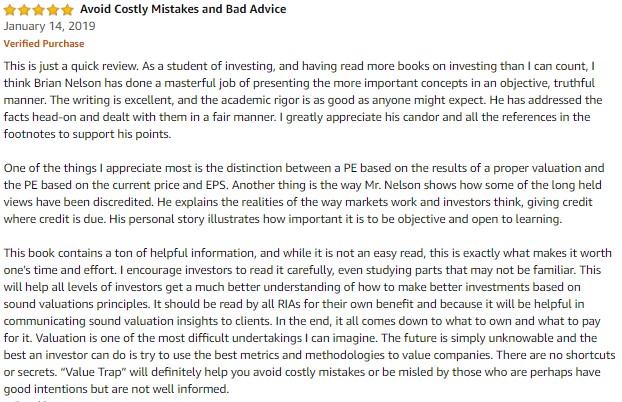

I can’t begin to tell you how happy I am. The sentiment from our members has been absolutely fantastic of late, and in case you missed what a few have been saying, I have included some of their comments below. One of them included a reference to General Electric (GE), and a supplementary image is provided. Also, a reader published the first review of Value Trap on Amazon! Thank you! Please keep the reviews of Value Trap and comments about our services coming. I have included an image to the book review below, too. Here are the comments and review, in case you missed them:

I know this response comes a few days late but I was staying away from emails and focused on the important things like family time during the last week. I want to thank you for all your wisdom. I too have been ~30% cash since late 2017 because of your insight. I listened and resisted the temptation of buying as things looked good. It would have been easy to get caught up in the flurry of the market back then while watching our retirement accounts grow. “Putting all our money to work” as others around me did, would have been costly. In fact a life time of membership fees would not come close to what was potentially saved. As painful as the last 3 months have been, it could have been much worse. I value your research, your newsletters and I look forward to your new release. Congratulations!

— Chip G. on December 27, 2018.

—–

Image shown: Members received an email notification May 15, 2017, that we were ridding the simulated newsletter portfolios of General Electric (GE).

I just wanted to send you a quick comment on your latest email titled: “Catching the Bottom?“. This catch was surely well done. You stayed in cash when almost everyone was nearly “all in” or on leverage while the market surged in the early part of the second half of 2018. That was a tough decision, but in retrospect of the huge November and even larger December market selloff a very prescient and wise one. Getting all in now near what appears to be the bottom of the market is also well played.

Of all the financial reports you have written and all the portfolio changes you have made in the model portfolio, your prediction of an imminent drop in the price of GE stock and your decision to sell out your portfolio holdings in GE has to be one of the best yet. Who would have thought that such a long-established company with such world-wide holdings could fall so far, but your analysis showed that it was highly probable and thereby acted wisely in eliminating GE from your model portfolio – in time to avoid a substantial loss. This type of analysis and forward-looking model action is what makes your publications well worth the subscription costs.

— Detlev T. on January 8, 2019.

—–

Here is the review of Value Trap on Amazon. Please be sure to leave yours here. The more buzz you create, the better.

Link to original email: http://campaign.r20.constantcontact.com/render?preview=true&m=1110817109903&ca=8a7d8705-9f2e-4531-b5c9-f0dd4d7306a8&id=preview

Tickerized for holdings of the SPDR S&P 500 ETF (SPY)

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies