By Brian Nelson, CFA

We continue to reiterate that the key components of a company’s valuation are the following: net cash on the balance sheet and future expected free cash flows. These two cash-based sources of intrinsic value generally account for almost all of the value of a firm. There are some exceptions, where contingent liabilities and a more complicated capital structure come into play, but when it comes to simplifying what drives share prices, that’s about it. It’s probably no wonder then that we love net-cash-rich, free-cash-flow, secular growth powerhouses, and it’s also probably no wonder why these companies have grown into some of the strongest-performing stocks on the market, dominating last decade.

Most of big cap tech and the stylistic area of large cap growth are overflowing with companies that have large net cash positions and generate gobs and gobs of free cash flow, but there are other, smaller companies with these characteristics. Granted, these firms aren’t as well known as the likes of Alphabet (GOOG) (GOOGL), Meta Platforms (META), or Microsoft (MSFT), but their financial make-ups are quite attractive, in our view. Each of the three mid-cap ideas below have a nice net cash position on the balance sheet and generate robust free cash flow for their size. Though they may not necessarily be considered safe havens like big cap tech and large cap growth these days, they are nonetheless worthy of consideration for the aggressive, risk-seeking investor targeting long-term capital appreciation potential.

Chewy, Inc. (CHWY)

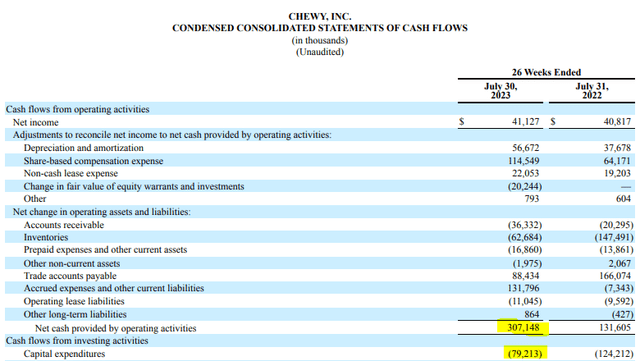

Image: Chewy’s best-in-class customer service is paying off in strong free cash flow generation.

A pure play e-commerce operation that centers on products and services for dogs, cats and other pets, Chewy, Inc. is in a class by itself, in our view. The company is perhaps one of the most customer-friendly companies out there, often sending flowers to its customers. Its “high-tough customer service” is a key differentiator, which makes us believe that Chewy is one of the best long-term stories out there in mid-cap. At the end of the second quarter of 2023, the firm had 20.4 million active customers, which translated into net sales growth of more than 14% during its second quarter of this year. Chewy ended July with cash and marketable securities of ~$905 million and no debt to speak of. As shown in the image above, the company generated ~$307.3 million in operating cash flow and shelled out $79.2 million in capital spending, good for considerable free cash flow generation during the first six months of its fiscal year.

E.L.F Beauty (ELF)

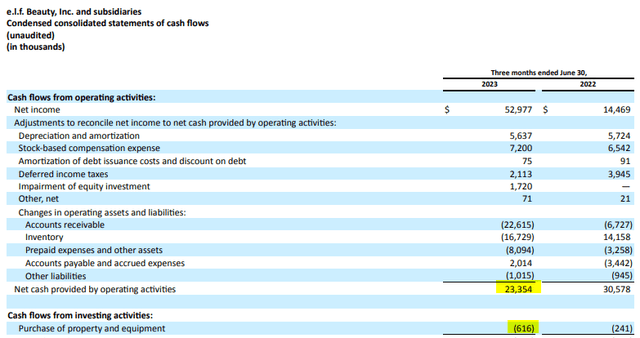

Image: E.L.F. Beauty is off to a great start in its fiscal 2024.

E.L.F. Beauty operates within the skin care market, which is estimated to be a ~$12 billion opportunity growing at a 10% year-over-year clip, but E.L.F is growing at a much faster clip than the market, however. The firm has put up 18 consecutive quarters of net sales growth, and in its past two quarters, net sales expansion have been greater than 75%–so we’re talking about one of the fastest-growing firms on the market today. It continues to gain share against the likes of Maybelline, L’Oreal, Covergirl, and Revlon. E.L.F Beauty ended June with ~$142.5 million in cash and cash equivalents and ~$59.6 in long-term debt, good for a very nice net cash position on the books. As shown in the image above, the firm generated $23.4 million in operating cash flow and spent just $0.6 million in property and equipment during the first three months of its fiscal year, translating into robust free cash flow generation.

DocuSign, Inc. (DOCU)

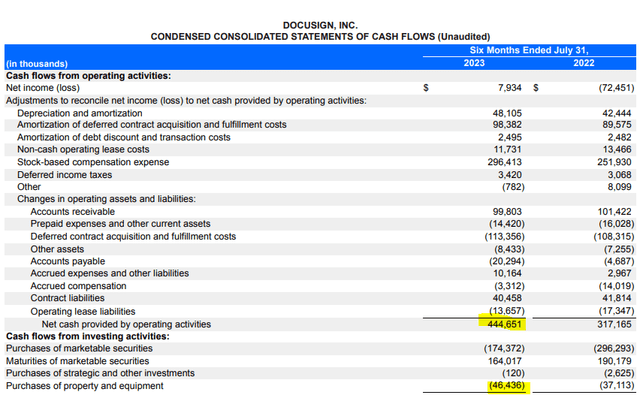

Image: DocuSign is a strong free cash flow generator.

DocuSign, Inc. has a strong first-mover advantage in the electronic signature category that has only been augmented as a result of the outbreak of COVID-19. Its DocuSign Agreement Cloud has hundreds of thousands of customers and hundreds of millions of users. The firm estimates that its existing customers account for just 1% of total available enterprises and businesses around the world, offering a long runway of growth, but Adobe (ADBE) remains a fierce competitor in this area. DocuSign ended July with cash and cash equivalents of ~$1.02 billion, current investments of ~$426 million and non-current investments of ~$85.2 million. Convertible senior notes totaled $725.1 million, meaning the firm had a nice net cash position at the end of July. The firm’s free cash flow generation is also robust, with DocuSign generating ~$44.7 million in operating cash flow and shelling out just $46.4 million in capital spending during the first six months of its fiscal year, as shown in the image above.

Wrapping Things Up

We’re huge fans of companies with net cash on their balance sheet and strong free cash flow generating potential. This view has led us to favor the areas of big cap tech and the stylistic area of large cap growth in the newsletter portfolios, but there are other companies emerging with similar economics on a smaller scale. Chewy, Inc. E.L.F Beauty and DocuSign are three that come to mind, and all three of these names boast a strong balance sheet and favorable free cash flow dynamics. Each of these companies is also benefiting from secular growth trends as they seek to gain market share against rivals. Though certainly not without valuation risk as the trajectory of free cash flow expectations will certainly cause volatility in their respective stocks, we think all three may be worthy of consideration for the aggressive, risk-seeking investor targeting long-term capital appreciation.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.