We hope you enjoyed the “Off the Cuff” video series, where President of Investment Research at Valuentum Brian Nelson talked in front of the camera for about 10 minutes each episode! The videos were purposely designed to be low-tech, we know – we call this “authen-tech.” We like that, and you should, too. These are not instructional videos. They are meant to be energetic, exciting, and a bit controversial. Nelson tells it how it is. That’s the only way. Follow up reading/videos provided.

Videos filmed December and January 2017/2018.

Don’t miss an episode!

Episode 1 – North Korea, Indexing and ETFs (December 4, 2017): President of Investment Research Brian Nelson talks about the non-zero probability of nuclear war, lofty equity market valuations, the impact of ultra-low interest rates, the Bitcoin phenomenon, the importance of paying attention to financial adviser fees, as well as the pitfalls when it comes to assigning styles to ETFs. Running time: ~11 minutes.

Follow up reading: The “Luck” and “Randomness” of Index Funds” (pdf)

Episode 2 – Backwards, Forwards, Frameworks, Boeing/GE, and Methodology (December 8, 2017): President of Investment Research Brian Nelson talks about the tragedy of the investment business in using backward-looking information, the absurdity of making prognostications about stock market returns, market sentiment through the price of Boeing, applying future forecasts and predicting dividend cuts with GE, and why Valuentum’s methodology makes sense for long-term investors. Running time: ~10 minutes.

Follow up reading (predicting dividend cuts): The Forward-Looking Dividend Cushion ratio >>

Episode 3 – Indexing/Quant Bubble, Pitfalls of Backward Multiple Analysis, and Thoughts on the CAPE Ratio (December 10, 2017): President of Investment Research Brian Nelson talks about what causes a stock pricing bubble, notes how the “price setters” are disappearing in today’s market, explains the pitfalls of backward-looking multiple analysis, and shares his thoughts on the CAPE (cyclically-adjusted price-to-earnings) ratio. Running time: ~11 minutes

Follow up reading: “The Universal Theorem of Value, aka The Tragedy of Quantitative Finance (2018) (pdf)”

Follow up video: “Podcast: Fallacy of Index Funds (October 2016)”

Episode 4 – Nelson’s Active Management Theorem, Poker and “High Society,” Inertia and the Value-Growth Conundrum (December 11, 2017): President of Investment Research Brian Nelson details his simple new theorem of the stock market that may change everything you believe. Nelson explains using poker as an example, and he goes on to caution about the concept of inertia, and how investing has somehow transformed into a “game” — if investors truly believe there are ‘value’ and ‘growth’ stocks. A must-watch intrigue. Running time: ~11 minutes.

Follow up reading (excerpts): “Value and Momentum Within Stocks, Too” (pdf)

Episode 5 – Get to Know Valuentum’s Brian Nelson (December 12, 2017): On episode 5 of “Off the Cuff,” President of Investment Research Brian Nelson talks about…well…himself, and why it’s worth listening in on his views. He also explains the Firm Foundation dynamic that differentiates stocks from most any other investment, and he goes into what makes value and technical analysis tick. Get inspired. Running time: ~11 minutes.

Follow up reading: “The 16 Most Important Steps to Understand the Stock Market”

Episode 6 – Nelson Answers Questions! Valu+entum (December 13, 2017): President of Investment Research Brian Nelson answers questions about the stock market and investing (e.g. if nobody is paying attention to price-to-fair value, will value investors ever be rewarded?). Keep the emails and comments coming! Running time: ~10 minutes.

Follow up reading: “Resetting Your Mental Model”

Follow up reading: “Stock-Selection Methodology, the Valuentum Buying Index“

Episode 7 – What Cash Flow Are You Talking About? (December 14, 2017): President of Investment Research Brian Nelson reviews important topics from the first six episodes of “Off the Cuff,” and goes into great detail about all the intricacies of “cash flow” from traditional free cash flow to enterprise free cash flow valuation. You know you want to watch. Running Time: ~14 minutes.

Follow up reading: “The Ultimate Cash Flow Guide (EBITDA, CF, FCF, FCFF)”, Corporate Finance Institute

Follow up reading: “How Well Do Enterprise Free Cash Flow Derived Fair Value Estimates Predict Future Stock Prices (pdf)”

Episode 8 – Stop Using the Darn PE Ratio for Goodness Sake! (December 15, 2017): President of Investment Research Brian Nelson talks about his views with respect to backtests versus walk-forward tests, and explains why the PE ratio is doomed as a value tool. It’s all psychological. Running Time: ~12 minutes.

Follow up reading: “The Price-to-Earnings Ratio Demystified”

Episode 9 – Has Brian Completely Lost It? Janet Yellen and Speculation Versus Investing (December 16, 2017): President of Investment Research Brian Nelson talks about the importance between prices and valuations quoting a recent Fed statement. He also goes into what truly constitutes investing versus speculation. You can’t miss it. Running time: ~11 minutes.

Follow up video: “The Most Important Topic in Investing (August 2014)”

Episode 10 – Quants! You’re NOT Measuring VALUE and Nelson’s Theory of Universal Value (December 19, 2017): President of Investment Research Brian Nelson defines the concept of universal value and shows how quantitative statistical methods are inextricably linked to those of fundamental, financial, business-model related analysis. Value does not exist in respective process vacuums! Value is universal. Find out why. Running time: ~10 minutes.

Follow up reading: “The Universal Theorem of Value, aka The Tragedy of Quantitative Finance (2018) (pdf)”

Epsiode 11 – I Love Dividends But the Dividend Discount Model is DEAD! (December 24, 2017): President of Investment Research Brian Nelson gives a plethora of reasons why the dividend discount model is dead and expresses his worries about how it continues to be used academically and professionally. Also included is a discussion about why the weighted average cost of capital, or the WACC, is used in the enterprise free cash flow valuation process, or the free cash flow to the firm process. Running time: ~13 minutes.

