By Kris Rosemann

Another simplification transaction in the MLP space — who would have thought an MLP needed material changes in their corporate structures? If you’ve been reading our analysis of the industry recently, you would be on that list, “Distributing Truth on MLPs,” “Plains All American to Undergo Simplification Transaction.” To us, the merger agreement between Energy Transfer Partners (ETP) and Sunoco Logistics Partners (SXL) November 21 is yet another acknowledgement of the flaws in the MLP business model and recognition of the lack of clarity regarding the long-term viability of the MLP model.

In the merger agreement, Energy Transfer Partners unitholders will receive 1.5 units of Sonoco Logistics Partners for each Energy Transfer Partners unit held. Also, all Sunoco common and Class B units held by Energy Transfer Partners will be retired, and all Class H units of Energy Transfer Partners held by Energy Transfer Equity (ETE) will be retired, which will result in Energy Transfer Equity owning 100% of the combined company’s General Partner and incentive distribution rights. The deal is expected to close in the first quarter of 2017.

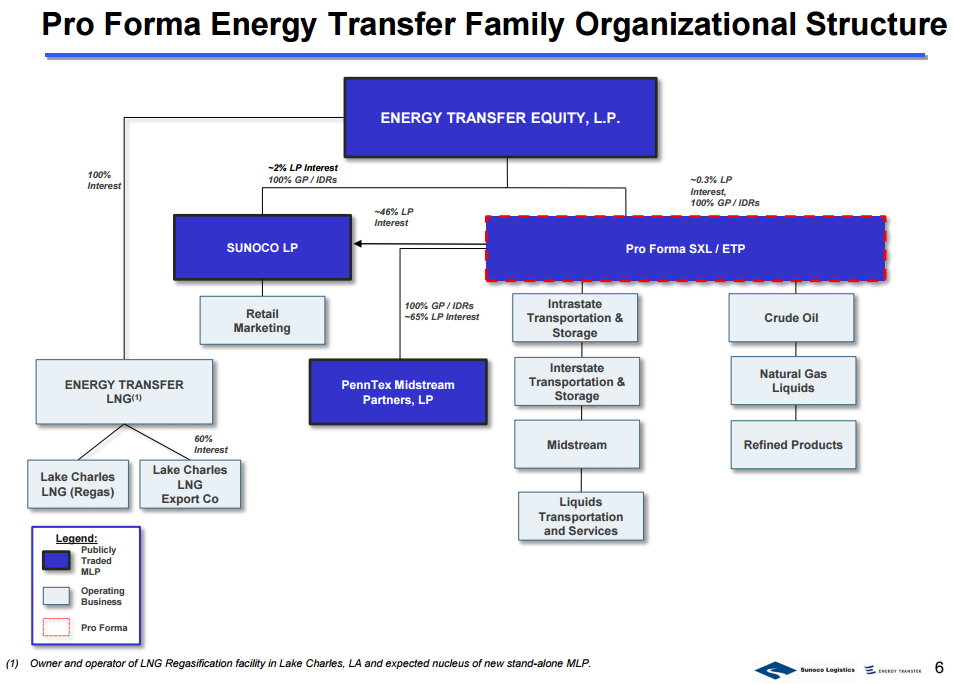

Image source: Energy Transfer presentation

We cannot dispute the simplification benefits of the transaction, but a greater issue lies in the leverage of the to-be-formed entity. Sunoco will assume Energy Transfer Partners’ outstanding debt, resulting in the addition of ~$30.4 billion of Energy Transfer Partners’ total debt to Sunoco’s current total debt load of more than $6 billion. The cash balances of each firm are negligible compared to the debt loads, and the resulting net debt load of ~$36 billion leads us to a net debt-to-adjusted EBITDA ratio of more than 6.4x when using annualized adjusted EBITDA results provided by management.

The merger is also expected to be accretive to Sunoco’s distributable cash flow and distribution per unit, which management has said will put the company in a position to achieve near-term distribution increases in the low double digit range with a more than 1x distribution coverage ratio (in questionable industry-specific metrics, of course). We’re not fond of any entity with the leverage of the proposed combination of these two MLPs targeting double digit distribution increases.

