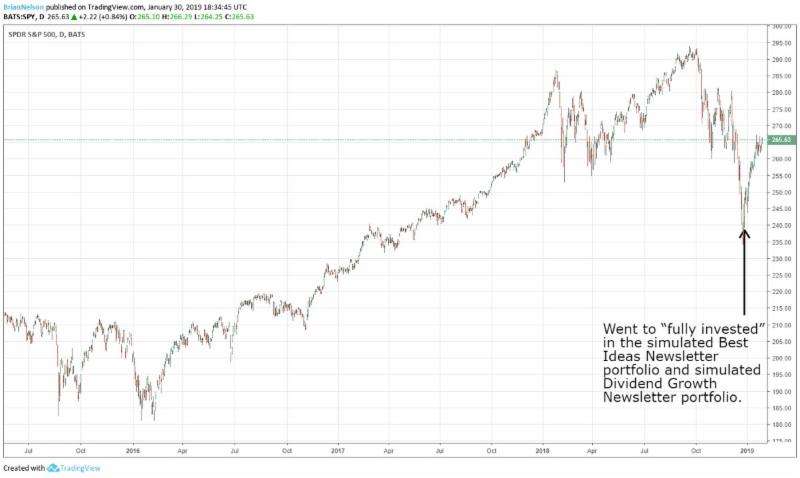

Image shown: The markets continue to rally significantly since the near-term bottom in December. Here’s the email we sent to members December 26.

No changes to simulated newsletter portfolios.

By Brian Nelson, CFA

Hope you are doing great. Believe it or not, the wind chill may have hit 50 or 60 below-zero in Woodstock, Illinois this morning. The polar vortex has most of the Midwest running for cover. Even the Chicago Bears have changed their name to the Chicago Polar Bears. Just kidding. In any case, the markets don’t mind. We continue to recover from the December lows, and we’ve been staying mighty busy. For starters, if you haven’t read Value Trap: Theory of Universal Valuation, you’re not going to get as much out of our website, so please be sure to do that while you’re staying warm the next few days. You can order the digital download here, or the paperback on Amazon here.

We probably don’t have to remind you, but it may be worth reiterating in any case. The asset class “cash” was the best-performing one during 2018, and we had it overweight while the markets swooned. Excellent. Then during the doldrums near the December 2018 lows, we went to “fully invested” in the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Nice. Then, our latest idea that we highlighted in the simulated Dividend Growth Newsletter portfolio, Xilinx (XLNX) absolutely soared. Awesome. In case you missed them, we recently hosted two website and methodology walk-throughs. You can view the recording for the latest one here. We covered a lot of ground, and I hope that you enjoy it.

We received some good news from Apple (AAPL) yesterday, and the company remains a “holding” in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. We continue to believe that Apple is one of the strongest dividend growth equities on the market today. Why? Well, it’s quite simple really: the company has a strong brand, excellent ecosystem, large installed base, growing services revenue, massive net cash position and significant free cash flow generation. At the moment, its Dividend Cushion ratio stands at a whopping 5.8 (that’s really, really good). We talk about the Dividend Cushion ratio in the book Value Trap, but you can read about the Dividend Cushion here, too. My colleague Kris Rosemann recently wrote up Apple’s most recent quarter, and you can read that write-up here (login required).

Just a reminder, Facebook (FB) and Alphabet (GOOG, GOOGL) have both registered a 10 on the Valuentum Buying Index, and I am quite concerned about Facebook, but we’ll see when it reports after the close today. The bad media reports about Facebook keep piling up, but the stock continues to act well (about $150 per share). I think the fourth-quarter results may be quite telling of the impact that the negativity is having on its free cash flow generation, but my initial read is that the concerns may be overdone. I don’t want to speak to soon, as we’ll have more details after the report, however. We’ll see in a few hours. Also, it looks like the Fed is becoming more “dovish,” as we predicted more recently. See a prior email, “Fed Might Slow After All…” This is really good news.

We’ve been busy updating reports and writing-up earnings, and pasted below are links to some of our latest work:

Novartis Closes Out Busy Year; Proposes Dividend Hike

Apple’s Services Growth on Track; Weakness to Persist in China

Our Reports on Stocks in the Integrated Circuits Industry

Caterpillar Crushed by Expectations for No Growth in China

Today’s Recorded Website Walk Through

Intel Disappoints with 2019 Guidance; Sell-off Overdone

Our Reports on Stocks in the Alcoholic Beverage Industry

Our Reports on Stocks in the Software Industry

Our Reports on the Retail REIT Industry

Our Reports on Stocks in the Metals and Mining (Aluminum) Industry

Thank you!

Brian Nelson, CFA

President, Investment Research

brian@valuentum.com

——————–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

—–

Pasted below is the first review of Value Trap on Amazon. Please be sure to leave yours here. The more buzz you create, the better.