Follow up reading: “How Well Do Enterprise Free Cash Flow Derived Fair Value Estimates Predict Future Stock Prices (pdf)”

Follow up reading: “The 16 Most Important Steps to Understand the Stock Market”

Follow up video: “A Glimpse Into Valuentum’s Discounted Cash Flow (DCF) Process (January 2015)”

Follow up reading: “Don’t Just Look at the House, Examine the Foundation”

Follow up video: The Free Dividend Fallacy (video), Chicago Booth

Episode 12 – Objectivity in Analysis and the MLP Enigma (December 27, 2017): President of Investment Research Brian Nelson talks about how financial statement analysis keeps analysts objective. He also goes into how the distribution yields of MLPs may not reflect underlying business dynamics. Nelson also explains an inconsistency in the use of financing that supports the idea that MLPs are using external capital market issuances to fund distributions. Running time: ~15 minutes.

Follow up reading: “Nearly 60 Distribution Cuts Later, We Maintain Our View on the Hazards of the MLP Business Model”

Follow up reading: “MLP Speak: A Critique of Distributable Cash Flow”

Episode 13 – Bank Valuations and We’re All Market Timers? (December 29, 2017): President of Investment Research Brian Nelson dives into questions about why an enterprise free cash flow model is not used for banking and insurance entities, and offers up the idea that we all might be market timers. What do you think? Running time: ~14 minutes.

Follow up reading: “Banks and Money Centers Industry Report (pdf)”

Follow up subscription consideration for additional relevant content: “The Nelson Exclusive publication (click to subscribe)”

Episode 14 – The Fed’s Dislocation and Too Few Stocks? (January 1, 2018): President of Investment Research Brian Nelson talks about how central banks may be pushing savers into riskier assets than what might otherwise be warranted by their risk profiles, how interest rates should be viewed within the valuation context, and whether too few stocks to invest in is driving a ‘rising tide lifts all boats’ dynamic. A discussion about the severe limitations of the price-to-earnings ratio is included. Running time: ~14 minutes.

Follow up subscription consideration for additional relevant content: “The High Yield Dividend Newsletter (click to subscribe)”

Ask about a sample of the High Yield Dividend Newsletter.

Episode 15 – Admit It: You Know Nothing About the Dividend (January 5, 2018): President of Investment Research Brian Nelson talks about how the concept of a dividend is completely miscontrued due to societal and cultural reasons, but he also explains why he likes dividends. Warning: He’s going to bust out Monopoly pieces. You don’t want to miss this! Running time: ~15 minutes.

Follow up reading: “You Already Own Whatever Your Investment Will Pay You in Dividends”

Follow up reading: “Nelson’s Warning to the Board Rooms of America”

Episode 16 – Mutual Fund Tragedy, ROE, and the Time Horizon (January 6, 2018): Comparisons between growth versus value stocks may never go away, but President of Investment Research Brian Nelson explains why you should know better than to think stocks can easily be divided up as such. He talks about this, as well as the pitfalls of ROE (return on equity) and how to think about the time horizon. Running time: ~10 minutes.

Follow up video: “Do You Know What You Don’t Know? (February 2015)”

Episode 17 – Nelson Talks His New Theory of the Stock Market (January 8, 2018): President of Investment Research Brian Nelson talks about the new theory of the stock market and explains how syllogisms developed by Noble prize winners and the largest asset managers may not accurately reflect active management at the investor level, which Nelson argues is what matters. Running time: ~15 minutes.

Follow up reading: “Valuentum’s 3 Breakthroughs in the Field of Finance and More”

Follow up reading (excerpts): “Value and Momentum Within Stocks, Too” (pdf)

Episode 18 – Discount Rates, Growth Rates, and “Skin in the Game” (January 11, 2018): In episode 18 of his video series “Off the Cuff,” President of Investment Research Brian Nelson talks about why it is so important for you to learn the discounted cash-flow model and how to think about discount rates and growth rates within it. He also provides a few perspectives on the concept of “skin in the game,” and the areas where it might be good and the areas where it might be bad. Running time: ~12 minutes.

Follow up reading: “The Price-to-Earnings Ratio Demystified”

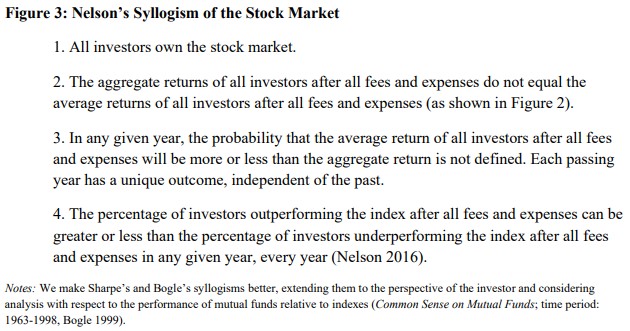

Episode 19 – Active vs. Passive Still Undefined, Even After Fees and Expenses (January 15, 2018): In the final episode of “Off the Cuff,” President of Investment Research at Valuentum Brian Nelson explains that, even after fees and expenses, the active versus passive debate remains undefined. It is on this consideration, that Nelson’s Syllogism of the Stock Market is based. Running time: ~4 minutes.

Follow up reading: The “Luck” and “Randomness” of Index Funds” (pdf)

Follow up video: “The New Theorem of the Stock Market”

Image Source: “Value and Momentum Within Stocks, Too” (pdf)

————————————————–

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

————————————————–

Valuentum has developed a user-friendly, discounted cash-flow model that you can use to value any operating company that you wish. Click here to buy this individual-investor-friendly model now! It could be the best investment you make.