At Valuentum, we follow hundreds of stocks and dividends. We serve individual investors, financial advisers, and institutions. Join Today! You’ll gain immediate access to our premium product and service offering (including articles, commentary, stock reports, dividend reports, and more). You’ll also receive the Best Ideas Newsletter and Dividend Growth Newsletter in your inbox every month. You can also order our ultra-premium publications, the High Yield Dividend Newsletter and the Exclusive publication, too!

-

Netflix Continues Its Bid for Warner Bros. Discovery

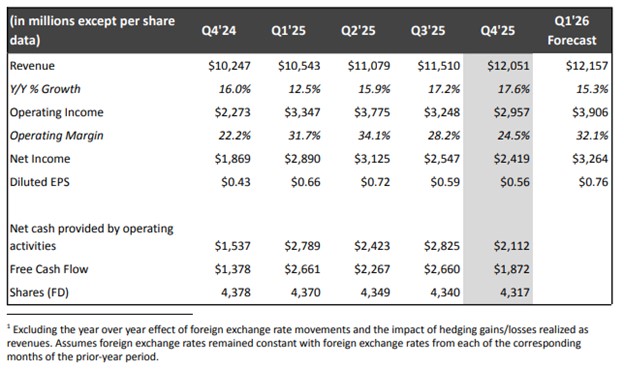

Image Source: Netflix By Brian Nelson, CFA On January 20, Netflix (NFLX) reported fourth quarter results that came in better than expected on both the top and bottom lines. In the period, revenue increased 17.6% year-over-year, while the firm crossed the 325 million paid membership milestone. Operating income increased 30% year-over-year, with its operating margin…

-

Key Comments from the Banks This Earnings Season

Image Source: TradingView By Valuentum Analysts JPMorgan’s (JPM) CEO Jamie Dimon: The Firm concluded the year with a strong fourth quarter, generating net income of $14.7 billion excluding a significant item. Each line of business performed well. In the CIB, revenue rose 10%. Markets continued to benefit from demand for financing and robust client activity,…

-

Valuentum’s Best Ideas Newsletter Portfolio

*Portfolio information as of published date in top, left corner of table above. The Best Ideas Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments. By The Valuentum…

-

Valuentum’s Dividend Growth Newsletter Portfolio

*Portfolio Information as of published date in top, left corner of table. The Dividend Growth Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments. The Dividend Growth Newsletter portfolio puts into…

-

Oracle Has Turned Into a Net Debt Heavy, Free Cash Flow Burning Enterprise

Image Source: TradingView By Brian Nelson, CFA On December 10, Oracle (ORCL) reported second quarter fiscal 2026 results that were mixed, with revenue missing the consensus forecast, but non-GAAP earnings per share exceeding expectations. Total quarterly revenues were up 14% in USD, and up 13% in constant currency. Second quarter remaining performance obligations (RPO) were $523…