Exxon Mobil’s reported results are improving as the global oil markets continue to work towards rebalancing. Let’s take a look at the most recent quarter of one of our favorite oil and gas majors.

By Kris Rosemann

In light of the well-publicized recent dividend cuts at ConocoPhillips (COP) and Kinder Morgan (KMI), it’s no surprise to readers why we continue to prefer the diversified Energy Select SPDR ETF (XLE) when it comes to energy exposure in the newsletter portfolios. Operating debt-heavy, capital-intensive business models in a violently cyclical industry such as upstream exploration and production can be a recipe for disaster, as the fallout of 2015 showed. Exxon Mobil (XOM), however, continues to be one of our favorite income ideas relative to its energy peers, and it only makes sense that Exxon Mobil also makes up more than 16% of the XLE, too. It also benefits from having both upstream and downstream assets.

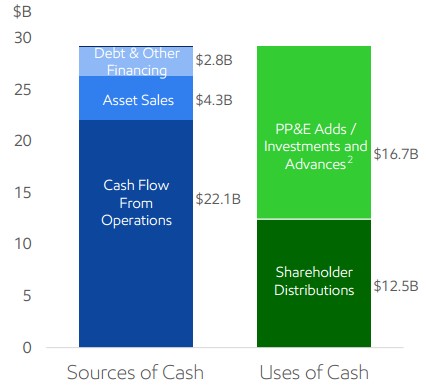

What’s more, during 2016, Exxon Mobil was significantly free cash flow positive on an annual basis, as measured by cash flow from operations less all capital spending, something that cannot be said for all of its rivals. As performance has rebounded along with oil prices in recent quarters, traditional free cash flow alone is still coming up short in covering cash dividends paid though. As the image below shows, Exxon Mobil has to consider proceeds from asset sales and capital market issuance to meet both capital spending and dividend obligations. Expectations for continued improvement in energy resource prices in the coming years helps to push the company’s Dividend Cushion near parity, however, offsetting near term shortfalls.

Image Source: Exxon Mobil fourth quarter presentation

The fourth quarter of 2016 was a sign of things moving in the right direction for Exxon, but free cash flow generation in the period of $2.6 billion ($7.4 billion in cash flow from operations less $4.8 billion in capital and exploration expenditures = $2.6 billion in free cash flow) still came up short in covering cash dividends paid in the quarter ($3.1 billion). Only when proceeds from asset sales ($2.1 billion) are included in the calculation are dividends then covered. This is an improvement over full-year results, where the company had to access the debt/equity markets to fund free cash flow and asset-sale shortfalls, but still insufficient organic quarterly performance, nonetheless.

Asset sales are not included in traditional definitions of free cash flow because they are not sustainable operationally (a company, for example, cannot continue to sell its assets forever, and therefore such sales are excluded from traditional free cash flow). Still, traditional free cash flow is trending in the right direction at Exxon thanks to material reductions in capital spending (down 35% in the fourth quarter and 38% on a year-over-year basis in 2016) and rebounding commodity prices, which are aiding operating cash flow improvements (up 70%+ in the fourth quarter, but still down meaningfully on a full-year basis).

Perhaps most importantly, Exxon Mobil did a good job preserving its balance sheet throughout a difficult 2016. Management was able to fund all of its business needs as well as $12.5 billion in shareholder distributions in the year with only ~$2.8 billion in incremental debt and other financing. This compares favorably to the likes of Chevron (CVX), whose total debt load, for example, rose nearly $8 billion in the year. Exxon is anticipating a return to growth in capital spending in 2017, up to $22 billion from $19.3 billion in 2016, as the ongoing rebalancing of the global crude oil markets makes exploration spending and other investments in the business increasingly more attractive. We’ll be watching implications on traditional free cash flow measures, however, in the event energy resource pricing potentially turns for the worse.

Shares of Exxon are currently trading in the lower half of our fair value range, though we note the sizeable margin of safety we use in estimating the intrinsic value of the company. A look at free cash flow trends and capital spending initiatives through the course of the energy market cycle is quite telling of its free cash flow volatility. There’s still a lot to like about the company’s integrated upstream and downstream operations (and chemicals business), its fortress credit rating, and solid free cash flow generating capacity during times of economic duress, but we still prefer the XLE, which includes a sizable chunk of Exxon Mobil in it anyway. With the XLE, a devastating income-related event such as when ConocoPhillips and Kinder Morgan slashed their respective payouts just isn’t a high probability.