Additionally, the deal will result in an implied distribution reduction, which likely would have been necessary anyway. Management has noted that without the deal, Energy Transfer Partners “would need to consider a distribution reduction in the range of 15-25%, subject to a number of assumptions, in order to reduce leverage and increase distribution coverage to strengthen ETP’s financial health and future cash distribution growth profile.” The terms of the deal will result in an implied distribution reduction for unitholders from current quarterly levels at Energy Transfer Partners of $1.055 to $0.765 (1.5 times Sonoco’s current quarterly distribution of $0.51). Energy Transfer Partners’ unadjusted Dividend Cushion ratio is currently -1.2 (negative 1.2).

While we continue to be wary of the structure of the MLP business model, the underlying fundamentals of those businesses are strong, and should benefit from more relaxed regulatory environment in the US with the coming administration change. In this light, the deal makes a reasonable amount of sense. The simplification transaction will ensure strong access to capital markets in the near term and help maintain investment grade credit metrics and attractive funding costs, all of which enhance the firms’ ability to manage the inherent risk in large-scale growth investments (read: Donald Trump’s promise to promote infrastructure investments).

If Energy Transfer Partners was going to be forced to reevaluate its distribution, which would have undoubtedly sent shockwaves through the MLP space, a reduction of the distribution in the form of a simplification transaction may be a savvy move, even if it only alleviates some of our concerns temporarily. There’s also the potential that management may be using the transaction to avoid a downgrade of Energy Transfer Partners’ credit rating to junk territory, of which it is currently on the precipice of. Each major credit rating agency currently rates its debt as the lowest rung of investment grade, Moody’s (MCO) recently reduced its outlook to ‘Negative,’ and traditional free cash flow generation remains substantially negative as of the end of the third quarter of 2016. Sunoco’s free cash flow generation is also in negative territory, but it currently has higher credit ratings, and the moving parts of the simplification transaction could convolute the rating agencies’ processes for the time being.

Management will continue to tout the operational synergies and growth potential of the newly combined entity, and we’re not here to discredit those remarks. What we’re concerned about is the long-term viability of the MLP structure that have, at times, used lofty distribution yields to lure investors into what could turn out to be severely destructive to their invested capital. We view this simplification transaction as a short term alleviation of what will eventually turn out to be long-term pressures. As the market digested the news of the hidden distribution cut, shares were punished, but aside from the equity impact of the implied distribution reduction, the transaction should benefit the Energy Transfer family in the near to medium term.

The recent developments at the Energy Transfer family does very little to change our opinion of the midstream MLP space. In fact, it seems to add more validity to our thesis. From a July 2016 article:

We expect the MLP business/financial model to eventually be reevaluated at the highest regulatory levels and deemed an “unfair” structure. That MLPs can recirculate capital raised from the financial markets (financing section of the cash flow statement) to pay distributions, which are widely followed by “trusting” investors and often used to value their equities is incredible. How can you be sure that our perspective is worth considering? Ask one question: what would happen to MLPs if the capital markets shut down? The answer: They would have to cut their distributions as cutting off growth and investment would be a bonehead move in light of potential positive NPV projects. In any business seeking to generate value for shareholders, which all are, investment growth capital therefore will always be funded first and foremost through a company’s operating cash flow, and since most capital investment and dividends, collectively, overwhelm operating cash flow generation, most all MLP payouts are in part financially-engineered (i.e. supported by the financing section of the cash flow statement). External capital is not the primary source of growth funding.

Though it may not happen anytime soon, we believe there will eventually be an “investor-led” crusade against this dangerous business model. Such opposition doesn’t necessarily have to come from investors either. It could come from a corporate coalition. There are many corporates, for example, that have decent balance sheets and cover their dividends with traditional free cash flow, but have much less sanguine credit marks by the agencies relative to those of such overleveraged, “cash-burning” (after dividend payments) pipeline MLP plays. Moreover, we believe the SEC should take a hard look at the industry’s definition of “cash flow,” which we believe is very misleading to even the most sophisticated investors. In particular, an MLP’s definition of distributable cash flow excludes the very growth capital spending that drives net income, which itself is included in the calculation of distributable cash flow. When analysts use distributable cash flow in valuation, they, by its very own definition, exclude a portion of the cash capital outflows (shareholder money) that are used to drive net income higher, a severe imbalance in the valuation equation.

We can only hope our members are not among those who allow the wool to be pulled over their eyes, but we can only promise one thing: we are going to give it, and have been giving it, to you straight.